Prudential (PRU), Warburg Pincus Form Prismic Life Reinsurance

Prudential Financial Inc. PRU and Warburg Pincus jointly launched Prismic Life Reinsurance, Ltd. (Prismic). Both entities, along with a group of investors, will have a stake in Prismic, a licensed Class E Bermuda-based life and annuity reinsurance company.

Prismic will have $10 billion initial reinsurance transaction and $1 billion equity capital investment from Prudential, Warburg Pincus and a group of investors. PRU visions Prismic to be a strategic reinsurance partner offering industry-leading life and annuity products across the globe, and hence, PGIM and Warburg Pincus will provide asset management services to Prismic. Charles Lowrey, chairman & CEO of Prudential, stated, “This unique reinsurance platform will play an important role in our vision to be a global leader in expanding access to investing, insurance and retirement security for people around the world.”

Prismic stands to benefit from PGIM’s and Warburg Pincus’ global investment management capabilities across public and private markets, including public fixed income, private credit, private real estate, and private equity. This strategic endeavor will entail Prismic to become a client of PGIM Portfolio Advisory, a newly established affiliate within PGIM that combines asset-liability management expertise with portfolio strategy and asset allocation to deliver integrated solutions across public and private asset classes.

Chip Kaye, CEO of Warburg Pincus, stated that the combination of PGIM’s expertise in public fixed income, private credit, and real estate and Warburg Pincus’ private markets investment capabilities well poise Prismic for growth.

Prudential and Warburg Pincus will initially have 20% and 15% equity stake in Prismic, respectively. Prismic’s board will include two independent directors and one director nominated by each of Prudential, Warburg Pincus, and the group of investors.

Prudential has emerged to be among the top five individual life insurance companies in the United States, with new recurring premium sales, greater scale, expanded product offerings and broader distribution capabilities. Such strategic initiatives will help it consolidate its global presence.

Prudential is witnessing huge demand for retirement benefits’ products for baby boomers, which is expected to continue. The U.S. Census Bureau projects that nearly 25% of the population will be 65 years or older by 2050. Prudential’s vast distribution network, compelling product portfolio and superior brand image will give it a competitive edge. The company intends to be a global leader in expanding its access to investment, insurance and retirement security.

Zacks Rank & Price Performance

Prudential currently carries a Zacks Rank #3 (Hold).

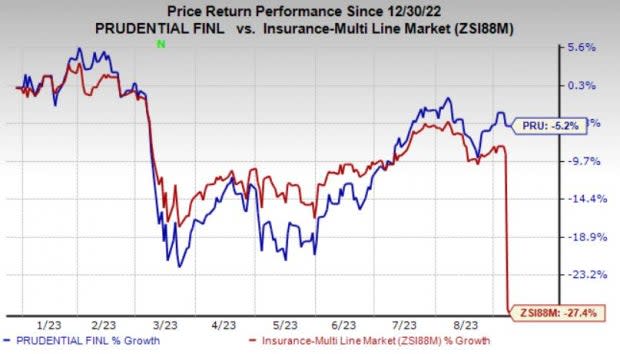

Shares of Prudential have lost 5.2% year to date compared with the industry’s decline of 27.4%. Solid asset-based businesses, improved margins in the Group Insurance business, strong international operations, a high-performing asset management business and deeper reach in the pension risk transfer market should help PRU bounce back.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the same space are Old Republic International ORI, Radian Group RDN and Corebridge Financial, Inc. CRBG.

Old Republic’s earnings surpassed estimates in all the last four quarters, the average beat being 29.85%. Year-to-date (YTD), the stock has gained 12.8%. It sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for ORI’s 2024 earnings indicates a 1% year-over-year increase and has a Value Score of A.

Radian delivered a trailing four-quarter average earnings surprise of 30.88%. YTD, the stock has gained 39.7%. It carries a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for RDN’s 2023 and 2024 earnings moved 5.8% and 4%, respectively, in the last 30 days.

Corebridge Financial’s earnings surpassed estimates in all the last four quarters, the average being 14.34%. YTD, the stock has lost 10.1%.

The Zacks Consensus Estimate for CRBG’s 2023 and 2024 earnings implies a year-over-year rise of 45.6% and 21.2%, respectively. It currently carries a Zacks Rank of 2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Prudential Financial, Inc. (PRU) : Free Stock Analysis Report

Radian Group Inc. (RDN) : Free Stock Analysis Report

Old Republic International Corporation (ORI) : Free Stock Analysis Report

Corebridge Financial, Inc. (CRBG) : Free Stock Analysis Report