Productivity Software Stocks Q3 Recap: Benchmarking Dropbox (NASDAQ:DBX)

The end of an earnings season can be a great time to assess how companies are handling the current business environment and discover new stocks. Let’s take a look at how Dropbox (NASDAQ:DBX) and the rest of the productivity software stocks fared in Q3.

Rising employee costs and the shift to more remote work has increased the ever-present pressure to improve corporate productivity, which in turn has driven rising demand for productivity software that enables remote work, streamline project management and automate business tasks.

The 17 productivity software stocks we track reported a mixed Q3; on average, revenues beat analyst consensus estimates by 2.2% while next quarter's revenue guidance was 0.6% below consensus. Inflation (despite slowing) has investors prioritizing near-term cash flows, but productivity software stocks held their ground better than others, with the share prices up 17% on average since the previous earnings results.

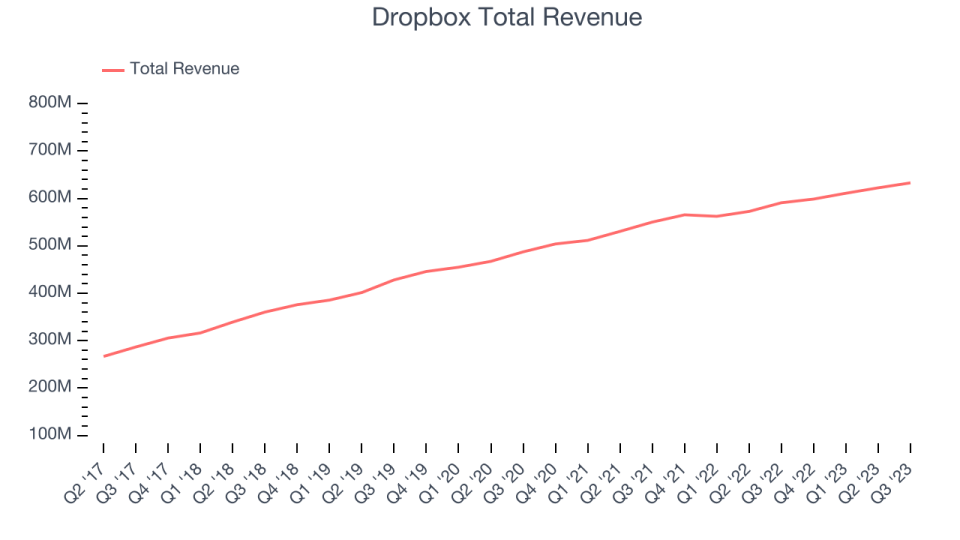

Dropbox (NASDAQ:DBX)

Founded by the long-serving CEO Drew Houston and Arash Ferdowsi in 2007, Dropbox (NASDAQ:DBX) provides a file hosting cloud platform that helps organizations collaborate and share documents.

Dropbox reported revenues of $633 million, up 7.1% year on year, in line with analyst expectations. It was a decent quarter for the company, with a narrow beat of analysts' revenue estimates and a solid beat of analysts' EPS estimates .

The stock is up 21.8% since the results and currently trades at $32.2.

Is now the time to buy Dropbox? Access our full analysis of the earnings results here, it's free.

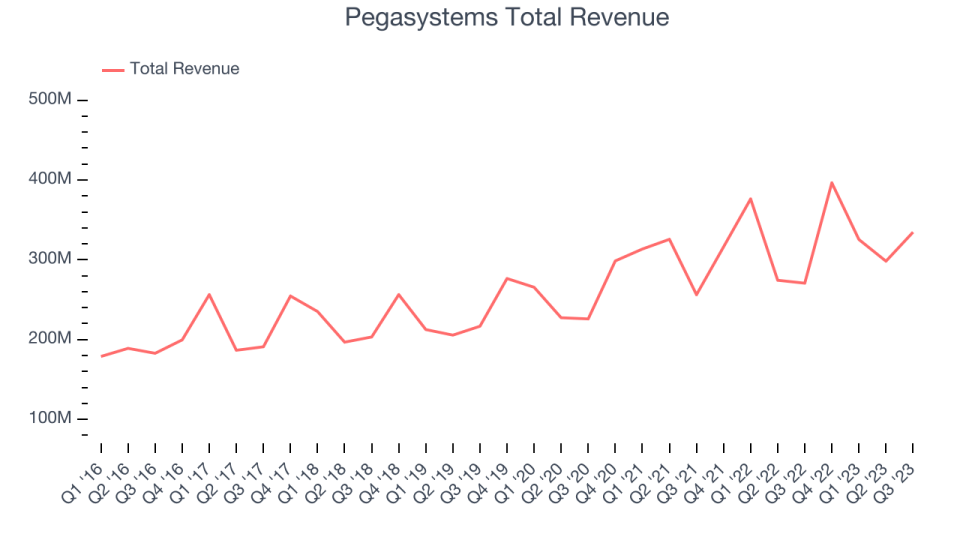

Best Q3: Pegasystems (NASDAQ:PEGA)

Founded by Alan Trefler in 1983, Pegasystems (NASDAQ:PEGA) offers a software-as-a-service platform to automate and optimize workflows in customer service and engagement.

Pegasystems reported revenues of $334.6 million, up 23.6% year on year, outperforming analyst expectations by 12.8%. It was an incredible quarter for the company, with a significant improvement in its gross margin and an impressive beat of analysts' revenue estimates.

Pegasystems pulled off the biggest analyst estimates beat among its peers. The stock is up 20.8% since the results and currently trades at $45.95.

Is now the time to buy Pegasystems? Access our full analysis of the earnings results here, it's free.

Weakest Q3: Box (NYSE:BOX)

Founded in 2005 by Aaron Levie and Dylan Smith, Box (NYSE:BOX) provides organizations with software to securely store, share and collaborate around work documents in the cloud.

Box reported revenues of $261.5 million, up 4.6% year on year, falling short of analyst expectations by 0.2%. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and full-year.

Box had the weakest performance against analyst estimates in the group. The stock is up 0.3% since the results and currently trades at $26.77.

Read our full analysis of Box's results here.

Monday.com (NASDAQ:MNDY)

Founded in Israel in 2014, and named after the dreaded first day of the work week, Monday.com (NASDAQ:MNDY) makes software as a service platforms that helps teams plan and track work efficiently.

Monday.com reported revenues of $189.2 million, up 38.2% year on year, surpassing analyst expectations by 3.7%. It was a good quarter for the company, with a decent beat of analysts' revenue estimates but its net revenue retention rate in jeopardy.

Monday.com pulled off the fastest revenue growth and highest full-year guidance raise among its peers. The company added 185 enterprise customers paying more than $50,000 annually to reach a total of 2,077. The stock is up 50.1% since the results and currently trades at $210.73.

Read our full, actionable report on Monday.com here, it's free.

Zoom (NASDAQ:ZM)

Started by Eric Yuan who once ran engineering for Cisco’s video conferencing business, Zoom (NASDAQ:ZM) offers an easy to use, cloud-based platform for video conferencing, audio conferencing and screen sharing.

Zoom reported revenues of $1.14 billion, up 3.2% year on year, surpassing analyst expectations by 1.6%. It was a mixed quarter for the company, with its net revenue retention rate in jeopardy and decelerating growth in large customers. On the other hand, it narrowly topped analysts' revenue expectations during the quarter, driven by more new customer wins than projected. Its free cash flow also beat Wall Street's estimates significantly.

The company added 59 enterprise customers paying more than $100,000 annually to reach a total of 3,731. The stock is up 3.7% since the results and currently trades at $68.5.

Read our full, actionable report on Zoom here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned