Progress Software (PRGS) to Post Q3 Earnings: What's in Store?

Progress Software PRGS is slated to release its third-quarter fiscal 2023 results on Sep 26.

For the to-be-reported quarter, the company anticipates non-GAAP revenues in the range of $172 million-$176 million. Non-GAAP earnings are anticipated between 98 cents and $1.02 per share.

The Zacks Consensus Estimate for fiscal third-quarter earnings has declined by a penny to $1 per share over the past 30 days, indicating flat year-over-year growth.

The consensus mark for revenues is pegged at $173.3 million, indicating 13.22% year-over-year growth.

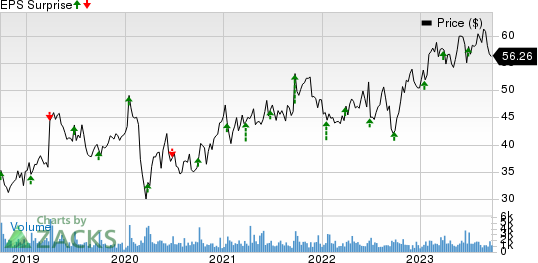

Progress Software Corporation Price and EPS Surprise

Progress Software Corporation price-eps-surprise | Progress Software Corporation Quote

Progress Software’s earnings beat the Zacks Consensus Estimate in all the trailing four quarters, delivering an earnings surprise of 9.51% on average.

Factors to Note

The company has been benefiting from a strong portfolio with a robust adoption rate of its OpenEdge, Loadmaster, Chef, Sitefinity Cloud, and MarkLogic solutions. In the fiscal second quarter, the net dollar retention rate was more than 101%. The trend is expected to have continued in the to-be-reported quarter.

Progress Software benefits from a strong clientele. Strong contributions from acquisitions like MarkLogic ($25 million in revenues in the fiscal second quarter) and Kemp are expected to have driven top-line growth in the fiscal third quarter. However, MarkLogic revenues are expected to suffer from seasonality in third-quarter fiscal 2023.

Loadmaster, which the company got through the acquisition of Kemp, is benefiting from expanding Dell Technologies DELL sales channel.

Loadmaster demand has been strong among Dell’s clients as it makes the environment much more reliable and resilient, thereby improving performance. Meanwhile, Sitefinity Cloud is making jobs easier for marketers, thereby saving marketing costs for clients. These trends are expected to have continued in the to-be-reported quarter, driving top-line growth.

Stringent cost management is expected to have benefited bottom-line growth despite headwinds related to persistent inflation, higher interest rates and a challenging macroeconomic environment.

What Our Model Says

Per the Zacks model, the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here.

Progress Software has an Earnings ESP of -0.33% and carries a Zacks Rank #3 at present. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks to Consider

Here are a few companies worth considering, as our model shows that these have the right combination of elements to beat on earnings in their upcoming releases:

Asure Software ASUR has an Earnings ESP of +21.74% and a Zacks Rank #1 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

ASUR shares have gained 43.7% year to date. Asure is likely to report its third-quarter 2023 results on Nov 6.

Fortive FTV has an Earnings ESP of +3.53% and a Zacks Rank #2.

FTV shares have gained 8.5% in the year-to-date period. Fortive is likely to report its third-quarter 2023 results on Oct 25.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

Progress Software Corporation (PRGS) : Free Stock Analysis Report

Asure Software Inc (ASUR) : Free Stock Analysis Report

Fortive Corporation (FTV) : Free Stock Analysis Report