Private Capital Increases Stake in Lakeland Industries Inc

On December 31, 2023, Private Capital (Trades, Portfolio) made a notable addition to its investment portfolio by acquiring 22,994 shares of Lakeland Industries Inc (NASDAQ:LAKE), a leading manufacturer of safety garments. This transaction increased the firm's total holdings in LAKE to 1,261,080 shares, marking a significant trade impact of 0.05% on the portfolio. The shares were purchased at a price of $18.54 each, reflecting Private Capital (Trades, Portfolio)'s confidence in the stock's value. This move adjusted the firm's position in LAKE to 2.77% of its portfolio, with a substantial 17.12% ownership of the company's outstanding shares.

Private Capital (Trades, Portfolio)'s Investment Strategy

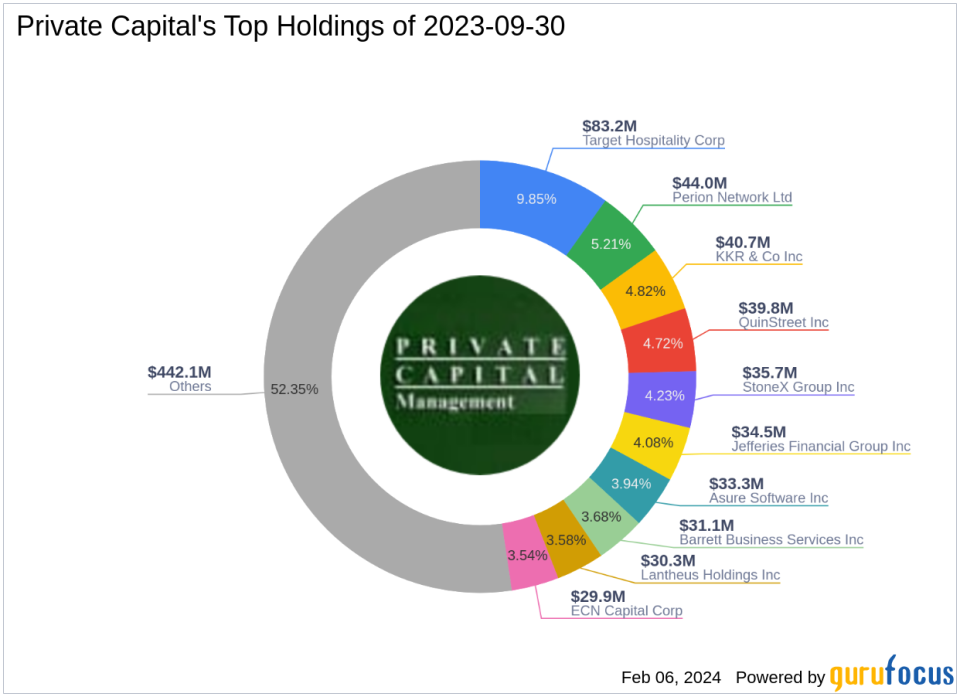

Private Capital (Trades, Portfolio) Management, established by Bruce Sherman in 1986, is known for its value investing approach. The firm seeks to purchase stocks at a considerable discount to their intrinsic value, focusing on managing downside risk and conducting thorough research to uncover investment opportunities. Gregg J. Powers, who took over as CEO after Sherman's retirement in 2009, continues to uphold these principles. Private Capital (Trades, Portfolio)'s portfolio is diverse, with top holdings in various sectors, including Financial Services and Industrials, and a total equity of $844 million.

Lakeland Industries: A Protective Apparel Leader

Lakeland Industries Inc specializes in the production and sale of industrial protective clothing. With product segments ranging from disposables to high-performance wear, the company serves a wide array of industries globally. Its customer base spans sectors such as oil, pharmaceuticals, and utilities, with operations across the United States, Latin America, Canada, Asia, and Europe. LAKE's commitment to safety and quality has positioned it as a key player in the protective apparel market.

Lakeland Industries' Financial Overview

As of the latest data, Lakeland Industries boasts a market capitalization of $130.651 million, with a current stock price of $17.74. The company's price-to-earnings (P/E) ratio stands at 20.66, indicating profitability. According to GuruFocus's exclusive valuation method, LAKE is deemed "Fairly Valued" with a GF Value of $18.55 and a price to GF Value ratio of 0.96. Despite a recent stock price decline of 4.31% since the transaction, LAKE has experienced a significant increase of 284.82% since its IPO, showcasing long-term growth potential.

