Private Capital Bolsters Stake in QuinStreet Inc

Introduction to the Transaction

Private Capital (Trades, Portfolio) Management, a firm known for its value investing approach, has recently increased its investment in QuinStreet Inc (NASDAQ:QNST), a leader in performance marketing products and technologies. On December 31, 2023, Private Capital (Trades, Portfolio) added 1,605,504 shares to its holdings, bringing the total share count to 6,046,568. This transaction had a 2.38% impact on the firm's portfolio, with the shares purchased at an average price of $12.82. Following the trade, QuinStreet Inc now represents 11.08% of Private Capital (Trades, Portfolio)'s portfolio, marking a significant position in the firm's investment strategy.

Profile of Private Capital (Trades, Portfolio)

Founded in 1986 by Bruce Sherman, Private Capital (Trades, Portfolio) Management has established itself as a firm with a keen focus on value investing. Sherman, a Certified Public Accountant, laid the groundwork for the firm's investment philosophy before retiring in March 2009. Gregg J. Powers, who began his career as a healthcare analyst and joined Private Capital (Trades, Portfolio) Management in 1988, now leads the firm as CEO. Under Powers' leadership, the firm continues to prioritize investments that present a substantial margin of safety and potential for long-term gains.

Investment Philosophy of Private Capital (Trades, Portfolio)

Private Capital (Trades, Portfolio) Management adheres to a disciplined value investing style, seeking to purchase stocks at least 40% below their intrinsic value. This approach is designed to manage downside risk while allowing for significant upside potential. The firm's strategy involves in-depth research to uncover undervalued opportunities and a patient approach to realize portfolio gains over time.

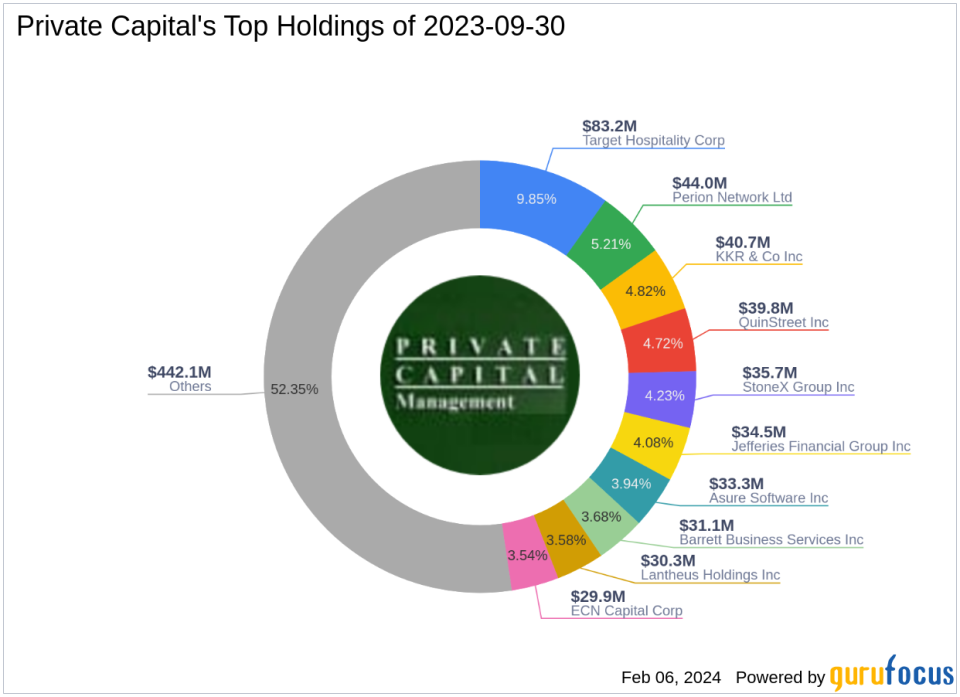

Private Capital (Trades, Portfolio)'s Portfolio Overview

The firm's portfolio is composed of 140 stocks, with top holdings in diverse sectors such as Financial Services and Industrials. Among its leading investments are StoneX Group Inc (NASDAQ:SNEX), Perion Network Ltd (NASDAQ:PERI), QuinStreet Inc (NASDAQ:QNST), KKR & Co Inc (NYSE:KKR), and Target Hospitality Corp (NASDAQ:TH). With an equity portfolio valued at $844 million, Private Capital (Trades, Portfolio) Management has a significant presence in the financial markets.

