Private Capital Bolsters Stake in Barrett Business Services Inc

Recent Acquisition by Private Capital (Trades, Portfolio)

Private Capital (Trades, Portfolio) Management, a firm known for its value investing approach, has recently increased its investment in Barrett Business Services Inc (NASDAQ:BBSI). On December 31, 2023, the firm added 1,965 shares to its holdings, marking a 0.57% change in share count. This transaction impacted the firm's portfolio by 0.03%, with the shares purchased at a price of $115.8 each. Following this acquisition, Private Capital (Trades, Portfolio) now holds a total of 346,448 BBSI shares, representing 4.75% of its portfolio and 5.24% of the company's outstanding shares.

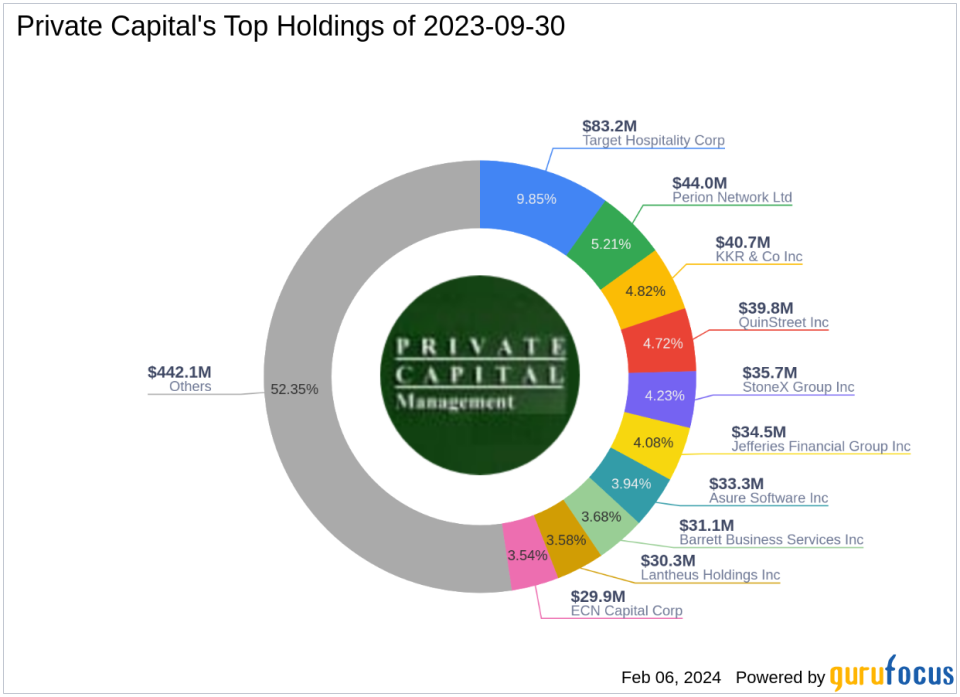

Private Capital (Trades, Portfolio) Management's Profile

Founded in 1986 by Bruce Sherman, Private Capital (Trades, Portfolio) Management has undergone a leadership transition with Gregg J. Powers taking the helm as CEO in 2009. The firm's investment philosophy is grounded in value investing, aiming to purchase stocks at a significant discount to their intrinsic value. With a focus on managing downside risk and patient capital appreciation, Private Capital (Trades, Portfolio) Management currently holds 140 stocks with a total equity of $844 million. The firm's top holdings include StoneX Group Inc (NASDAQ:SNEX), Perion Network Ltd (NASDAQ:PERI), and QuinStreet Inc (NASDAQ:QNST), with a particular emphasis on the Financial Services and Industrials sectors.

Barrett Business Services Inc at a Glance

Barrett Business Services Inc, operating in the USA since its IPO on June 11, 1993, provides comprehensive payroll administrative and staffing services. The company's offerings are divided into professional employer services, which include payroll management and workers' compensation solutions, and staffing services, which encompass temporary and contract staffing, as well as direct placement services. BBSI has established itself as a key player in the business services industry, primarily generating revenue from professional employer service fees.

Financial Health and Market Position of BBSI

With a market capitalization of $738.749 million and a current stock price of $111.65, BBSI trades at a price-to-earnings (PE) ratio of 16.16. The stock is considered modestly overvalued, with a GF Value of $96.26 and a price to GF Value ratio of 1.16. Since its IPO, the stock has seen a staggering price increase of 4,019.93%, although it has experienced a year-to-date price decline of -2.91%. The company's historical performance and current valuation suggest a cautious outlook for potential investors.

