Private Capital Bolsters Stake in Motorcar Parts of America Inc

Private Capital (Trades, Portfolio), a firm known for its value investing approach, has recently increased its investment in Motorcar Parts of America Inc (NASDAQ:MPAA), an aftermarket automotive parts manufacturer. On January 9, 2024, the firm added 541,195 shares to its holdings, impacting its portfolio by 0.58%. This transaction has brought Private Capital (Trades, Portfolio)'s total share count in MPAA to 2,965,443, representing a 3.17% position in its portfolio and a significant 15.12% ownership of the company's stock.

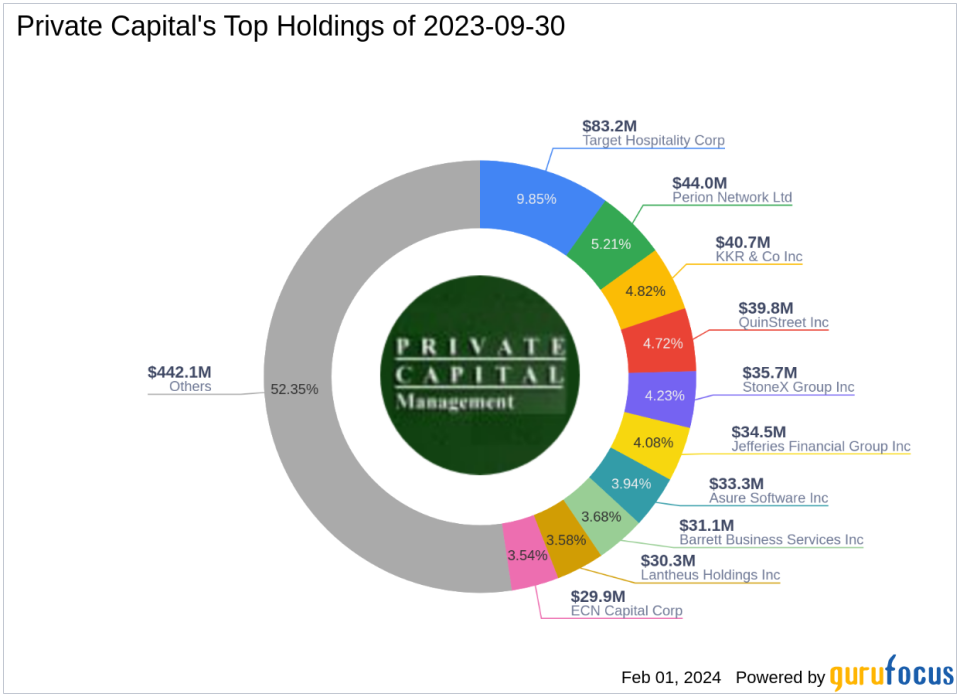

Insight into Private Capital (Trades, Portfolio)

Private Capital (Trades, Portfolio) Management, led by CEO Gregg J. Powers, has a rich history dating back to its founding in 1986 by Bruce Sherman. The firm's investment philosophy is deeply rooted in value investing, focusing on purchasing stocks at a substantial discount to their intrinsic value and emphasizing risk management. With a portfolio equity of $844 million and top holdings in various sectors, Private Capital (Trades, Portfolio) has a diverse investment landscape. Its top sectors include Financial Services and Industrials, with leading positions in companies like StoneX Group Inc (NASDAQ:SNEX) and Perion Network Ltd (NASDAQ:PERI).

Motorcar Parts of America Inc at a Glance

Motorcar Parts of America Inc, trading under the symbol MPAA, operates in the USA and has been publicly traded since March 23, 1994. The company specializes in manufacturing and distributing a wide range of aftermarket automotive parts, including starter engines, alternators, and brake-related products. With a market capitalization of $179.115 million and a current stock price of $9.135, MPAA's financial metrics are a key focus for investors. However, the company's PE percentage stands at 0.00, indicating it is currently not profitable.

Significance of Private Capital (Trades, Portfolio)'s Trade

The recent acquisition by Private Capital (Trades, Portfolio) is noteworthy, as it now holds a 15.12% ownership in MPAA. This position size is a testament to the firm's confidence in the potential of Motorcar Parts of America Inc and aligns with its value investing strategy. The trade's impact on the firm's portfolio is also significant, with a 3.17% position, highlighting the importance of this investment within its diverse portfolio.

Motorcar Parts of America Inc's Market Performance

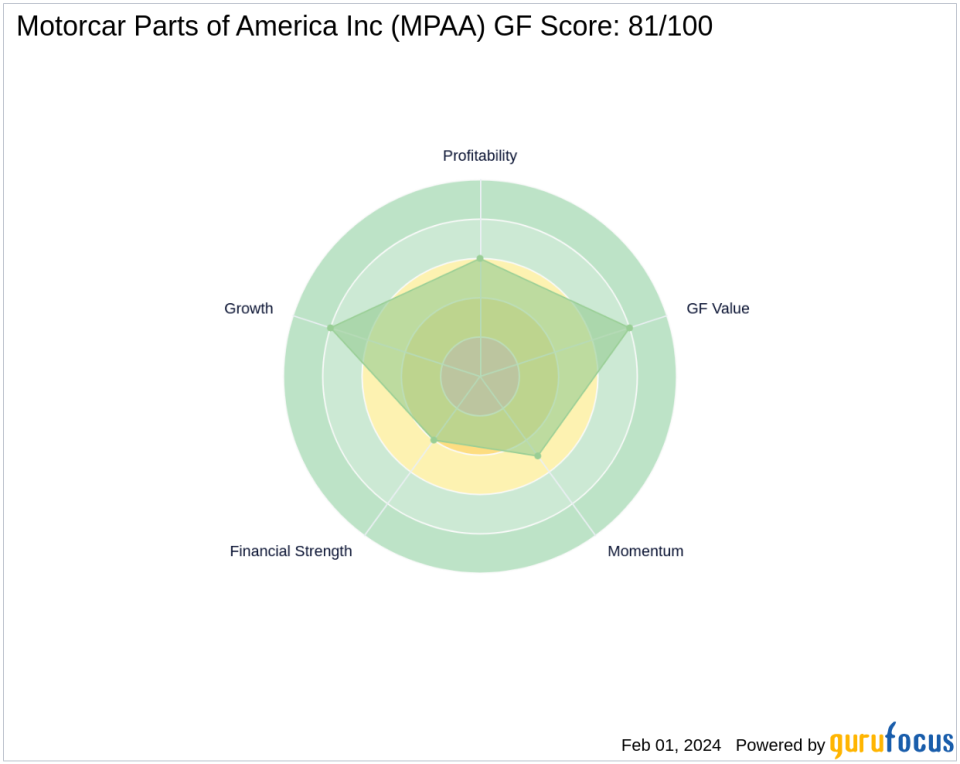

MPAA's stock is currently trading at $9.135, which is below the GF Value of $17.63, indicating that the stock might be undervalued. The stock's price to GF Value ratio stands at 0.52, suggesting that investors should think twice, as it could be a possible value trap. The stock has shown a modest gain of 0.5% since the transaction date and a year-to-date increase of 0.16%. Motorcar Parts of America Inc's GF Score is 81/100, indicating good outperformance potential.

Industry and Financial Health

Operating within the Vehicles & Parts industry, MPAA's financial health is a mixed bag. The company's cash to debt ratio is low at 0.04, and its ROE and ROA are negative, at -0.28 and -0.09, respectively. These figures suggest challenges in the company's financial stability and profitability. However, the firm's Growth Rank and GF Value Rank are both strong at 8/10, indicating potential for future growth.

Comparative Guru Holdings

While Private Capital (Trades, Portfolio) is the largest guru shareholder in MPAA, other notable investors like Donald Smith & Co also hold stakes in the company. The presence of multiple gurus investing in MPAA underscores the stock's appeal to value-oriented investors.

Market Context and Future Outlook

Motorcar Parts of America Inc's stock momentum and RSI indicators show mixed signals, with a 14-day RSI of 45.54. The company's growth prospects are supported by a three-year revenue growth rate of 7.60% and an EBITDA growth of 22.10%. However, potential challenges are evident in the company's negative operating margin growth and the need for improved financial health indicators.

In conclusion, Private Capital (Trades, Portfolio)'s recent trade in MPAA reflects a strategic move aligned with its value investing philosophy. The firm's significant stake in Motorcar Parts of America Inc, coupled with the stock's current valuation and growth potential, suggests a calculated bet on the company's future performance. Investors will be watching closely to see how this investment unfolds in the context of the broader market and industry trends.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.