Profire Energy Inc's Meteoric Rise: Unpacking the 64% Surge in Just 3 Months

Profire Energy Inc (NASDAQ:PFIE), a leading player in the Oil & Gas industry, has seen a significant surge in its stock price over the past three months. The company's market cap stands at $107.042 million, with its current stock price at $2.25, marking a substantial increase from its price of $1.15 three months ago. Over the past week, the stock price has seen a gain of 31.56%, and over the past three months, it has seen a gain of 64.20%. The company's current GF Value is $2.31, up from $2.06 three months ago. The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates. According to the GF Value, the stock is currently fairly valued, a significant improvement from being significantly undervalued three months ago.

Company Overview

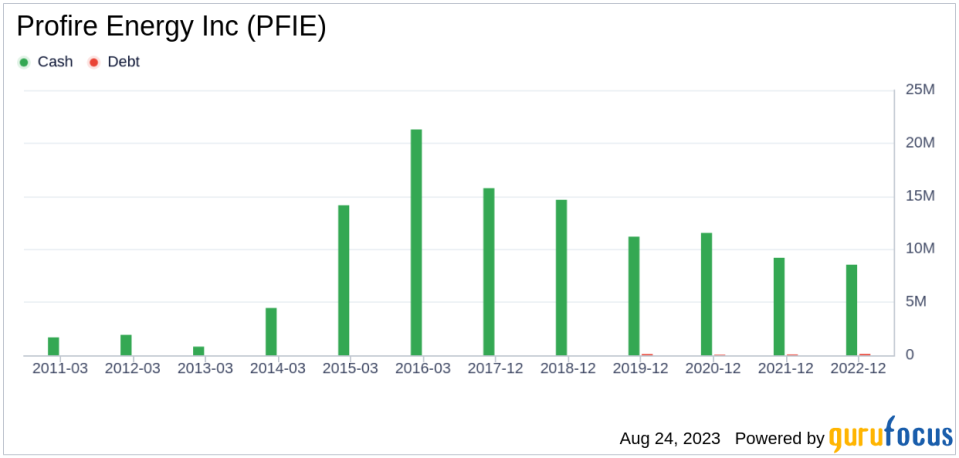

Profire Energy Inc is an oilfield technology company operating primarily in the United States. The company specializes in developing combustion management technologies for the oil and gas industry, creating burner-management systems used on various oilfield natural-draft fire tube vessels. In addition to these systems, Profire Energy also sells complementary oilfield products to its customers. The majority of the company's revenue comes from its operations in the United States.

