ProPetro Holding Corp's Meteoric Rise: Unpacking the 34% Surge in Just 3 Months

ProPetro Holding Corp (NYSE:PUMP), a Texas-based oilfield services company, has seen a significant surge in its stock price over the past three months. The company's stock price has risen by 34.28%, from its previous price, marking a notable gain for investors. As of September 27, 2023, the stock is trading at $10.66 with a market cap of $1.2 billion. This recent performance indicates a positive trend for the company, which operates in the Oil & Gas industry, providing hydraulic fracturing, wireline, and other complementary services to oil and gas companies engaged in the exploration and production of North American unconventional oil and gas resources.

Stock Performance Analysis

Over the past week, ProPetro Holding Corp's stock price has seen a gain of 2.66%. This recent performance is a continuation of the positive trend observed over the past three months, during which the stock price has risen by 34.28%. The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates. Currently, the GF Value of the stock is $12.28, indicating that it is modestly undervalued. This is a positive change from three months ago when the GF Value was $12.26, suggesting a possible value trap.

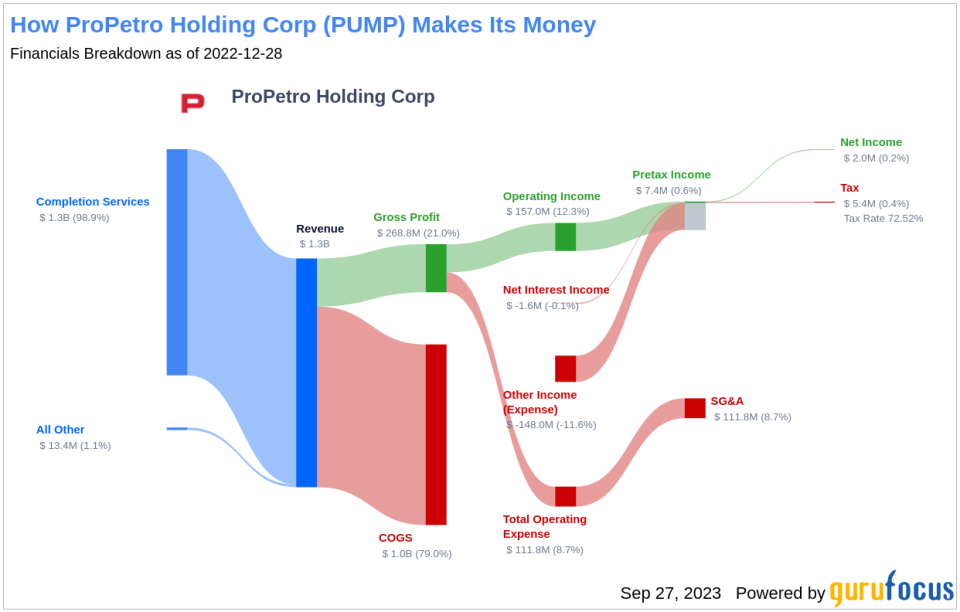

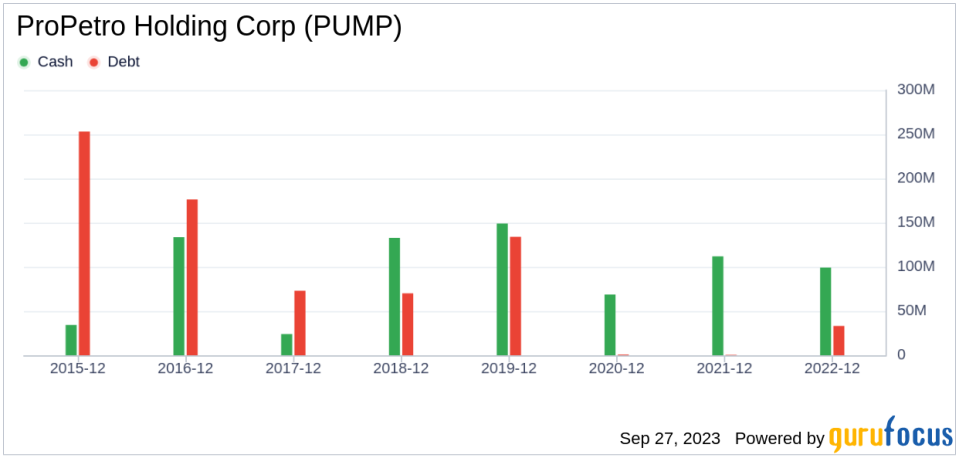

Profitability Analysis

ProPetro Holding Corp has a Profitability Rank of 5/10, indicating average profitability. The company's Operating Margin is 13.93%, which is better than 60.16% of companies in the same industry. The company's ROE, ROA, and ROIC are 9.91%, 7.14%, and 16.85% respectively, indicating a relatively strong return on investment. Over the past 10 years, the company has had 4 profitable years, which is better than 41.25% of companies in the industry.

