ProPetro (PUMP) Stock Rises Since Q4 Earnings: Here's Why

The stock of ProPetro Holding Corp. PUMP has gained 11.8% since its fourth-quarter earnings announcement on Feb 22. While the Permian-focused equipment and service provider to the energy industry missed the bottom line mark, the positive investor reaction could probably be attributed to revenue outperformance and pricing increases across its fleet, apart from the general bullishness associated with the surge in commodity prices.

What Did ProPetro’s Earnings Unveil?

ProPetro reported fourth-quarter 2021 loss per share of 20 cents. It was 19 cents wider than the Zacks Consensus Estimate and deteriorated from the year-ago loss of 13 cents. The underperformance reflects lower activity levels due to asset rejig, seasonality and escalating costs.

However, revenues of $246.1 million outpaced the consensus mark of $243 million and jumped 59.4% from the year-ago quarter’s sales of $154.3 million on pricing gains. This was partly offset by lower-than-expected revenues from the Pressure Pumping unit — the major contributor to PUMP’s sales. The segment reported revenues of $240.3 million, below the consensus mark of $243 million.

This oilfield service provider’s adjusted EBITDA in the fourth quarter amounted to $37.2 million, up from $23.8 million in the year-ago quarter. Better pricing and increased profitability drove the adjusted EBITDA.

But ProPetro’s adjusted EBITDA for the Pressure Pumping unit during the December quarter came in at $49 million, which undershot the Zacks Consensus Estimate of $52 million as lower fleet activity took its toll.

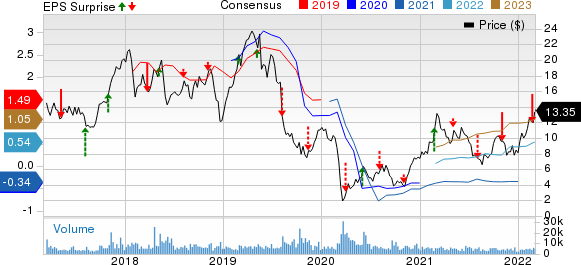

ProPetro Holding Corp. Price, Consensus and EPS Surprise

ProPetro Holding Corp. price-consensus-eps-surprise-chart | ProPetro Holding Corp. Quote

Pressure Pumping

PUMP provides hydraulic fracturing, cementing and acidizing functions through the Pressure Pumping segment. The business contributed around 98% to ProPetro's total revenues in the quarter under review. In particular, service revenues from this unit surged 58.7% from the prior-year quarter’s levels to $240.3 million, attributable to higher fleet strength and enhanced pricing.

Costs & Financial Position

ProPetro’s fourth-quarter total costs and expenses were $268.5 million, up 27.6% from the prior-year quarter. Service cost was $187.4 million compared with $115.6 in the fourth quarter of 2020.

PUMP spent $48.4 million in capital expenditure. The company booked $26.7 million of free cash flows in the fourth quarter.

As of Dec 31, the Midland, TX-based operator had approximately $111.9 million in cash and cash equivalents, and no debt. Including cash and $57 million under its revolving credit facility, ProPetro had total liquidity of $169 million at the end of 2021.

Guidance

Management remains optimistic about the U.S. frac market in 2022, with a favorable supply-demand backdrop. The company forecast a capital spending budget between $250 million and $300 million, which includes $9 million of maintenance expense per fleet. Of the total, $100 million will be earmarked for fleet refurbishments and upgrades.

Zacks Rank & Stock Picks

ProPetro currently carries a Zacks Rank #3 (Hold).

Some better-ranked players in the energy space are Centennial Resource Development CDEV, ConocoPhillips COP and Marathon Oil MRO. Each of the companies sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Centennial Resource Development: Centennial Resource Development is valued at some $2.4 billion. The Zacks Consensus Estimate for CDEV’s 2022 earnings has been revised 7.2% upward over the past 30 days.

Centennial Resource Development, headquartered in Denver, CO, delivered a 30% beat in Q4. CDEV shares have gained around 67.8% in a year.

ConocoPhillips: ConocoPhillips is valued at around $130 billion. The consensus estimate for COP’s 2022 earnings has been revised 7.5% upward over the past 30 days.

COP beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters, the average being 12.6%. ConocoPhillips has rallied around 72% in a year.

Marathon Oil: Marathon Oil has a projected earnings growth rate of 83.4% for this year. The Zacks Consensus Estimate for MRO’s 2022 earnings has been revised 16.1% upward over the past 30 days.

Marathon Oil beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters, the average being 37.4%. MRO shares have gained around 79% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ConocoPhillips (COP) : Free Stock Analysis Report

Marathon Oil Corporation (MRO) : Free Stock Analysis Report

Centennial Resource Development (CDEV) : Free Stock Analysis Report

ProPetro Holding Corp. (PUMP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research