Progress Software Corp (PRGS) Reports Fiscal Q4 and Year-End Results with Strong ARR Growth

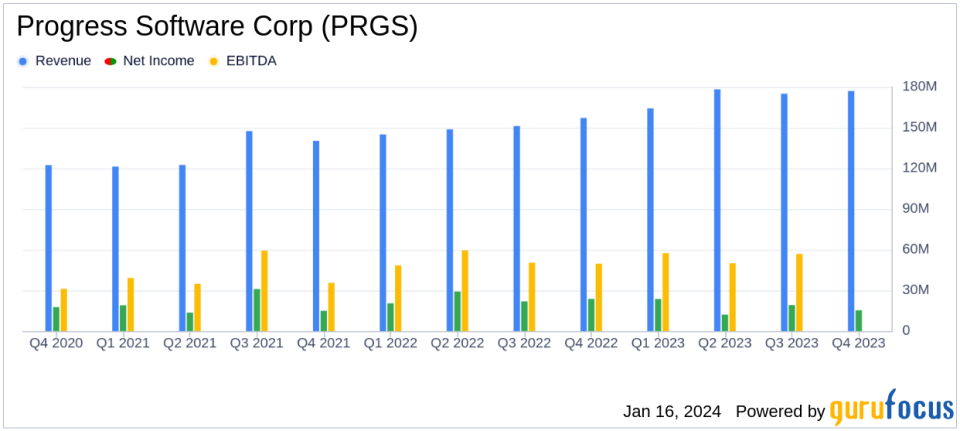

Revenue: Q4 revenue increased by 13% year-over-year to $177.0 million.

Annualized Recurring Revenue (ARR): Grew by 17% year-over-year to $574 million.

Operating Margin: GAAP operating margin was 13%, while non-GAAP operating margin stood at 35%.

Earnings Per Share: Q4 GAAP diluted EPS decreased by 37% to $0.34, non-GAAP diluted EPS decreased by 9% to $1.02.

Adjusted Free Cash Flow: Generated $175 million in adjusted free cash flow for fiscal 2023.

Debt Reduction: Paid down another $30 million of debt in Q4.

Dividend: Declared a quarterly dividend of $0.175 per share, payable on March 15, 2024.

On January 16, 2024, Progress Software Corp (NASDAQ:PRGS) released its 8-K filing, announcing financial results for its fiscal fourth quarter and fiscal year ended November 30, 2023. The company, a trusted provider of infrastructure software, reported a revenue increase and strong growth in its Annualized Recurring Revenue (ARR), despite a decrease in earnings per share (EPS).

Progress Software Corporation operates in the cloud-based security solutions sector, catering to a wide range of industries with products such as OpenEdge, Chef, and Kemp LoadMaster, among others. The company primarily generates revenue from perpetual licenses, with some products utilizing term licensing models, and subscription-based models for cloud offerings. A significant portion of PRGS's revenue comes from the United States, with a presence in Canada, EMEA, Latin America, and Asia Pacific.

Financial Performance and Challenges

For the fiscal fourth quarter of 2023, PRGS reported a revenue of $177.0 million, marking a 13% increase on an actual currency basis compared to the same period last year. The non-GAAP revenue also saw a 12% increase year-over-year. The company's ARR experienced a significant growth of 17% on a constant currency basis, reaching $574 million. However, the diluted EPS showed a decrease, with GAAP diluted EPS dropping by 37% to $0.34 and non-GAAP diluted EPS by 9% to $1.02.

Despite the strong revenue growth and ARR performance, the decrease in EPS highlights the challenges faced by PRGS, including the integration of acquisitions and market conditions that may affect profitability. The company's operating margin also experienced a decline, with GAAP operating margin falling by 600 basis points to 13% and non-GAAP operating margin by 400 basis points to 35%.

Financial Achievements and Industry Significance

The financial achievements of PRGS, particularly the growth in ARR, are significant as they indicate a stable and expanding customer base willing to commit to long-term subscriptions, which is vital for the software industry. The adjusted free cash flow of $175 million demonstrates the company's ability to generate cash from its operations, a crucial metric for sustaining growth and funding future acquisitions.

Moreover, the company's proactive debt reduction, with $30 million paid down in the fourth quarter, reflects a strong balance sheet and financial discipline. The declared dividend also signals confidence in the company's cash flow generation and commitment to returning value to shareholders.

Analysis of Company's Performance

CEO Yogesh Gupta expressed satisfaction with the company's performance, highlighting the successful execution of plans and the integration of MarkLogic ahead of schedule. CFO Anthony Folger noted the strong balance sheet and the company's readiness to deliver another robust performance in the upcoming year.

The company's guidance for fiscal year 2024 anticipates continued revenue growth and an increase in diluted EPS. The positive currency translation impact and the expected contributions from MarkLogic are set to propel operating income and cash flow, as well as revenues.

Overall, PRGS's fiscal fourth quarter and year-end results demonstrate a company that is growing its recurring revenue base and maintaining financial health, despite some declines in profitability metrics. The focus on operational efficiency, strategic acquisitions, and shareholder returns positions PRGS for potential success in the coming fiscal year.

For a detailed reconciliation of GAAP to non-GAAP financial measures and further financial information, please refer to the tables at the end of the 8-K filing.

Explore the complete 8-K earnings release (here) from Progress Software Corp for further details.

This article first appeared on GuruFocus.