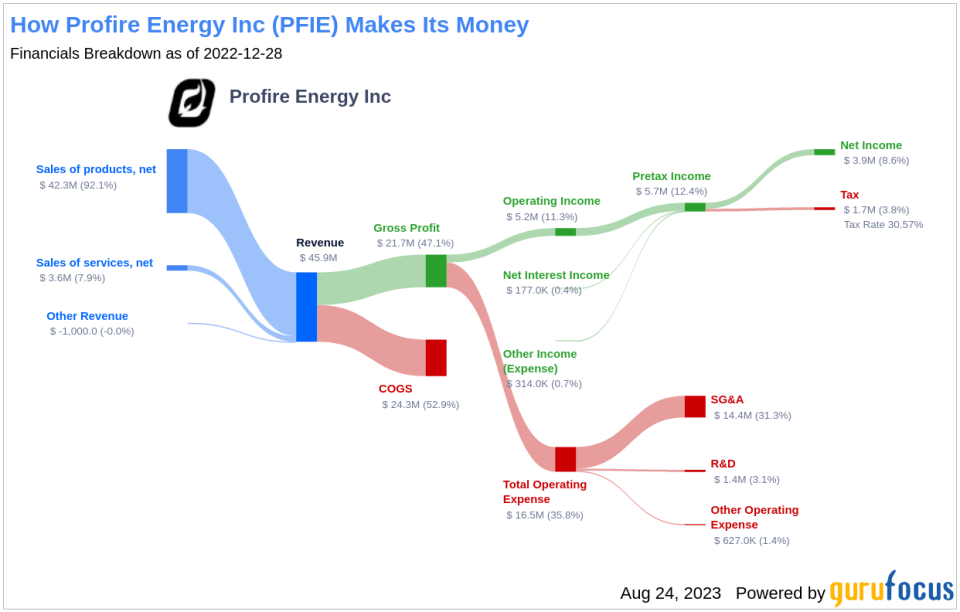

Profitability Analysis

Profire Energy Inc has a Profitability Rank of 7/10, indicating a strong profitability compared to its industry peers. The company's operating margin stands at 19.61%, better than 66.56% of the companies in the industry. Its ROE, ROA, and ROIC are 17.86%, 15.62%, and 20.16% respectively, all of which are better than the majority of the companies in the industry. Over the past 10 years, the company has had 8 years of profitability, better than 75.53% of the companies in the industry.

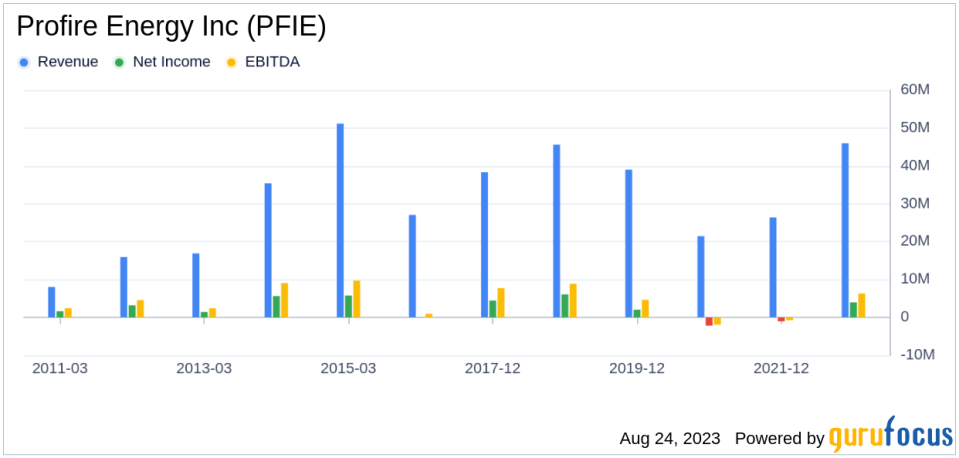

Growth Prospects

The company's Growth Rank is 3/10, indicating moderate growth compared to its industry peers. The 3-year and 5-year revenue growth rate per share are 5.40% and -3.10% respectively. However, the company's future total revenue growth rate is estimated to be 19.35%, better than 93.61% of the companies in the industry. The 3-year EPS without NRI growth rate is 26.00%, better than 53.03% of the companies in the industry.

Major Stock Holders

Chuck Royce (Trades, Portfolio) and Jim Simons (Trades, Portfolio) are the top two holders of Profire Energy Inc's stock. Chuck Royce (Trades, Portfolio) holds 2,033,761 shares, accounting for 4.3% of the company's stock, while Jim Simons (Trades, Portfolio) holds 1,356,195 shares, accounting for 2.86% of the company's stock.

Competitive Landscape

Profire Energy Inc operates in a competitive industry with companies like Flotek Industries Inc (NYSE:FTK) with a stock market cap of $123.445 million, Smart Sand Inc (NASDAQ:SND) with a stock market cap of $77.306 million, and Dawson Geophysical Co (NASDAQ:DWSN) with a stock market cap of $44.751 million.

Conclusion

In conclusion, Profire Energy Inc has shown impressive stock performance, profitability, and growth prospects. The company's stock has seen a significant surge over the past three months, and its profitability and growth ranks are commendable. The company's major stock holders and competitive landscape further underscore its position in the industry. Given these factors, Profire Energy Inc appears to be in a strong position for future growth.

This article first appeared on GuruFocus.