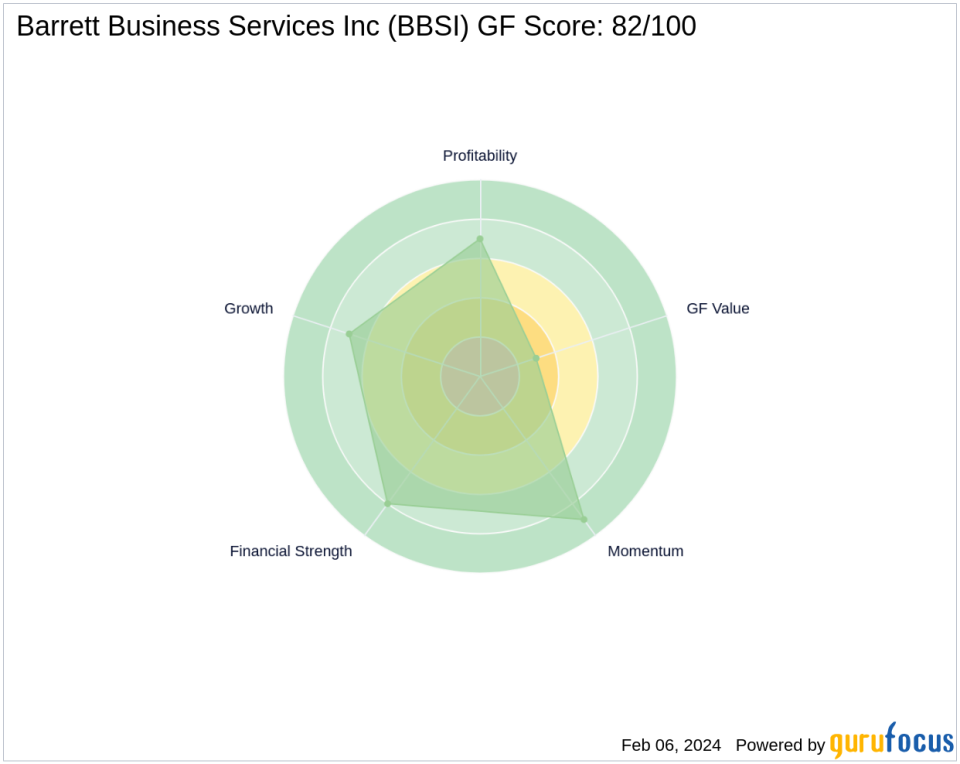

Performance Metrics and Market Sentiment

Barrett Business Services Inc boasts a strong GF Score of 82/100, indicating good potential for outperformance. The company's balance sheet receives an 8/10 Financial Strength rank, while its Profitability Rank and Growth Rank are both at 7/10. Key financial ratios such as ROE at 27.00% and ROA at 6.95% further underscore the company's robust financial health. Additionally, BBSI's cash to debt ratio stands at 6.53, reflecting a strong liquidity position. Market sentiment, as indicated by RSI indicators, shows a neutral to slightly bearish momentum, with a 14-day RSI of 44.78. Notably, other esteemed investors like Ken Fisher (Trades, Portfolio) also hold positions in BBSI, signaling confidence in the company's prospects.

Impact of Private Capital (Trades, Portfolio)'s Trade on BBSI

The recent trade by Private Capital (Trades, Portfolio) Management is a testament to the firm's belief in the value and future performance of Barrett Business Services Inc. The addition of shares to its portfolio, albeit a modest increase, reflects a strategic move to capitalize on the company's strong financial metrics and market position. With BBSI's solid Financial Strength, Profitability Rank, and Growth Rank, along with a good GF Score, Private Capital (Trades, Portfolio)'s increased stake could be well-positioned for future gains. The firm's latest move aligns with its investment philosophy of seeking undervalued opportunities with potential for appreciation.

Conclusion

Private Capital (Trades, Portfolio) Management's recent addition to its BBSI holdings underscores the firm's confidence in the company's financial health and growth potential. With a solid track record since its IPO and a robust set of performance metrics, Barrett Business Services Inc remains an intriguing prospect for value investors. As market conditions evolve, the firm's strategic investments, such as this one, will continue to be closely watched by the investment community.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.