ProPetro Holding Corp (PUMP) Faces Headwinds in Q4 But Posts Annual Revenue Growth

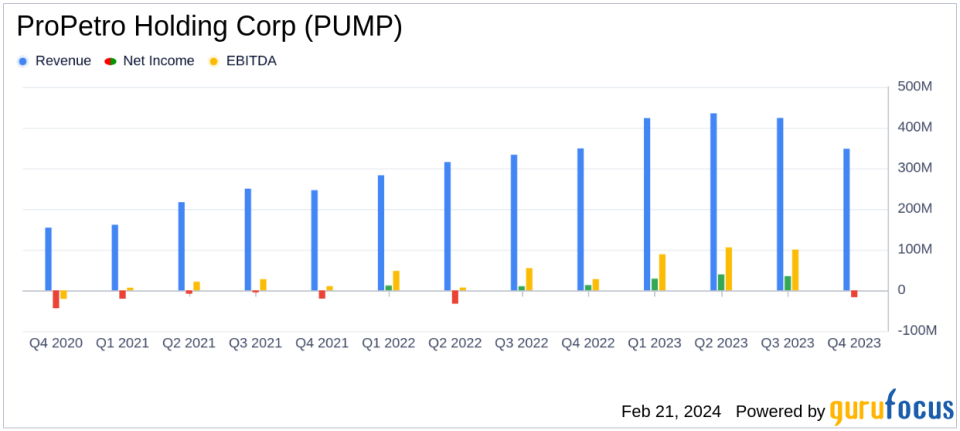

Annual Revenue: $1.6 billion, up 27% from 2022.

Net Income: Significant increase to $86 million in 2023 from $2 million in 2022.

Adjusted EBITDA: Grew 28% to $404 million in 2023.

Q4 Revenue: Dropped to $348 million from $424 million in the previous quarter.

Q4 Net Loss: Reported at $17 million, or $0.16 per diluted share.

Capital Expenditure Guidance: Expected to be between $200 million and $250 million for 2024, down from $310 million in 2023.

On February 21, 2024, ProPetro Holding Corp (NYSE:PUMP) released its 8-K filing, detailing its financial and operational results for the fourth quarter and full year of 2023. The Texas-based oilfield services company, which specializes in hydraulic fracturing and other complementary services in the Permian Basin, reported a significant increase in annual revenue and net income despite facing headwinds in the fourth quarter.

Company Overview

ProPetro Holding Corp (NYSE:PUMP) is an oilfield services company that provides a suite of services including hydraulic fracturing, cementing, coiled tubing, drilling, and flowback to oil and gas companies focused on the exploration and production of unconventional oil and natural gas resources in North America. The company's operations are primarily concentrated in the Permian Basin.

Annual Performance and Strategic Highlights

For the full year of 2023, ProPetro reported a 27% increase in revenue, reaching $1.6 billion. The company's net income saw a dramatic rise to $86 million, compared to just $2 million in the previous year. Adjusted EBITDA also grew by 28% to $404 million. ProPetro's strategic initiatives included the deployment of two FORCESM electric hydraulic fracturing fleets, with two more expected in the first half of 2024. These fleets, along with the company's Tier IV DGB Dual-fuel fleets, will represent approximately 65% of its hydraulic fracturing capacity. The company also completed an accretive acquisition to expand its cementing services and published its first sustainability report.

Challenges and Q4 Performance

The fourth quarter of 2023 proved challenging for ProPetro, with revenue falling to $348 million from $424 million in the prior quarter. The company reported a net loss of $17 million, or $0.16 per diluted share, a stark contrast to the net income of $35 million, or $0.31 per diluted share, in the previous quarter. Adjusted EBITDA for Q4 was $64 million, down from $108 million in the third quarter. The company attributed the decreased performance to higher than expected seasonality, holiday impacts, and customer budget exhaustion.

Financial Summary and Outlook

ProPetro's liquidity at the end of Q4 stood at $134 million, including cash and available borrowing capacity. Capital expenditures for the quarter were $39 million, primarily related to maintenance and support equipment for the FORCESM electric frac fleet. The company's guidance for 2024 capital expenditures is between $200 million and $250 million, indicating a strategic reduction from the $310 million spent in 2023.

CEO Sam Sledge expressed confidence in the company's positioning for value-creating opportunities in 2024, despite the Q4 downturn. CFO David Schorlemer highlighted the company's progress, noting the over $1 billion investment in state-of-the-art technologies and completion services over the last two years, which is expected to lead to reduced capital spending and an improved operating expense profile.

ProPetro's outlook for 2024 includes the deployment of additional FORCESM electric frac fleets and anticipates frac fleet utilization of 14 to 15 fleets in the first quarter. The company remains optimistic about the demand for its services and its ability to generate meaningful shareholder returns.

For a detailed analysis of ProPetro Holding Corp's financial results and strategic outlook, investors are encouraged to review the full 8-K filing and join the conference call scheduled for 8:00 AM Central Time on February 21, 2024.

Explore the complete 8-K earnings release (here) from ProPetro Holding Corp for further details.

This article first appeared on GuruFocus.