ProQR (PRQR) Rises on Expanding RNA-Editing Deal With Eli Lilly

Shares of ProQR Therapeutics N.V. PRQR were up 63.6% on Thursday after the company announced that it expanded its current licensing and collaboration agreement with pharma giant Eli Lilly LLY for the development and commercialization of new genetic medicines.

Last September, ProQR entered a licensing agreement with Eli Lilly for ProQR’s proprietary Axiomer RNA base-editing platform.

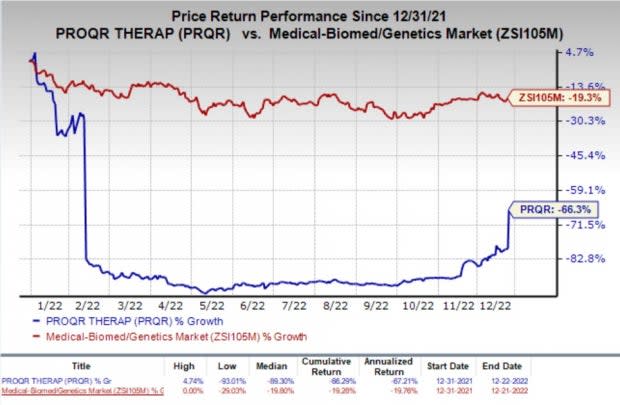

The ProQR stock has plunged 66.3% so far this year compared with the industry’s decline of 19.3%.

Image Source: Zacks Investment Research

Per the terms of the latest expanded agreement, PRQR is eligible to receive $75 million, comprising upfront and an equity investment from LLY.

Eli Lilly will get access to additional targets in the central nervous system and peripheral nervous system with ProQR’s Axiomer platform. It will also have the right to exercise an option to further expand the partnership for a consideration of $50 million. Eli Lilly may provide ProQR access to its proprietary delivery technology for its wholly-owned pipeline.

Based on the actual deal entered in September 2021 and the expanded agreement today, ProQR is entitled to receive up to $3.75 billion in research, development/commercialization milestones from Eli Lilly.

PRQR will also likely receive tiered royalties of up to a mid-single-digit percentage on net product sales if a product is approved and commercialized from the above collaboration.

With the expanded collaboration deal, the companies are looking to explore more applications of the Axiomer platform to unveil innovative treatments for people living with diseases that have a high unmet medical need.

The partnership continues to leverage ProQR’s Axiomer RNA editing technology platform with Eli Lilly’s expertise in RNA therapeutics.

Zacks Rank & Stocks to Consider

ProQR currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the biotech sector are ASLAN Pharmaceuticals Limited ASLN and Immunocore Holdings plc IMCR, both carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Loss per share estimates for ASLAN Pharmaceuticals have narrowed 7.7% for 2022 and 7.4% for 2023 in the past 60 days.

Earnings of ASLAN Pharmaceuticals surpassed estimates in two of the trailing four quarters and missed on the remaining two occasions. ASLN witnessed an earnings surprise of 1.64% on average.

Loss per share estimates for Immunocore have narrowed 56.8% for 2022 and 58.5% for 2023 in the past 60 days.

Earnings of Immunocore surpassed estimates in three of the trailing four quarters and missed on the remaining occasion. IMCR witnessed an earnings surprise of 68.34% on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

ProQR Therapeutics N.V. (PRQR) : Free Stock Analysis Report

ASLAN Pharmaceuticals Ltd. (ASLN) : Free Stock Analysis Report

Immunocore Holdings PLC Sponsored ADR (IMCR) : Free Stock Analysis Report