Procter & Gamble (PG) Stock Gains on Q1 Earnings & Sales Beat

The Procter & Gamble Company PG has reported strong top and bottom lines in first-quarter fiscal 2024, surpassing the Zacks Consensus Estimate. Sales and earnings also improved year over year. The company’s organic sales grew, driven by robust pricing and a favorable mix, along with strength across segments.

Procter & Gamble’s core earnings of $1.83 per share increased 17% from $1.57 in the year-ago quarter. The figure also beat the Zacks Consensus Estimate of $1.71. The strong bottom-line results have stemmed from improved sales, a higher operating margin and lower shares outstanding. Currency-neutral net earnings per share (EPS) rose 21% year over year.

The company has reported net sales of $21,871 million, up 6% year over year. Sales surpassed the Zacks Consensus Estimate of $21,648 million. The increase in sales can be attributed to growth across all segments. Currency negatively impacted net sales by 1%.

Procter & Gamble Company (The) Price, Consensus and EPS Surprise

Procter & Gamble Company (The) price-consensus-eps-surprise-chart | Procter & Gamble Company (The) Quote

On an organic basis (excluding the impacts of acquisitions, divestitures and foreign exchange), revenues improved 7% year over year, backed by a 7% rise in pricing and a 1% gain from a positive product mix, offset by a 1% decline in volume.

Our model had predicted organic revenue growth of 5.3% for the fiscal first quarter, with a 6% gain from price/mix and a 2.9% decline in volume.

Net sales increased 3% for Beauty, 6% for Grooming, 11% for Health Care, 8% for Fabric & Home Care, and 5% for the Baby, Feminine & Family Care segment. All the company’s business segments have reported growth in organic sales. Organic sales rose 5% for Beauty, 9% each for Grooming and the Fabric & Home Care segment, 10% for Health Care, and 7% for the Baby, Feminine & Family Care segment.

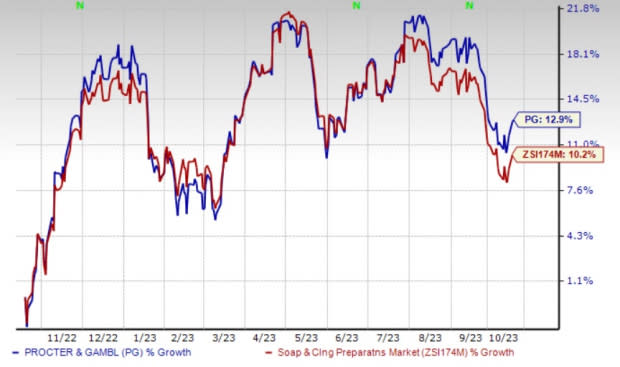

Shares of the company gained 2% in the pre-market session, following the solid top and bottom lines, and the robust fiscal 2024 view. The Zacks Rank #3 (Hold) company’s stock has gained 12.9% in the past year compared with the industry’s 10.2% growth.

Image Source: Zacks Investment Research

Margins

In the reported quarter, the gross margin increased 460 basis points (bps) to 52%. Favorable currency rates aided the gross margin by 0.6%. The currency-neutral gross margin improved 520 bps to 52.6%. The increase in the gross margin was driven by 330 bps of pricing gains, 160 bps of favorable commodity costs and 150 bps of gross productivity savings. This was partly offset by a 60-bps impact of negative product mix, and 60 bps of product and package reinvestments, and other impacts.

Selling, general and administrative expenses (SG&A), as a percentage of sales, expanded 220 bps from the year-ago quarter to 25.6%. Currency hurt the SG&A expense rate by 0.4%. The SG&A expense rate increased 180 bps to 25.2% on a currency-neutral basis. The increase was driven by a 260-bps rise in marketing investments, 140-bps wage inflation and other impacts, offset by a 160-bps net sales growth leverage and 60-bps of productivity savings.

