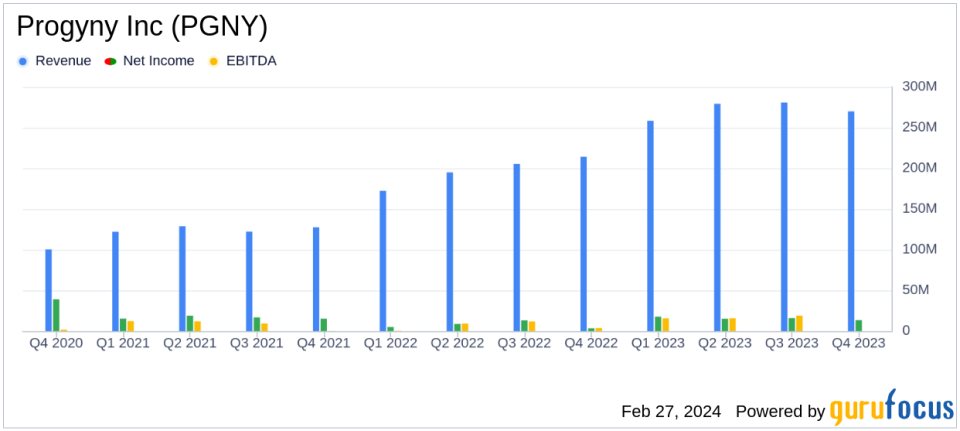

Progyny Inc (PGNY) Surpasses $1 Billion Annual Revenue, Net Income Soars in Q4

Annual Revenue: Surged to $1,088.6 million, marking a 38% year-over-year growth.

Net Income: Q4 net income nearly quadrupled to $13.5 million; Full-year net income doubled to $62.0 million.

Adjusted EBITDA: Grew by 49% to a record $187.1 million for the full year.

Gross Margin: Improved by 60 basis points to 21.9% for the full year.

Client Base: Expanded to 392 clients, up from 288 the previous year.

Cash Flow: Operating cash flow more than doubled to a record $188.8 million.

2024 Guidance: Revenue projected to cross the $1.3 billion milestone at midpoint.

On February 27, 2024, Progyny Inc (NASDAQ:PGNY) released its 8-K filing, announcing a remarkable financial performance for the fourth quarter and full year of 2023. The company, a leader in fertility and family building benefits solutions, reported record revenue and net income, driven by significant client growth and demand for fertility services.

Financial Performance Overview

Progyny's revenue for the full year reached an unprecedented $1,088.6 million, a 38% increase from the previous year, while the fourth quarter revenue grew by 26% to $269.9 million. The company's net income for the full year was $62.0 million, or $0.62 per diluted share, nearly doubling from the $30.4 million reported in the prior year. The fourth quarter saw net income skyrocket to $13.5 million, or $0.13 per diluted share, nearly quadrupling from the same period last year.

The company's gross margin for the full year improved to 21.9%, up from 21.3% in the prior year, reflecting ongoing efficiencies in care management services. Adjusted EBITDA for the full year was a record $187.1 million, a 49% increase from the previous year, with an Adjusted EBITDA margin of 17.2%, up from 16.0%.

Operational Highlights and Future Outlook

Progyny's client base expanded to 392 by the end of 2023, up from 288 the previous year. The company also reported a significant increase in ART cycles and member utilization rates, indicating a growing demand for its fertility services.

Looking ahead, Progyny anticipates continued growth, projecting 2024 revenue to be between $1,285 million and $1,315 million, with net income expected to be between $68.1 million and $73.6 million. Adjusted EBITDA is forecasted to be between $224.0 million and $232.0 million for the full year of 2024.

Management Commentary

"2023 was another exceptional year for Progyny. We achieved record levels of revenue, profitability and operating cash flow," said Pete Anevski, Chief Executive Officer of Progyny. He also highlighted the company's strong positioning for 2024, with a comprehensive suite of services and the highest ever pipeline at this time of year.

"Adjusted EBITDA margin on incremental revenue continued to exceed 20% in 2023, highlighting the high rate of margin capture that we continue to realize on new revenue," added Mark Livingston, Progynys Chief Financial Officer.

Conclusion

Progyny's impressive financial results and optimistic outlook for 2024 underscore the company's leadership in the fertility benefits space and its ability to capitalize on the growing demand for family building services. With a strong balance sheet, no debt, and a robust cash position, Progyny is well-equipped to continue its growth trajectory and expand its market presence.

For detailed financial tables and a reconciliation of GAAP to non-GAAP financial measures, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Progyny Inc for further details.

This article first appeared on GuruFocus.