Private Capital's Strategic Exits and Additions with a Spotlight on Air Transport Services Group

Insights from Private Capital (Trades, Portfolio)'s Latest 13F Filing for Q4 2023

Private Capital (Trades, Portfolio) Management, a firm with a rich history dating back to 1986, has recently disclosed its 13F filings for the fourth quarter of 2023. Founded by Bruce Sherman, a Certified Public Accountant with a background in family investments, the firm is now under the leadership of CEO Gregg J. Powers, who joined the team in 1988. Private Capital (Trades, Portfolio) Management is known for its value investing approach, seeking to purchase stocks at a significant discount to their intrinsic value, while emphasizing downside risk management, in-depth research, and patience to achieve long-term portfolio growth.

Summary of New Buys

During the quarter, Private Capital (Trades, Portfolio) expanded its portfolio with 7 new stock additions. Noteworthy among these are:

Blackstone Real Estate Income Trust Inc (BSTT), with 108,262 shares, making up 0.17% of the portfolio and valued at $1.55 million.

IBEX Ltd (NASDAQ:IBEX), comprising 48,396 shares, which is approximately 0.1% of the portfolio, with a total value of $920,010.

iShares Core MSCI Total International Stock ETF (NASDAQ:IXUS), with 4,031 shares, accounting for 0.03% of the portfolio and a total value of $261,760.

Key Position Increases

Private Capital (Trades, Portfolio) also bolstered its stakes in 61 stocks, with significant increases in:

Harrow Inc (NASDAQ:HROW), adding 1,377,597 shares for a total of 2,794,497 shares, marking a 97.23% increase in share count and a 1.72% impact on the current portfolio, valued at $31,298,370.

Lantheus Holdings Inc (NASDAQ:LNTH), with an additional 121,290 shares, bringing the total to 556,771 shares, a 27.85% increase in share count, valued at $34,519,800.

Summary of Sold Out Positions

Private Capital (Trades, Portfolio) exited 9 holdings in the fourth quarter of 2023, including:

Air Transport Services Group Inc (NASDAQ:ATSG), selling all 1,179,054 shares, which had a -2.91% impact on the portfolio.

Fiesta Restaurant Group Inc (FRGI), liquidating all 1,533,737 shares, resulting in a -1.54% impact on the portfolio.

Key Position Reductions

Reductions were made in 28 stocks, with the most significant being:

Stoneridge Inc (NYSE:SRI), reduced by 229,122 shares, leading to a -44.73% decrease in shares and a -0.55% impact on the portfolio. The stock traded at an average price of $17.36 during the quarter.

KKR & Co Inc (NYSE:KKR), reduced by 53,460 shares, a -8.1% reduction, impacting the portfolio by -0.39%. The stock traded at an average price of $67.71 during the quarter.