The operating margin rose 240 bps from the prior year to 26.4%. Currency rates aided the operating margin by 1%. On a currency-neutral basis, the operating margin expanded 340 bps to 27.4%. Operating margin included gross productivity savings of 210 bps.

We had expected the core gross profit margin to expand 100 bps in the fiscal first quarter. The core SG&A expense rate was anticipated to increase 50 bps, while our core operating margin projection suggested growth of 50 bps.

Financials

Procter & Gamble ended first-quarter fiscal 2024 with cash and cash equivalents of $9,733 million, long-term debt of $24,069 million, and total shareholders’ equity of $48,014 million.

The company generated an operating cash flow of $4,904 million in first-quarter fiscal 2024 and an adjusted free cash flow of $4,401 million. Adjusted free cash flow productivity was 97% in the fiscal first quarter.

Procter & Gamble returned $3.8 billion of value to its shareholders in first-quarter fiscal 2024. This included $2.3 billion of dividend payouts and $1.5 billion of share buybacks.

FY24 Guidance

Management has raised its view for fiscal 2024. The company anticipates year-over-year all-in sales growth of 2-4% for fiscal 2024 compared with 3-4% mentioned earlier. Organic sales are likely to increase 4-5% in fiscal 2024. Currency movements are expected to negatively impact all-in sales growth by 1-2%.

Procter & Gamble expects the reported EPS to increase 6-9% year over year to $6.25-$6.43. Notably, it posted $5.90 in fiscal 2023. The company maintained the EPS guidance despite an incremental $600-million after-tax foreign exchange headwind since its initial fiscal 2024 guidance in late July.

The current earnings view for fiscal 2024 includes after-tax benefits of $800 million related to favorable commodity costs, net of adverse currency impacts. However, the company expects unfavorable currency rates to be a headwind of $1 billion after tax. Procter & Gamble expects the net impact of interest expenses and interest income to be a headwind of $200 million after tax.

The company projects a core effective tax rate of 21% for fiscal 2024. It expects a capital expenditure of 4.5% of net sales in fiscal 2024.

Adjusted free cash flow productivity is estimated to be 90% for fiscal 2024. The company intends to make dividend payments of more than $9 billion, along with share repurchases of $5-$6 billion in fiscal 2024.

Here’s How Better-Ranked Stocks Fared

We highlighted some better-ranked stocks from the broader Consumer Staples space, namely e.l.f. Beauty ELF, Church & Dwight Co. CHD and Inter Parfums IPAR.

e.l.f. Beauty currently sports a Zacks Rank #1 (Strong Buy). ELF has a trailing four-quarter earnings surprise of 108.3%, on average. The company has gained 170.6% in the past year.

You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for e.l.f. Beauty’s current financial-year sales and EPS suggests growth of 44.2% and 48.2%, respectively, from the year-ago reported numbers. The consensus mark for ELF’s EPS has moved up 0.8% in the past seven days.

Church & Dwight currently carries a Zacks Rank of 2 (Buy). CHD has a trailing four-quarter earnings surprise of 12.1%, on average. The company has risen 21.1% in the past year.

The Zacks Consensus Estimate for CHD’s current financial year’s sales and earnings suggests growth of 8.4% and 6.7%, respectively, from the prior-year reported numbers. The consensus mark for Church & Dwight’s EPS has been unchanged in the past 30 days.

Inter Parfums currently carries a Zacks Rank #2. IPAR has a trailing four-quarter earnings surprise of 45.9%, on average. The company has gained 61.1% in the past year.

The Zacks Consensus Estimate for Inter Parfums’ current financial year’s sales and EPS suggests growth of 19.7% and 14.9%, respectively, from the year-ago reported numbers. The consensus mark for CHD’s EPS has moved up by a penny in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Procter & Gamble Company (The) (PG) : Free Stock Analysis Report

Church & Dwight Co., Inc. (CHD) : Free Stock Analysis Report

Inter Parfums, Inc. (IPAR) : Free Stock Analysis Report

e.l.f. Beauty (ELF) : Free Stock Analysis Report