Progressive (PGR) to Release Q3 Earnings: Is a Beat in Store?

The Progressive Corporation PGR is slated to report third-quarter 2022 earnings on Oct 13 before the opening bell. The company’s earnings were in line with the estimate in the last reported quarter.

Factors to Note

Progressive is a leading auto insurer in the United States and the largest seller of motorcycle policies. PGR is a market leader in commercial auto insurance and one of the top 15 homeowner carriers based on premiums written.

Net premiums earned in the third quarter are likely to have benefited from a compelling product portfolio, a leadership position, strength in the Vehicle and Property businesses, healthy policies in force and solid retention. The Zacks Consensus Estimate for net premiums earned is pegged at $12.7 billion, suggesting growth of 11.9% from the year-ago reported number. We estimate net premiums earned of $12.9 billion in the to-be-reported quarter.

Policies in force are likely to have improved, given the focus on segmentation and prudent risk selection. The Zacks Consensus Estimate for personal lines policies in force stands at 24 million, indicating an improvement of 4.1% from the year-ago reported figure. We estimate policies in force of 25 million in the to-be-reported quarter.

PGR’s personal auto business is likely to have benefited from its focus on marketing and competitive product offerings and strong market presence.

Higher-invested asset base and a higher interest rate likely have aided net investment income. The Zacks Consensus Estimate for the metric is pegged at $281 million, up 35.1% from the year-ago reported quarter. We estimate a net investment income of $220.6 million in the to-be-reported quarter.

Improved premiums, an increase in service revenues and fees and other revenues might have contributed to the improvement in revenues. The Zacks Consensus Estimate for third-quarter revenues stands at $13.2 billion, suggesting year-over-year growth of approximately 11.3%.

Expenses might have risen on a higher loss and loss-adjustment expenses, policy acquisition costs and other underwriting expenses. The consensus mark for the loss and loss-adjustment expense ratio is pegged at 75.

The Zacks Consensus Estimate for earnings is pegged at $1.40, indicating a 900% surge from the year-ago quarter.

What the Zacks Model Says

Our proven model predicts an earnings beat for Progressive this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat, which is the case here.

Earnings ESP: Progressive has an Earnings ESP of +0.24%. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

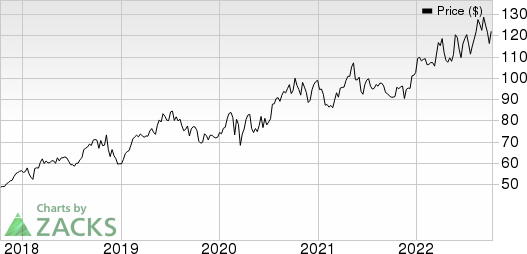

The Progressive Corporation Price and EPS Surprise

The Progressive Corporation price-eps-surprise | The Progressive Corporation Quote

Zacks Rank: PGR currently carries a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Other Stocks to Consider

Here are three other P&C insurance stocks you may want to consider, as our model shows that these too have the right combination of elements to post an earnings beat:

The Allstate Corporation ALL has an Earnings ESP of +20.07% and a Zacks Rank of 3. The Zacks Consensus Estimate for third-quarter 2022 earnings is pegged at 39 cents, indicating a decrease of 46.6% from the year-ago reported figure.

ALL’s earnings beat estimates in two of the last four reported quarters while missing in the other two.

Selective Insurance Group SIGI has an Earnings ESP of +0.80% and a Zacks Rank #3. The Zacks Consensus Estimate for third-quarter 2022 earnings is pegged at $1.05, up 5.9% from the figure reported in the year-ago quarter.

SIGI’s earnings beat estimates in three of the last four reported quarters while missed in one.

EverQuote EVER has an Earnings ESP of +8.21% and a Zacks Rank of 3. The Zacks Consensus Estimate for third-quarter 2022 earnings stands at a loss of 41 cents, wider than 18 cents loss reported in the year ago quarter from the year-ago reported figure.

EVER’s earnings beat estimates in three of the last four reported quarters while missed in one.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Allstate Corporation (ALL) : Free Stock Analysis Report

The Progressive Corporation (PGR) : Free Stock Analysis Report

Selective Insurance Group, Inc. (SIGI) : Free Stock Analysis Report

EverQuote, Inc. (EVER) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research