Private Capital's Q2 2023 13F Filing: Key Trades and Portfolio Overview

Private Capital, a renowned investment firm, recently disclosed its portfolio updates for the second quarter of 2023, which ended on June 30, 2023. The firm's investment philosophy is rooted in rigorous research and a disciplined approach to capital allocation, focusing on long-term value creation.

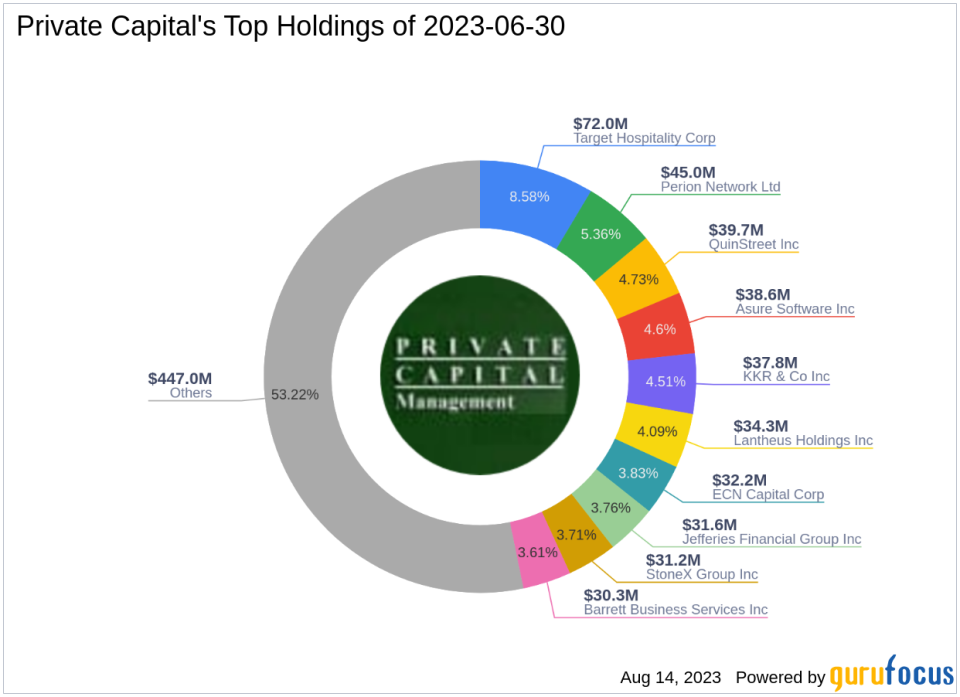

The firm's portfolio for Q2 2023 comprised 141 stocks with a total value of $840 million. The top holdings were TH (8.58%), PERI (5.36%), and QNST (4.73%).

Top Three Trades of the Quarter

The following were the firm's top three trades of the quarter:

JPMorgan Chase & Co (NYSE:JPM)

During the quarter, Private Capital (Trades, Portfolio) purchased 109,588 shares of JPMorgan Chase & Co, bringing its total holding to 120,725 shares. This trade had a 1.9% impact on the equity portfolio. The stock traded for an average price of $137.42 during the quarter. As of August 14, 2023, JPM's price was $154.77, with a market cap of $449.77 billion. The stock has returned 30.58% over the past year. GuruFocus gives the company a financial strength rating of 4 out of 10 and a profitability rating of 6 out of 10. In terms of valuation, JPM has a price-earnings ratio of 9.96, a price-book ratio of 1.59, a price-earnings-to-growth (PEG) ratio of 1.51, and a price-sales ratio of 3.16.

QuinStreet Inc (NAS:QNST)

Private Capital (Trades, Portfolio) bought 679,436 shares of QuinStreet Inc during the quarter, increasing its total holding to 4,500,267 shares. This trade had a 0.71% impact on the equity portfolio. The stock traded for an average price of $10.17 during the quarter. As of August 14, 2023, QNST's price was $9.7, with a market cap of $524.94 million. The stock has returned -22.48% over the past year. GuruFocus gives the company a financial strength rating of 8 out of 10 and a profitability rating of 4 out of 10. In terms of valuation, QNST has a price-book ratio of 2.28, a EV-to-Ebitda ratio of -320.50, and a price-sales ratio of 0.90.

Motorcar Parts of America Inc (NAS:MPAA)

During the quarter, Private Capital (Trades, Portfolio) bought 710,543 shares of Motorcar Parts of America Inc, bringing its total holding to 2,459,853 shares. This trade had a 0.66% impact on the equity portfolio. The stock traded for an average price of $5.74 during the quarter. As of August 14, 2023, MPAA's price was $8.57, with a market cap of $167.93 million. The stock has returned -46.11% over the past year. GuruFocus gives the company a financial strength rating of 4 out of 10 and a profitability rating of 6 out of 10. In terms of valuation, MPAA has a price-book ratio of 0.52, a EV-to-Ebitda ratio of 8.80, and a price-sales ratio of 0.24.

In conclusion, Private Capital (Trades, Portfolio)'s Q2 2023 portfolio reveals a strategic focus on value investing, with significant investments in diverse sectors. The firm's top trades reflect its commitment to rigorous research and disciplined capital allocation.

This article first appeared on GuruFocus.