ProAssurance (PRA) and Caresyntax Unite for Better Health Outcome

ProAssurance Corporation PRA recently collaborated with Caresyntax, a surgical data intelligence platform, to make surgery smarter for PRA’s insured surgeons. Under this partnership, insured surgeons will benefit from Caresyntax’s artificial intelligence ("AI") suite of tools to improve the quality of surgeries.

With Caresyntax’s tools, surgeons can incorporate video and other real-world proofs coupled with data sets to get insights on patient health outcomes and improve efficiency and profits. Moreover, surgeons can share data and content on surgeries with patients through the InfluenceOR app.

This partnership bodes well for ProAssurance, which derives most of its revenues from the property and specialty insurance business segment. Revenues from Healthcare Professional Liability (“HCPL”) contribute a major portion to this segment, which is expected to grow more in the future through a partnership like this. Partnering with Caresyntax will further enhance PRA’s existing offerings and help with client retention.

Surgical care accounts for 50% of the overall hospital costs according to current estimates for the United States. This partnership is expected to lower the surgical costs incurred by hospitals. The insurers will experience an improvement in HCPL claim costs as the AI tools will help surgeons improve the quality of surgeries, resulting in fewer lawsuits for mistakes.

However, the property and specialty business of ProAssurance has been incurring losses. The top-line decline in the first quarter shows inefficiency in dealing with competitive pressures. Although the company experienced rate increases in the first quarter, its top line declined due to cheaper rates offered by its competitors, leading to loss of business. Challenging claims environment and social inflation would continue to put pressure on the company’s margins in the future.

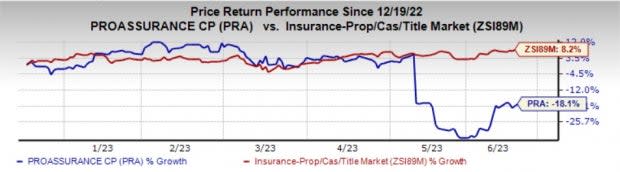

Price Performance

Shares of ProAssurance have lost 18.1% in the past six months against the industry’s growth of 8.2%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

ProAssurance currently has a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the broader finance space are Ambac Financial Group, Inc. AMBC, Lemonade, Inc. LMND and AXIS Capital Holdings Limited AXS. Each of these companies carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Ambac Financial’s 2023 earnings has improved 68% over the past 30 days. During this time, AMBC has witnessed one upward estimate revision against none in the opposite direction.

The Zacks Consensus Estimate for Lemonade’s 2023 earnings suggests 15.9% year-over-year growth. The consensus mark for LMND’s 2023 revenues implies a 53.6% year-over-year rise.

The Zacks Consensus Estimate for AXIS Capital’s 2023 bottom line suggests a 33.2% year-over-year improvement. The estimate has risen 4.9% over the past 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Axis Capital Holdings Limited (AXS) : Free Stock Analysis Report

ProAssurance Corporation (PRA) : Free Stock Analysis Report

Ambac Financial Group, Inc. (AMBC) : Free Stock Analysis Report

Lemonade, Inc. (LMND) : Free Stock Analysis Report