QuinStreet Inc Company Information

QuinStreet Inc, headquartered in the USA, has been a prominent player in the internet marketing industry since its IPO on February 11, 2010. The company specializes in performance marketing products, including clicks, inquiries, calls, applications, and full customer acquisitions. QuinStreet's business model focuses on serving clients in large, information-intensive industries, leveraging its expertise to deliver measurable online marketing results. The company operates in segments such as Financial Services, Home Services, and Other Revenue.

Financial Analysis of QuinStreet Inc

QuinStreet Inc is currently considered modestly undervalued with a GF Value of $14.88 and a Price to GF Value ratio of 0.87. Despite a PE Percentage of 0.00, indicating the company is not profitable at the moment, the stock has shown a gain of 1.48% since the transaction date. Year-to-date, the stock has increased by 1.56%, although it has experienced a decline of 13.84% since its IPO.

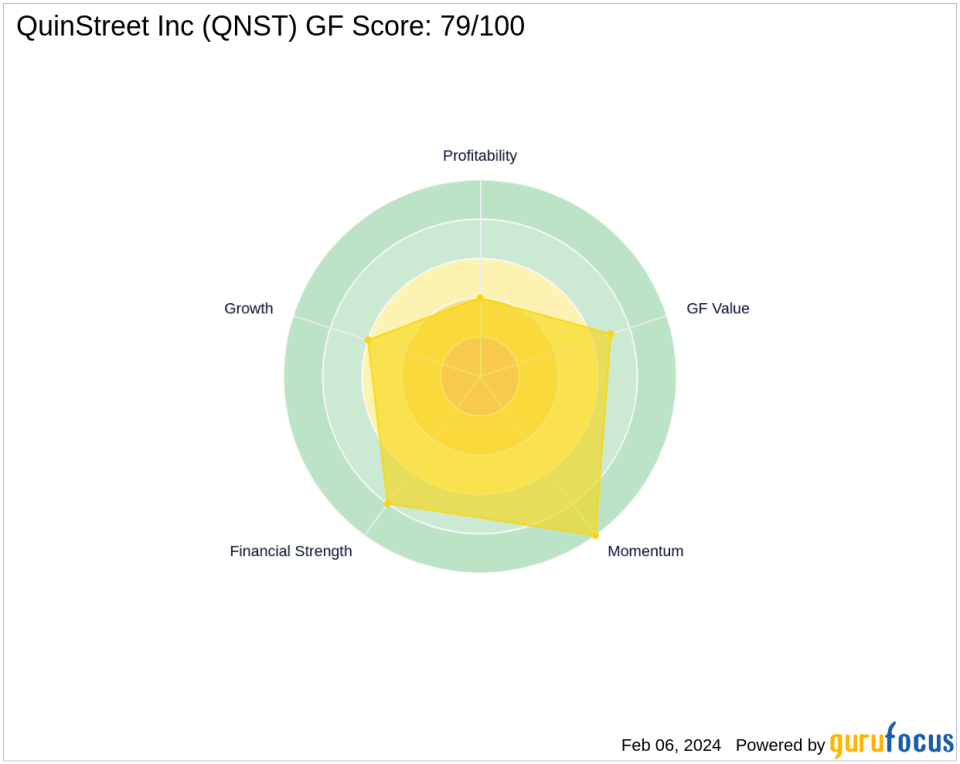

QuinStreet Inc's Rankings and Scores

QuinStreet Inc boasts a GF Score of 79/100, suggesting a likelihood of average performance in the future. The company has a strong Balance Sheet Rank of 8/10 and a moderate Profitability Rank of 4/10. Its Growth Rank and GF Value Rank stand at 6/10 and 7/10, respectively, while it excels with a Momentum Rank of 10/10. However, the Piotroski F-Score is low at 3, indicating potential issues in financial health.

Other Gurus' Interest in QuinStreet Inc

Private Capital (Trades, Portfolio) Management is not the only investment firm with a stake in QuinStreet Inc. First Eagle Investment (Trades, Portfolio) is another notable investor in the company. However, Private Capital (Trades, Portfolio)'s recent acquisition has solidified its position as the largest guru shareholder in QuinStreet Inc.

Transaction Analysis

The recent acquisition by Private Capital (Trades, Portfolio) Management has not only increased the firm's stake in QuinStreet Inc but also underscored its confidence in the company's future prospects. This strategic move aligns with the firm's investment philosophy of identifying undervalued stocks with potential for significant returns. As QuinStreet Inc continues to navigate the competitive landscape of internet marketing, Private Capital (Trades, Portfolio)'s bolstered position may prove to be a savvy investment decision in the long run.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.