Prologis sees occupancy dipping through Q2 before sustained rebound

Logistics facility owner Prologis provided a positive outlook for 2024 on Wednesday but noted that facility occupancy will likely trend lower through the second quarter before climbing in the back half of the year.

The company’s 1.2 billion square feet of space remains largely occupied currently, but new facilities continue to come online across the market, creating relative looseness following a stretch of record leasing fundamentals for industrial landlords.

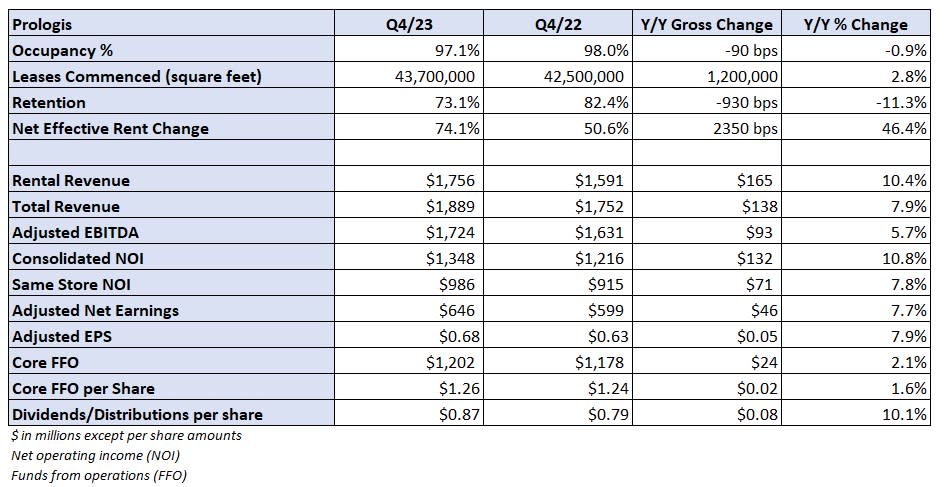

The San Francisco-based operator reported core funds from operations (FFO) of $1.26 per share for the fourth quarter on Wednesday. The result was 2 cents better year over year (y/y) and in line with the consensus estimate. Rental revenue stepped 10.4% higher y/y to $1.76 billion, pushing consolidated revenue up 7.9% to $1.89 billion.

Occupancy across its portfolio was 97.1% in the quarter, in line with the prior quarter but 90 basis points lower y/y. Management’s 2024 outlook calls for occupancy to be between 96.5% and 97.5%, with vacancy rates rising to 6% through the second quarter. That said, 45% of its currently available facilities already have proposals from potential tenants.

Prologis (NYSE: PLD) commenced leases representing 43.7 million square feet of space in the period, a 2.8% increase from the year-ago quarter. Net effective rent change (over the entire lease term) was 74.1%.

Prologis estimates that facility development starts across the industry are off roughly two-thirds from the peak.

“The supply cliff will converge with normalized demand later this year, delivering an environment conducive to strong market rent growth,” said Tim Arndt, Prologis chief financial officer, on a Wednesday call with analysts.

The company is forecasting annual rent growth between 4% and 6% over the next three years but with rents in 2024 only slightly positive.

Hamid Moghadam, Prologis co-founder and CEO, is confident that retailers will need to add inventory to their networks. He said better-than-expected retail and e-commerce sales during the recent holiday season left some sellers short on merchandise again.

“The point is, people thought COVID was the big unknown factor, and now that COVID is over the world is going to go back to a stable, predictable, just-in-time type of inventory strategy,” Moghadam said. “I think each one of these things — whether it’s Panama, whether it’s Suez, whether it’s … the Middle East, will remind people that they generally need to have a more conservative inventory strategy and that’s the big long-term driver, which is going to be a tailwind for demand that we haven’t really seen play out just yet.”

Prologis’ lease mark to market across the entire portfolio stood at 57% in the quarter as new supply added in Southern California has made leasing very competitive. Also, the region is up against tough comparisons due to exorbitant rent growth, up 110% since 2020.

Prologis issued 2024 FFO guidance of $5.42 to $5.56 per share compared to the consensus estimate of $5.52. The number is expected to be 9% higher y/y at the midpoint of the range when excluding promote expense. The guidance also includes development starts ranging between $3 billion and $3.5 billion, which is $500 million higher than its 2023 guidance at both ends of the range.

Prologis grew earnings by double-digit percentages for a fourth straight year in 2023.

More FreightWaves articles by Todd Maiden

The post Prologis sees occupancy dipping through Q2 before sustained rebound appeared first on FreightWaves.