Provident Financial Services Inc Reports Mixed Results Amid Economic Challenges

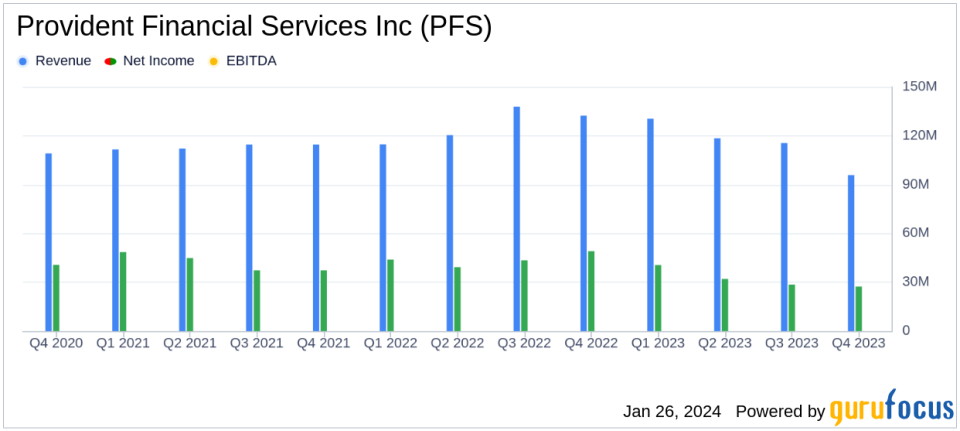

Net Income: Q4 net income of $27.3 million, down from $49.0 million in Q4 2022; Full year net income of $128.4 million, down from $175.6 million in 2022.

Net Interest Margin: Decreased to 2.92% in Q4 2023 from 3.62% in Q4 2022.

Loan Portfolio: Increased by $206.1 million to $10.87 billion in Q4 2023.

Provision for Credit Losses: Q4 provision of $500,000, down from $11.0 million in the previous quarter.

Dividend: Declared a quarterly cash dividend of $0.24 per common share.

Efficiency Ratio: Increased to 61.32% in Q4 2023 from 46.88% in Q4 2022.

Asset Quality: Non-performing loans at 0.46% of total loans as of December 31, 2023.

On January 25, 2024, Provident Financial Services Inc (NYSE:PFS) released its 8-K filing, detailing the financial results for the fourth quarter and full year ended December 31, 2023. The company reported a net income of $27.3 million for Q4, a decrease from the $49.0 million reported in the same quarter of the previous year. The full year net income also saw a decline to $128.4 million from $175.6 million in 2022.

Provident Financial Services Inc, the holding company for The Provident Bank, operates with a focus on high-return businesses and a secure capital structure. The bank's commercial loans are a significant portion of its portfolio, followed by construction loans. Non-interest income streams, including wealth management revenue, insurance agency income, and banking service charges, contribute to the company's revenue.

The decrease in net income for both the quarter and the year was primarily due to a reduction in net interest income, influenced by lower-costing deposits and increased borrowings, coupled with unfavorable repricing of deposits and borrowings. Additionally, the company faced increased provisions for credit losses due to a worsened economic forecast. Transaction costs related to the pending merger with Lakeland Bancorp, Inc. also impacted earnings.

Financial Performance Analysis

The company's total loan portfolio exhibited growth, increasing by $206.1 million to $10.87 billion at the end of Q4. However, net interest income before provision for credit losses remained relatively flat at $95.8 million for the quarter. The net interest margin saw a decrease of four basis points to 2.92% for Q4 2023, from 2.96% for the previous quarter. The average yield on total loans increased, while the average cost of deposits also rose, indicating pressure on the net interest margin.

Anthony J. Labozzetta, President and CEO, commented on the results, stating, "Provident produced respectable financial results for the fourth quarter and the full year 2023 despite challenging market conditions throughout the year." He highlighted solid loan growth and significant contributions from fee income businesses to the company's financial success. Labozzetta also noted the impact of elevated short-term interest rates and a shift in funding mix on the net interest margin, as well as an increased provision for loan losses driven by changes in the economic forecast.

Provident is actively engaged in discussions with our regulators concerning the merger. Both Provident and Lakeland have agreed to extend the merger deadline to March 31, 2024, to allow additional time to obtain the necessary regulatory approvals. Provident looks forward to closing the transaction as soon as possible following receipt of the approvals.

The company's asset quality remains strong, with non-performing loans constituting 0.46% of total loans as of December 31, 2023. The allowance for credit losses related to the loan portfolio was 0.99% of total loans, indicating a prudent approach to credit risk management.

In conclusion, Provident Financial Services Inc's Q4 and full-year 2023 results reflect the challenges of a shifting economic landscape and the impact of interest rate changes on the banking sector. Despite these headwinds, the company's loan portfolio growth and asset quality demonstrate resilience. The pending merger with Lakeland Bancorp, Inc. remains a key focus for the company as it seeks to enhance its market position and create value for shareholders.

Explore the complete 8-K earnings release (here) from Provident Financial Services Inc for further details.

This article first appeared on GuruFocus.