ProPetro Holding Corp's Meteoric Rise: Unpacking the 43% Surge in Just 3 Months

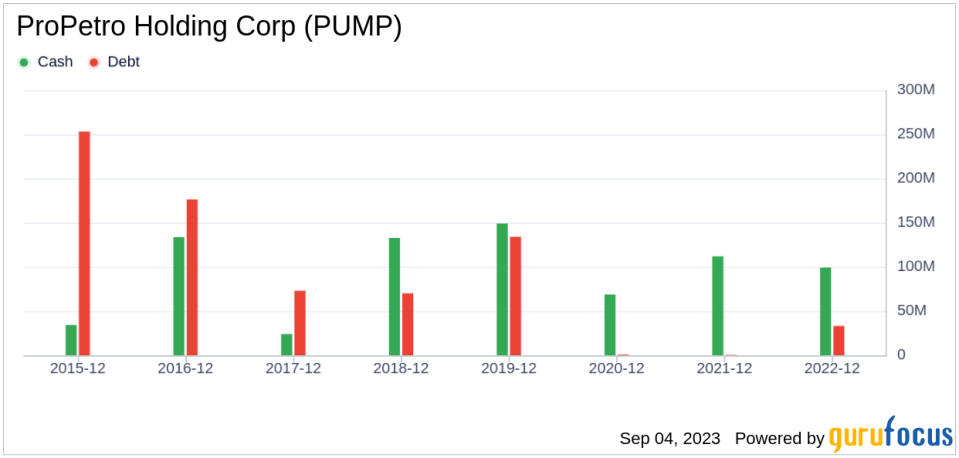

ProPetro Holding Corp (NYSE:PUMP), a Texas-based oilfield services company, has seen a significant surge in its stock price over the past three months. With a current market cap of $1.13 billion and a stock price of $10.05, the company's stock has gained 3.08% over the past week and a whopping 43.37% over the past three months. This impressive performance has caught the attention of investors and market analysts alike.

Stock Performance and Valuation

ProPetro's stock performance has been bolstered by its GF Value, which currently stands at $12.55, up from $12.26 three months ago. The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates. The company's current GF Valuation suggests that it is modestly undervalued, a significant improvement from three months ago when it was considered a possible value trap.

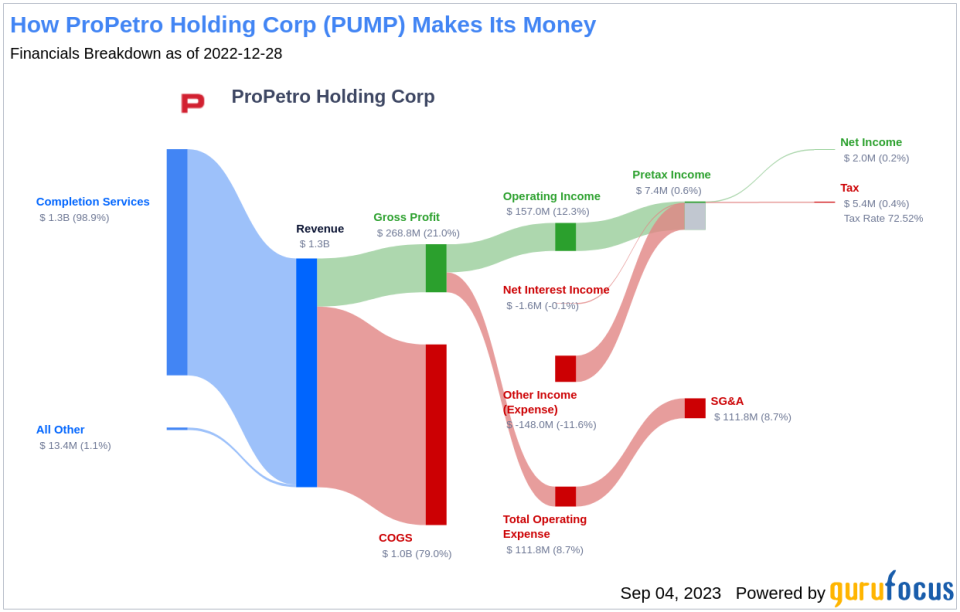

Profitability Analysis

ProPetro's profitability has been a key factor in its recent stock performance. The company's Profitability Rank is 5/10, indicating its relative profitability within the Oil & Gas industry. Its Operating Margin of 13.93% is better than 59.73% of companies in its industry. Furthermore, the company's ROE, ROA, and ROIC, which are 9.91%, 7.14%, and 16.85% respectively, indicate its relative efficiency and profitability. Over the past 10 years, the company's profitability has been better than 41.39% of companies in its industry.

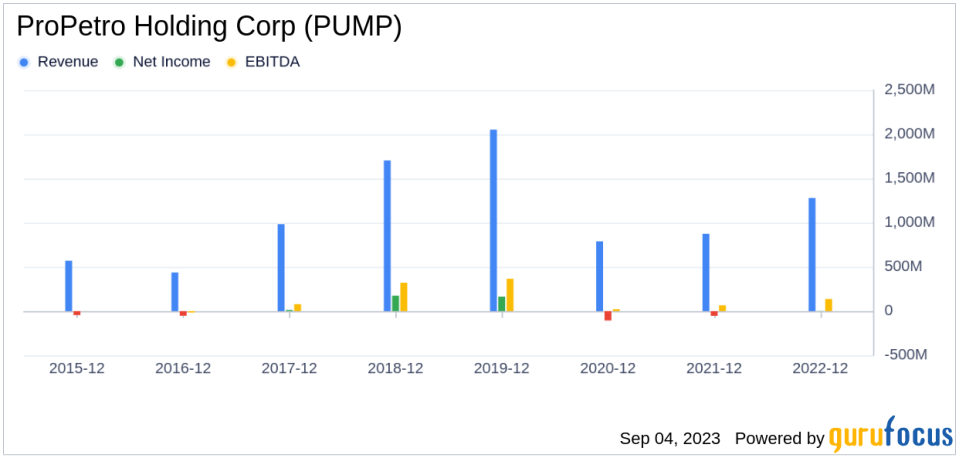

Growth Prospects

Despite its impressive profitability, ProPetro's growth rank is a modest 2/10, indicating its relative growth within its industry. The company's 3-year and 5-year revenue growth rates per share are -15.40% and -9.70% respectively. Furthermore, the company's 3-year EPS without NRI growth rate stands at -76.60%. These figures suggest that while the company has been profitable, its growth has been somewhat sluggish.

Top Holders and Competitors

ProPetro's stock is held by several prominent investors. Ken Fisher (Trades, Portfolio) holds 0.97% of the company's shares, followed by HOTCHKIS & WILEY and First Eagle Investment (Trades, Portfolio), who hold 0.79% and 0.7% of the company's shares respectively. In terms of competition, ProPetro faces stiff competition from US Silica Holdings Inc (NYSE:SLCA), Oceaneering International Inc (NYSE:OII), and Core Laboratories Inc (NYSE:CLB), with market caps of $1 billion, $2.42 billion, and $1.16 billion respectively.

Conclusion

In conclusion, ProPetro Holding Corp's recent stock performance has been impressive, driven by its profitability and undervalued status. However, its growth prospects remain a concern. With top investors holding its stock and facing competition from major players in the Oil & Gas industry, the company's future performance will be closely watched by investors and market analysts alike.

This article first appeared on GuruFocus.