Private Capital Trims Stake in First Northwest Bancorp

Overview of Private Capital (Trades, Portfolio)'s Recent Trade

Private Capital (Trades, Portfolio), a notable investment firm, has recently adjusted its investment portfolio by reducing its stake in First Northwest Bancorp (NASDAQ:FNWB). The transaction, which took place on December 31, 2023, saw the firm decrease its holdings by 57,116 shares. This move has caught the attention of value investors, as it reflects a strategic decision by the firm regarding its investment in the banking sector.

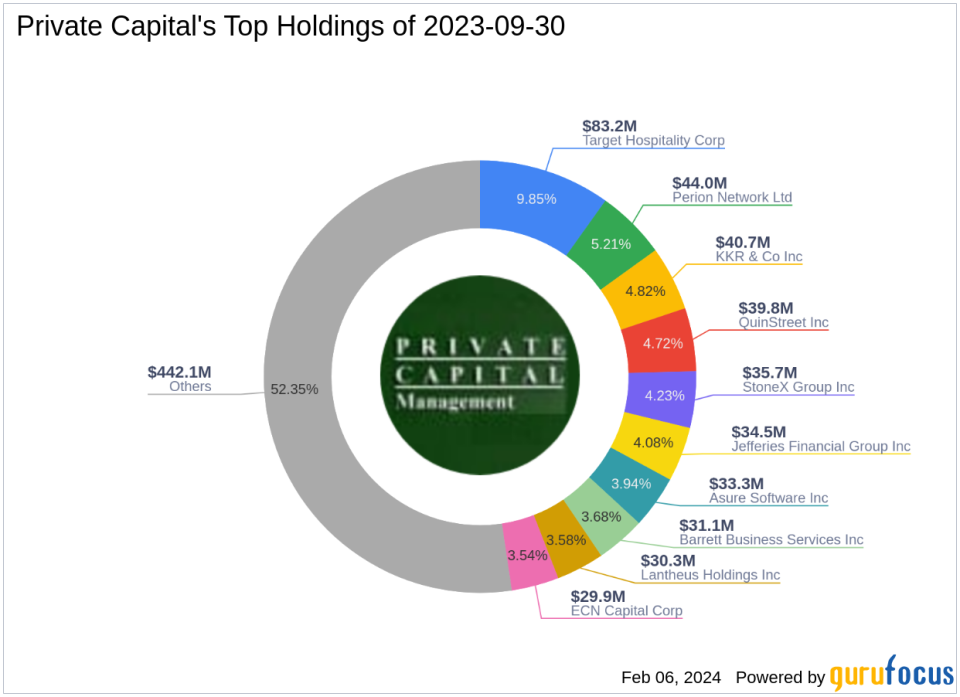

Insight into Private Capital (Trades, Portfolio)

Private Capital (Trades, Portfolio) Management, established by Bruce Sherman in 1986, has a rich history in value investing. Sherman, a Certified Public Accountant, laid the foundation for the firm's investment philosophy before retiring in March 2009. Gregg J. Powers, who took over as CEO, continues to uphold the firm's commitment to purchasing stocks at a significant discount to their intrinsic value, emphasizing thorough research, risk management, and patience. With a portfolio of 140 stocks and an equity of $844 million, Private Capital (Trades, Portfolio) has a strong presence in the Financial Services and Industrials sectors. Its top holdings include StoneX Group Inc (NASDAQ:SNEX), Perion Network Ltd (NASDAQ:PERI), and QuinStreet Inc (NASDAQ:QNST).

First Northwest Bancorp at a Glance

First Northwest Bancorp, operating under the symbol FNWB, is a bank holding company primarily engaged in banking activities through its subsidiary, First Fed Bank. Since its IPO on January 30, 2015, the company has focused on providing a range of deposit and lending services, with a strong emphasis on mortgage loans, commercial real estate loans, and consumer loans in Washington, US.

Details of the Transaction

The recent trade by Private Capital (Trades, Portfolio) marked a reduction in its position in FNWB, with the firm selling shares at a price of $15.94 each. This adjustment had a minor impact of -0.11% on the firm's portfolio, leaving Private Capital (Trades, Portfolio) with a total of 795,900 shares in FNWB, which now represents 1.5% of its portfolio and 8.28% of its holdings in the traded stock.

Financial Overview of First Northwest Bancorp

First Northwest Bancorp currently has a market capitalization of $130.914 million and a stock price of $13.62. The company's price-to-earnings (P/E) ratio stands at 54.44, indicating a valuation that may be considered high in relation to its earnings. However, GuruFocus deems the stock as Significantly Undervalued with a GF Value of $19.33, suggesting potential for price appreciation.

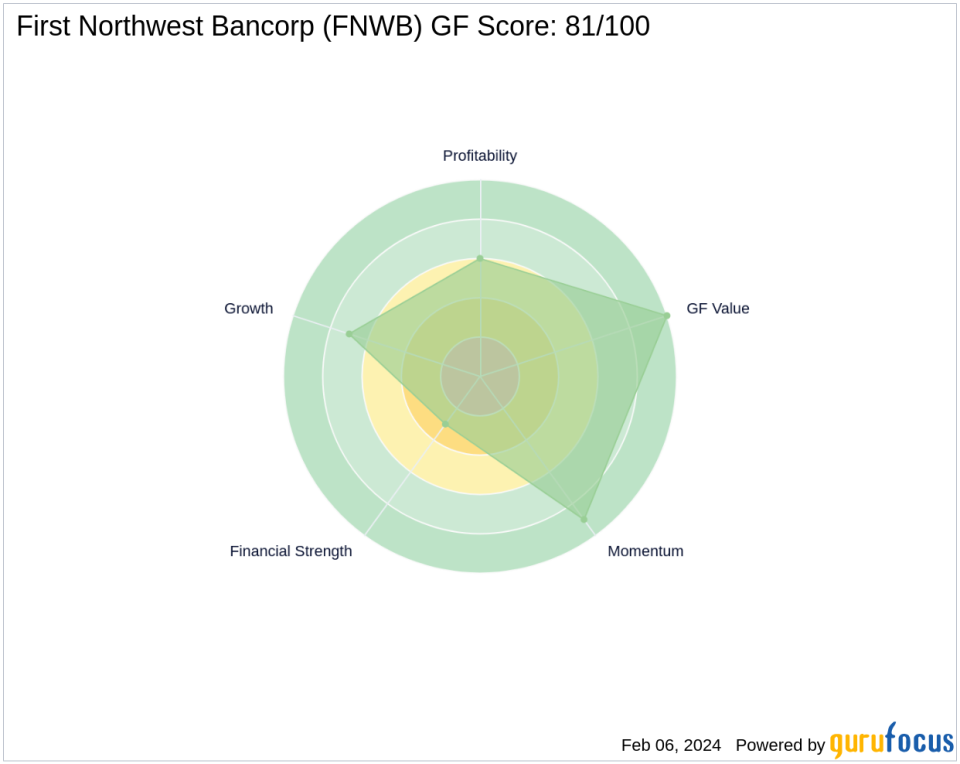

Performance Metrics and Rankings

First Northwest Bancorp boasts a GF Score of 81/100, indicating good potential for outperformance. The company's financial strength and profitability are reflected in its ranks, with a Profitability Rank of 6/10 and a Growth Rank of 7/10. The stock also holds a top GF Value Rank of 10/10 and a high Momentum Rank of 9/10, underscoring its favorable valuation and positive price momentum.

Market Reaction and Stock Performance

Since the transaction, FNWB's stock price has experienced a decline of -14.55%, with a year-to-date performance also down by -14.88%. When compared to the GF Value, the current stock price represents a ratio of 0.70, suggesting that the stock may still be undervalued despite recent market fluctuations.

Strategic Positioning by Private Capital (Trades, Portfolio)

Private Capital (Trades, Portfolio)'s decision to reduce its stake in First Northwest Bancorp aligns with its value investing philosophy and may reflect a strategic reallocation of resources within its portfolio. As the largest shareholder in FNWB, the firm's actions are closely monitored by investors for insights into market trends and potential investment opportunities. The significance of FNWB within Private Capital (Trades, Portfolio)'s portfolio remains notable, given its substantial remaining stake and the firm's history of patient, value-driven investing.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.