Private Capital (Trades, Portfolio)'s Position and Impact

Private Capital (Trades, Portfolio)'s recent acquisition of LAKE shares has solidified its position as a major investor in the company. Holding over 1.26 million shares, the firm has a commanding presence in Lakeland Industries' shareholder structure. This strategic investment aligns with Private Capital (Trades, Portfolio)'s value-driven philosophy and represents a substantial commitment to LAKE's future prospects.

Assessing Lakeland Industries' Market Performance

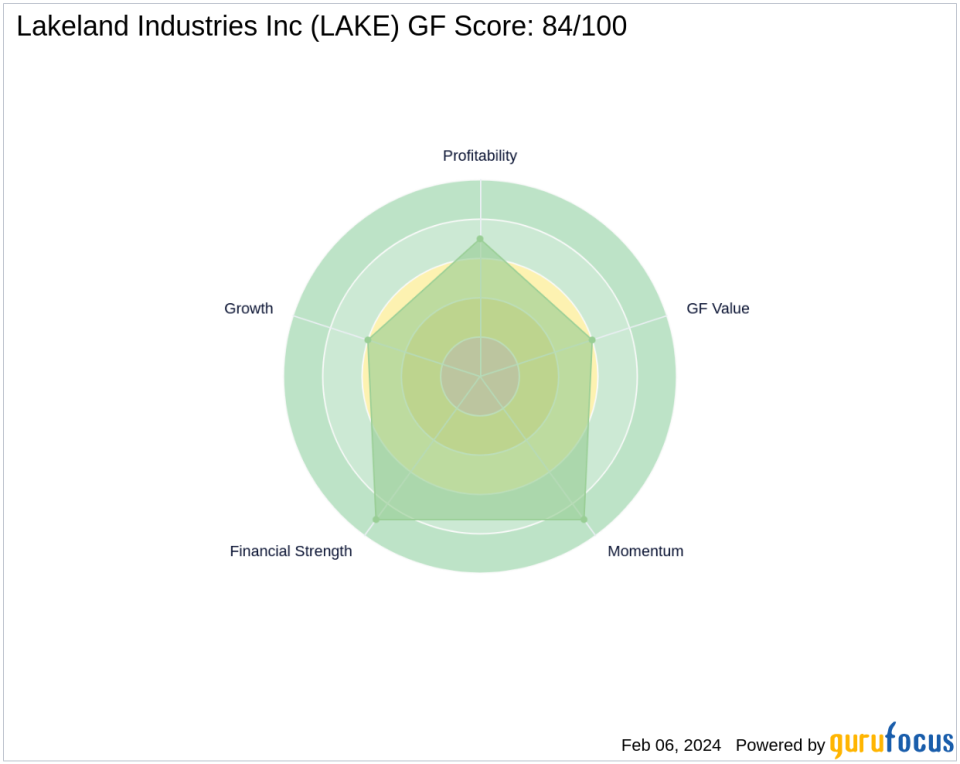

Lakeland Industries' stock performance and valuation metrics are noteworthy. The company's GF Score, an indicator of investment attractiveness, is a robust 84 out of 100, suggesting good outperformance potential. LAKE also scores high in Financial Strength, Profitability Rank, and Momentum Rank, reflecting its solid financial position and market dynamics. The Piotroski F-Score and Altman Z-Score further affirm the company's operational stability and financial health. GF-ScoreFinancial Strengthinterest coverageAltman Z scoreProfitability RankPiotroski F-ScoreOperating MarginGrowth RankGF Value RankMomentum Rank

Other Prominent Investors in Lakeland Industries

Private Capital (Trades, Portfolio) is not the only notable investor in Lakeland Industries; other investment firms, such as HOTCHKIS & WILEY, also hold stakes in the company. However, Private Capital (Trades, Portfolio)'s share percentage stands out, indicating a strong conviction in LAKE's value and growth prospects.

Market Trends and Future Prospects

The manufacturing and apparel industry is subject to various market trends, including technological advancements and shifting safety regulations. Lakeland Industries, with its comprehensive product range and global reach, is well-positioned to capitalize on these trends. Private Capital (Trades, Portfolio)'s recent investment move suggests a positive outlook on LAKE's ability to navigate the evolving market landscape and continue its growth trajectory.

In conclusion, Private Capital (Trades, Portfolio)'s increased stake in Lakeland Industries Inc reflects a strategic investment decision based on the firm's value investing philosophy. The transaction not only impacts the firm's portfolio but also underscores confidence in LAKE's financial strength and market position. As the industry evolves, both Lakeland Industries and Private Capital (Trades, Portfolio)'s investment strategy will be key factors to watch.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.