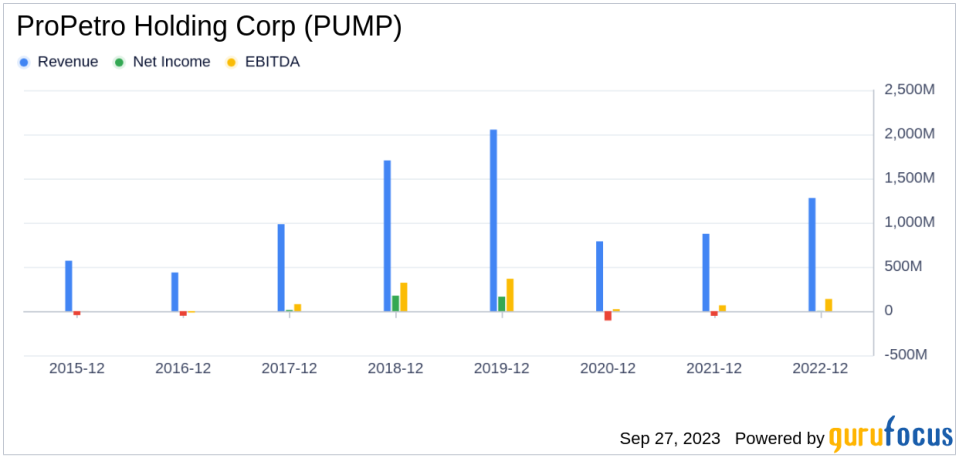

Growth Analysis

The company's Growth Rank is 2/10, indicating low growth. The 3-Year and 5-Year Revenue Growth Rates per share are -15.40% and -9.70% respectively. The company's 3-Year EPS without NRI Growth Rate is -76.60%. These figures suggest that the company has faced some challenges in maintaining consistent growth over the past few years.

Top Holders

The top three holders of ProPetro Holding Corp's stock are Ken Fisher (Trades, Portfolio), HOTCHKIS & WILEY, and First Eagle Investment (Trades, Portfolio). Ken Fisher (Trades, Portfolio) holds 1,093,716 shares, representing 0.97% of the total shares. HOTCHKIS & WILEY holds 896,490 shares, accounting for 0.79% of the total shares. First Eagle Investment (Trades, Portfolio) holds 786,103 shares, making up 0.7% of the total shares.

Competitor Analysis

ProPetro Holding Corp faces competition from several companies in the Oil & Gas industry. Its main competitors are US Silica Holdings Inc (NYSE:SLCA) with a market cap of $1.1 billion, Oceaneering International Inc (NYSE:OII) with a market cap of $2.72 billion, and Core Laboratories Inc (NYSE:CLB) with a market cap of $1.13 billion. Despite the competition, ProPetro Holding Corp has managed to maintain a competitive position in the market.

Conclusion

In conclusion, ProPetro Holding Corp's stock performance over the past three months has been impressive, with a gain of 34.28%. The company's profitability and return on investment are relatively strong, although its growth has been low. Despite facing competition from several companies in the industry, ProPetro Holding Corp has managed to maintain a competitive position in the market. Based on the analysis, the stock appears to be modestly undervalued, suggesting potential value for investors.

This article first appeared on GuruFocus.