Proto Labs Inc (PRLB) Posts Record Annual Revenue for 2023

Annual Revenue: Achieved a record $504 million in 2023, up 3.2% from 2022.

Q4 Revenue Growth: Q4 revenue increased by 8.2% to $125 million compared to the same quarter last year.

Net Income Recovery: Net income for Q4 stood at $7.0 million, a significant turnaround from a net loss in the same period last year.

Adjusted EBITDA Margin Improvement: Q4 Adjusted EBITDA margin rose to 17.8%, reflecting enhanced profitability.

Operational Cash Flow: Cash flow from operations reached $73.3 million in 2023, an increase from $62.1 million in 2022.

Share Repurchases: The company repurchased $44.0 million in common shares during 2023.

Customer Engagement: Served 53,464 customer contacts throughout the year.

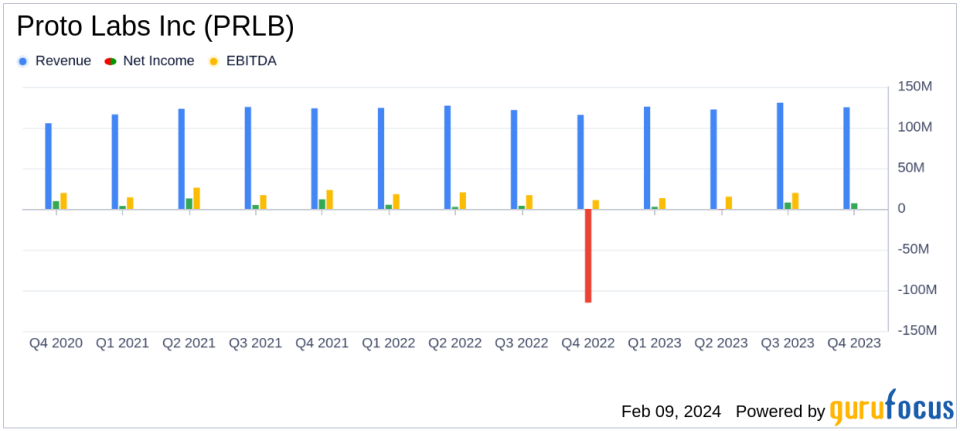

On February 9, 2024, Proto Labs Inc (NYSE:PRLB) released its 8-K filing, announcing its financial results for the fourth quarter and full year ended December 31, 2023. The company, a leading on-demand manufacturer of custom parts for prototyping and short-run production, reported record annual revenue of $504 million for 2023, marking a 3.2% increase over the previous year. Proto Labs' services, which include injection molding, CNC machining, and 3-D printing, cater to a diverse client base in need of rapid prototyping and production solutions.

Financial Performance and Challenges

Proto Labs' fourth-quarter revenue rose to $125 million, an 8.2% increase compared to the fourth quarter of 2022. The Protolabs Network contributed $22.5 million, a significant 52.0% increase from the previous year. Net income for the quarter was reported at $7.0 million, or $0.27 per diluted share, a notable recovery from a net loss of $4.24 per diluted share in the fourth quarter of 2022. The company's non-GAAP net income was $11.8 million, or $0.46 per diluted share, compared to $7.0 million, or $0.26 per diluted share, in the same quarter of the previous year.

Despite these positive results, the company acknowledges the challenges posed by the quick-turn nature of the business and global manufacturing uncertainties. These factors have led to a softer start to 2024, with December 2023 and early January 2024 order levels being lower than historical periods. However, recent performance has aligned more closely with historical trends, and the company's guidance assumes this will continue through the end of March 2024.

Financial Achievements and Industry Significance

The record annual revenue and improved profitability underscore Proto Labs' resilience and adaptability in the face of a dynamic manufacturing landscape. The company's robust cash flow from operations, which increased to $73.3 million in 2023 from $62.1 million in 2022, reflects its operational efficiency and financial health. The strategic share repurchases, amounting to $44.0 million, demonstrate the company's commitment to delivering shareholder value.

For a company like Proto Labs, operating within the Industrial Products sector, these financial achievements are particularly important. They indicate the company's ability to maintain a competitive edge through innovation, efficiency, and customer engagement, which is evidenced by the 53,464 customer contacts served during the year.

Key Financial Metrics

Proto Labs' financial strength is further highlighted by its EBITDA of $63.2 million, or 12.6% of revenue, and an Adjusted EBITDA of $83.2 million, or 16.5% of revenue, in 2023. These metrics are crucial as they reflect the company's earnings before interest, taxes, depreciation, and amortization, providing a clear picture of its operating performance and profitability.

"We capped off a record year with strong fourth quarter results, driven by consistent execution against our priorities, said Rob Bodor, President and CEO of Proto Labs. For the full year, we generated revenue above $500 million for the first time in our 25-year history, while delivering improved earnings, robust cash flow, and substantial capital returned to shareholders."

Dan Schumacher, Chief Financial Officer, added, "Along with record revenue in 2023, we significantly improved profitability in both the digital factory and the digital network. We generated an industry-leading $73 million in cash from operations, and we paid 97% of our free cash flows to shareholders through share repurchases."

Looking Ahead

For the first quarter of 2024, Proto Labs expects to generate revenue between $120 million and $128 million, with diluted net income per share between $0.09 and $0.17, and non-GAAP diluted net income per share between $0.26 and $0.34. This guidance reflects the company's cautious optimism and strategic focus on maintaining its industry-leading financial model and increasing value for shareholders.

Proto Labs' financial results and forward-looking statements are available in detail in the provided 8-K filing. The company will continue to provide financial guidance on a quarterly basis, adapting to the evolving manufacturing landscape and market conditions.

For more in-depth analysis and up-to-date financial information, investors and interested parties are encouraged to access the full earnings report and join the scheduled conference call to discuss the company's performance and outlook.

Explore the complete 8-K earnings release (here) from Proto Labs Inc for further details.

This article first appeared on GuruFocus.