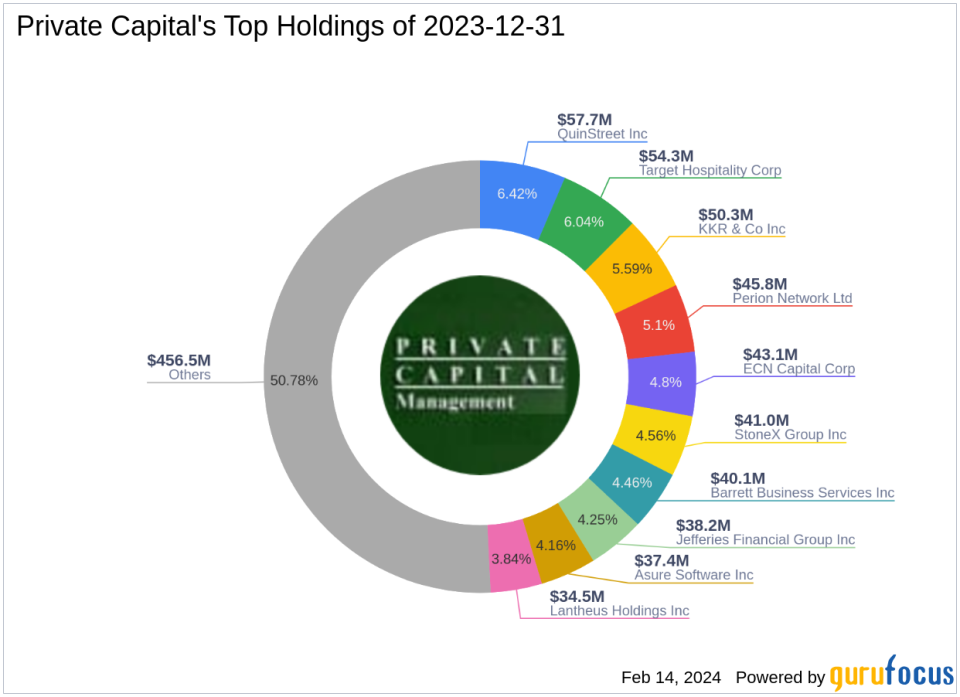

Portfolio Overview

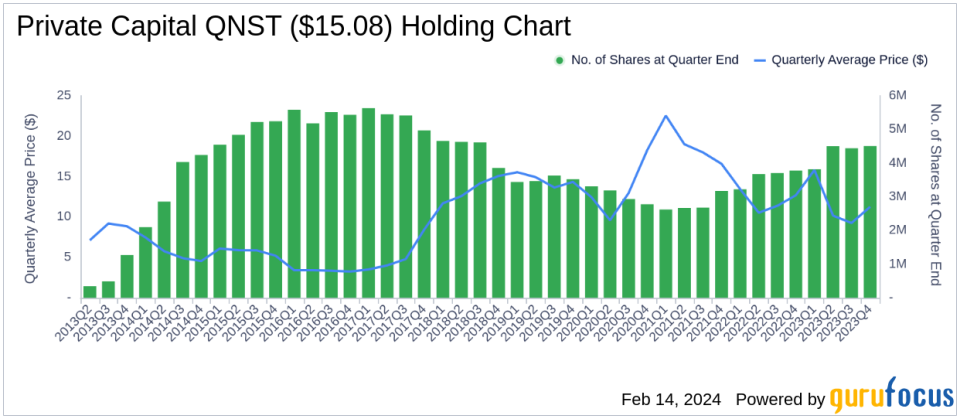

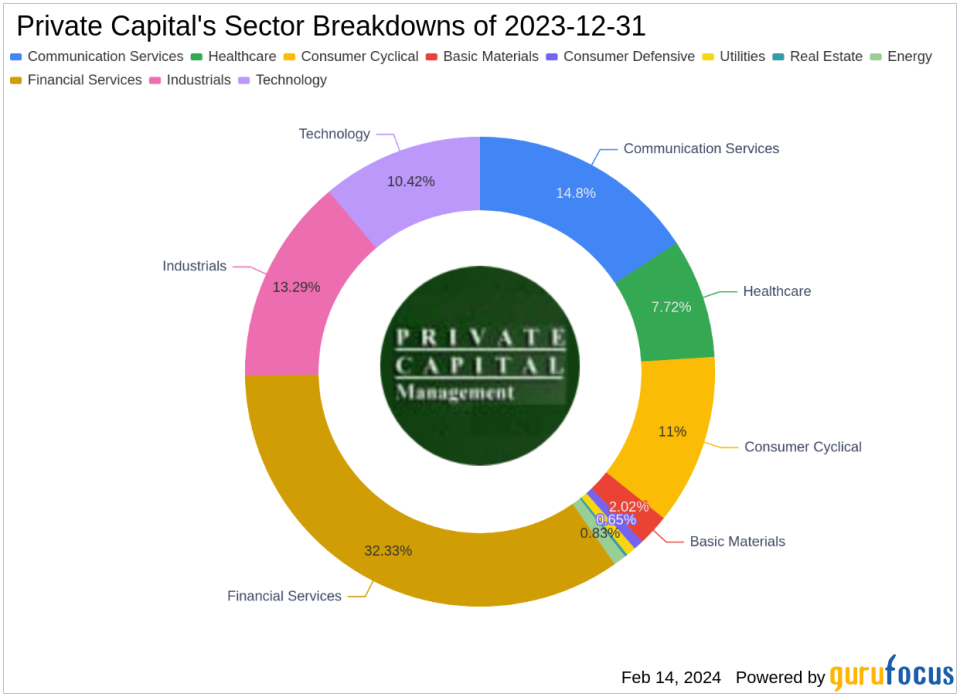

As of the fourth quarter of 2023, Private Capital (Trades, Portfolio)'s portfolio consisted of 143 stocks. The top holdings were 6.42% in QuinStreet Inc (NASDAQ:QNST), 6.04% in Target Hospitality Corp (NASDAQ:TH), 5.59% in KKR & Co Inc (NYSE:KKR), 5.1% in Perion Network Ltd (NASDAQ:PERI), and 4.8% in ECN Capital Corp (ECNCF). The investments span across all 11 industries, with a focus on Financial Services, Communication Services, Industrials, Consumer Cyclical, Technology, Healthcare, Basic Materials, Energy, Consumer Defensive, Utilities, and Real Estate.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.