Prothena's (PRTA) Update on Pipeline Progress Disappoints

Prothena PRTA provided updates on its pipeline progress and cash runway.

However, investors were not pleased. Shares of the company lost 13.2% on Jan 8, following the update, but recovered some of the lost ground to gain 12.30% on Jan 9.

Prothena stated that the ongoing phase I study on PRX012 — a wholly-owned potential best-in-class, next-generation subcutaneous (“SC”) antibody for the treatment of Alzheimer’s Disease ("AD”) that targets a key epitope at the N-terminus of amyloid beta (“Aβ”) with high binding potency — continues as planned.

An update from this study is expected in 2024. Data, so far observed, has been encouraging and supports once-monthly SC treatment and dose escalation in multiple-ascending dose cohorts (200mg and up to 400mg). Amyloid reduction was seen following six months of treatment at 70mg and amyloid-related imaging abnormalities (“ARIA”) were consistent with placebo.

The company is also developing BMS-986446, a potential best-in-class antibody for the treatment of AD that specifically targets a key epitope within the microtubule-binding region (“MTBR”) of tau, a protein implicated in the causal human biology of AD, with Bristol Myers Squibb BMY.

Bristol Myers Squibb reported that phase I data was encouraging and supports advancing the candidate into the phase II study in the first half of this year.

The FDA cleared an investigational new drug application for PRX123, a wholly-owned potential first-in-class dual Aβ/tau vaccine designed for the treatment and prevention of AD. It is a dual-target vaccine targeting key epitopes within the N-terminus of Aβ and MTBR-tau, designed to promote amyloid clearance and block the transmission of pathogenic tau.

The company will provide an update on a phase I study of the candidate in 2024.

Prasinezumab is being evaluated for the treatment of Parkinson’s Disease (“PD”) with Roche RHHBY.

Roche completed the enrollment for the mid-stage PADOVA study in patients with early PD (NCT04777331) and top-line results are expected in 2024.

Prothena is also evaluating birtamimab, a wholly-owned potential best-in-class amyloid depleter antibody, for the treatment of AL amyloidosis. The ongoing confirmatory late-stage AFFIRM-AL clinical trial (NCT04973137) in patients with Mayo Stage IV AL amyloidosis is being conducted under a Special Protocol Assessment agreement with the FDA with a primary endpoint of all-cause mortality (time-to-event) at a significance level of 0.10.

Patient enrollment remains on track. However, the company expects full top-line study results between the fourth quarter of 2024 and the first quarter of 2025 based on a predetermined number of mortality events. Earlier, the company expected the same in 2024. An interim analysis of overwhelming efficacy will be performed when approximately 50% of the events have occurred.

The delay most likely disappointed investors on Jan 8.

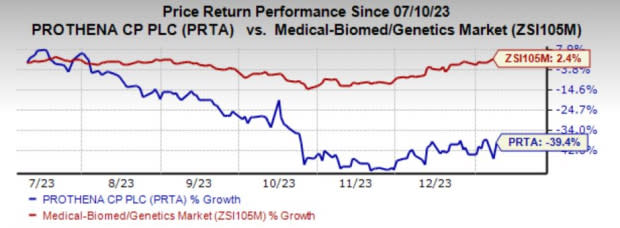

Shares of PRTA have lost 39.4% in the past six months against the industry’s growth of 2.4%.

Image Source: Zacks Investment Research

Prothena had cash, cash equivalents and restricted cash of approximately $621 million as of Dec 31, 2023. The company expects its cash balance to be sufficient to complete its ongoing studies and beyond.

While Prothena’s progress with its AD candidates is encouraging, the market is very challenging.

Shares of the company declined in October after Biogen BIIB and partner Eisai presented new data on the investigational SC formulation of the AD drug Leqembi.

Leqembi is an amyloid beta-directed antibody indicated as a disease-modifying treatment for AD in the United States. Data showed that SC formulation clears 14% more plaque than intravenous. However, an increase in ARIA, as observed with the SC formulation, was disappointing.

Prothena’s PRX012 is also a next-generation SC antibody being developed for the treatment of AD. Two preclinical studies earlier showed superior binding characteristics of PRX012, demonstrating a 20-fold higher affinity to Aβ soluble protofibrils when compared with Leqembi and clearing pyroglutamate-modified Aβ at lower concentrations when compared with investigational candidate donanemab.

However, given the higher incidence of ARIA with Leqembi SC, investors seem wary of Prothena’s SC candidate.

PRTA currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Biogen Inc. (BIIB) : Free Stock Analysis Report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Bristol Myers Squibb Company (BMY) : Free Stock Analysis Report

Prothena Corporation plc (PRTA) : Free Stock Analysis Report