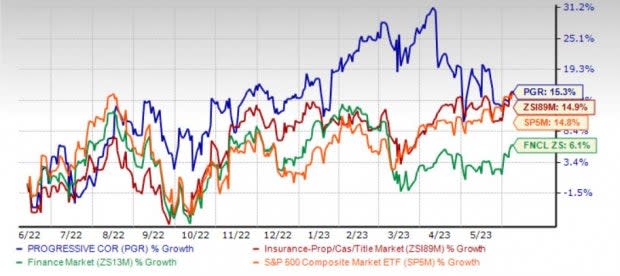

Progressive (PGR) Gains 15% in a Year: More Upside Left?

The Progressive Corporation’s PGR shares have gained 15.3% in a year, outperforming the industry’s increase of 14.9%. The Finance sector and the Zacks S&P 500 composite have risen 6.1% and 14.8%, respectively, in the same period. With a market capitalization of $76.6 billion, the average volume of shares traded in the last three months was 3 million.

A compelling portfolio, leadership position, strength in Vehicle and Property businesses, healthy policies in force, retention and solid capital position continue to drive this Zacks Rank #3 (Hold) insurer. Earnings of this largest seller of motorcycle and boat policies have risen 6.9% over the last five years.

PGR’s trailing 12-month return on equity was 15.7%, which came ahead of the industry average of 6.7%. Return on equity, a profitability measure, reflects how effectively a company is utilizing its shareholders.

The company has a VGM Score of B. The Style Score rates stocks on the combined weighted styles, helping to identify those with the most attractive value, best growth and most promising momentum.

Image Source: Zacks Investment Research

Can PGR Retain the Momentum?

The Zacks Consensus Estimate for Progressive’s 2023 earnings is pegged at $5.34 per share, indicating an increase of 31.5% on 16.5% higher revenues of $60 billion. The Zacks Consensus Estimate for 2024 earnings is pegged at $7.86, indicating an increase of 47.2% on 12.1% higher revenues of $67.3 billion.

The long-term earnings growth rate is currently pegged at 25.6%, better than the industry average of 13.7%. It has a Growth Score of A. This score analyzes the growth prospects of a company.

Progressive is a market leader in commercial auto insurance and one of the top 15 homeowner carriers based on premiums written. PGR’s premiums written increased 11% in the last 10 years and surpassed the industry average of 4%. On the strength of a compelling product portfolio, leadership position, healthy policies in force, better pricing and a solid retention ratio, PGR should continue to deliver improved premiums.

Policy life expectancy, a measure of customer retention, has improved in the last few years across all business lines. Strategic initiatives to provide consumers with a distinctive new auto insurance option along with competitive pricing should help Progressive retain its momentum. The insurer thus has been focusing on cross-selling homes with auto insurance.

PGR’s combined ratio averaged less than 93% in a decade and compared favorably with the industry average of more than 100%. Progressive is poised to deliver a better combined ratio, banking on prudent underwriting and favorable reserve development.

In tandem with the industry, PGR continues to invest heavily in technology. It estimates accelerated digitalization to improve the non-acquisition ratio in 2023.

Banking on operational excellence, PGR has a solid capital position and engages in capital deployment that, in turn, enhance shareholders’ value. Progressive has been paying dividends uninterruptedly since 1971, yielding 0.3%, and has a 24.2 million share buyback program under its authorization.

Stocks to Consider

Some better-ranked stocks from the insurance industry are HCI Group HCI, RLI Corporation RLI and Kinsale Capital Group KNSL, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for HCI Group’s 2023 and 2024 earnings indicates a year-over-year increase of 149.3% and 35.2%, respectively. HCI delivered a four-quarter average earnings surprise of 308.82%.

The consensus estimate for 2023 and 2024 earnings has moved up 22.7% and 14.1%, respectively, in the past seven days. Shares of HCI have gained 3.1% year to date.

RLI delivered a four-quarter average earnings surprise of 43.50%. Year to date, the insurer has gained 5%.

The Zacks Consensus Estimate for RLI’s 2023 earnings indicates a year-over-year increase of 4.1%.

Kinsale Capital delivered a four-quarter average earnings surprise of 14.77%. Year to date, the insurer has gained 36.1%.

The Zacks Consensus Estimate for KNSL’s 2023 and 2024 earnings indicates a year-over-year increase of 32.9% and 19.7%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RLI Corp. (RLI) : Free Stock Analysis Report

The Progressive Corporation (PGR) : Free Stock Analysis Report

HCI Group, Inc. (HCI) : Free Stock Analysis Report

Kinsale Capital Group, Inc. (KNSL) : Free Stock Analysis Report