Processors and Graphics Chips Stocks Q3 Earnings Review: Nvidia (NASDAQ:NVDA) Shines

As Q3 earnings season comes to a close, it’s time to take stock of this quarter's best and worst performers amongst the processors and graphics chips stocks, including Nvidia (NASDAQ:NVDA) and its peers.

The biggest demand drivers for processors (CPUs) and graphics chips at the moment are secular trends related to 5G and Internet of Things, autonomous driving, and high performance computing in the data center space, specifically around AI and machine learning. Like all semiconductor companies, digital chip makers exhibit a degree of cyclicality, driven by supply and demand imbalances and exposure to PC and Smartphone product cycles.

The 9 processors and graphics chips stocks we track reported a decent Q3; on average, revenues beat analyst consensus estimates by 1.7% while next quarter's revenue guidance was 3.5% below consensus. Inflation (despite slowing) has investors prioritizing near-term cash flows, but processors and graphics chips stocks held their ground better than others, with the share prices up 16.1% on average since the previous earnings results.

Best Q3: Nvidia (NASDAQ:NVDA)

Founded in 1993 by Jensen Huang and two former Sun Microsystems engineers, Nvidia (NASDAQ:NVDA) is a leading fabless designer of chips used in gaming, PCs, data centers, automotive, and a variety of end markets.

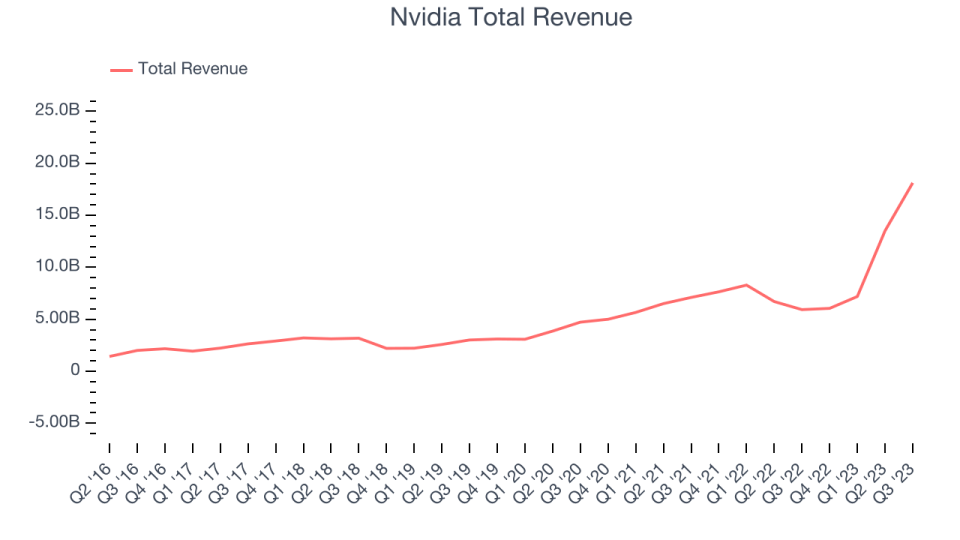

Nvidia reported revenues of $18.12 billion, up 206% year on year, topping analyst expectations by 12.5%. It was a stunning quarter for the company, with a significant improvement in its gross margin and an impressive beat of analysts' EPS estimates.

“Our strong growth reflects the broad industry platform transition from general-purpose to accelerated computing and generative AI,” said Jensen Huang, founder and CEO of NVIDIA.

Nvidia scored the biggest analyst estimates beat and fastest revenue growth of the whole group. The stock is up 5.1% since the results and currently trades at $525.1.

Intel (NASDAQ:INTC)

Inventor of the x86 processor that powered decades of technological innovation in PCs, data centers, and numerous other markets, Intel (NASDAQ: INTC) is the leading manufacturer of computer processors and graphics chips.

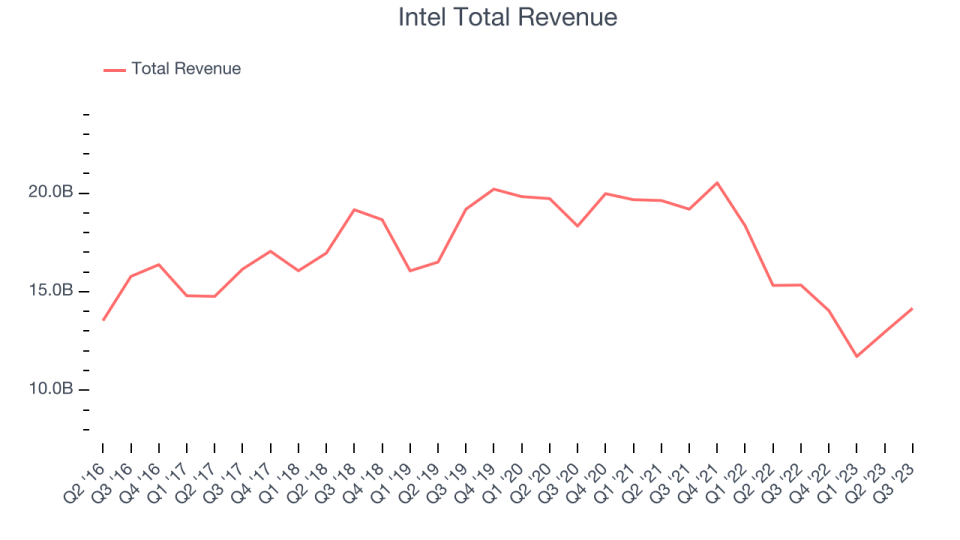

Intel reported revenues of $14.16 billion, down 7.7% year on year, outperforming analyst expectations by 4.1%. It was a very good quarter for the company, with an impressive beat of analysts' EPS estimates and a significant improvement in its operating margin.

The stock is up 48.8% since the results and currently trades at $48.31.

Is now the time to buy Intel? Access our full analysis of the earnings results here, it's free.

Weakest Q3: SMART (NASDAQ:SGH)

Based in the US, SMART Global Holdings (NASDAQ:SGH) is a diversified semiconductor company offering memory, digital, and LED products.

SMART reported revenues of $316.7 million, down 27.7% year on year, falling short of analyst expectations by 15.6%. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and a miss of analysts' revenue estimates.

SMART had the weakest performance against analyst estimates and slowest revenue growth in the group. The stock is down 23.1% since the results and currently trades at $18.11.

Read our full analysis of SMART's results here.

AMD (NASDAQ:AMD)

Founded in 1969 by a group of former Fairchild semiconductor executives led by Jerry Sanders, Advanced Micro Devices or AMD (NASDAQ:AMD) is one of the leading designers of computer processors and graphics chips used in PCs and data centers.

AMD reported revenues of $5.8 billion, up 4.2% year on year, surpassing analyst expectations by 1.9%. It was a mixed quarter for the company, with a significant improvement in its inventory levels but underwhelming revenue guidance for the next quarter.

The stock is up 47.9% since the results and currently trades at $145.65.

Read our full, actionable report on AMD here, it's free.

Lattice Semiconductor (NASDAQ:LSCC)

A global leader in its category, Lattice Semiconductor (NASDAQ:LSCC) is a semiconductor designer specializing in customer-programmable chips that enhance CPU performance for intensive tasks such as machine learning.

Lattice Semiconductor reported revenues of $192.2 million, up 11.4% year on year, in line with analyst expectations. It was a mixed quarter for the company, with underwhelming revenue guidance for the next quarter. On the other hand, Lattice Semiconductor's revenue and EPS outperformed Wall Street's estimates, even if the beats weren't too big.

The stock is down 1.4% since the results and currently trades at $66.3.

Read our full, actionable report on Lattice Semiconductor here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned