Prudential's (PRU) Asset Management Arm Unveils New Buffer ETFs

Prudential Financial Inc.’s PRU asset management arm, PGIM, recently launched two buffer ETF series, namely PGIM U.S. Large-Cap Buffer 12 ETF and PGIM U.S. Large-Cap Buffer 20 ETF. Buffer ETF is a revolutionary product line aiming to provide limited downside risk to investors amid market uncertainty. This new product will enhance PGIM’s offerings and help it cater to the evolving needs of investors. These ETFs will be sub-advised by PGIM Quantitative Solutions.

The launch of these 2 ETF series bodes well for PRU as it will contribute to its asset management fees in the future. A higher level of assets under management and administration translates to a higher asset management fee income in the coming days. We expect assets under management and administration to grow 2.2% year over year in 2023. Per PGIM Quantitative Solutions 2024 outlook, a recession is not in sight, although downside risks prevail. The uneven economic conditions across the globe, going into 2024, should lead to improved demand for products offering downside protection.

PGIM’s investment strategies have been bearing positive results as 80% or more of its AUMs outperformed their respective benchmarks in the past five and 10-year periods. However, 83% of PGIM’s assets exceeded their benchmarks in the one-year period. Growing insurance and retirement businesses will also provide an impetus to PGIM through access to insurance liabilities and affiliated net flows.

PGIM’s buffer ETFs will provide exposure to an ETF tracking the S&P 500 Index and have embedded 12% and 20% buffer options. In this new ETF, the upside will be limited to a predetermined level, and the downside will have buffer options till the first 12% or 20% of the fund’s losses over one year. Offering a narrow range of results makes this investment vehicle attractive for investors seeking less volatile results. With this new launch, PGIM’s total active ETFs have doubled to 16 from last year.

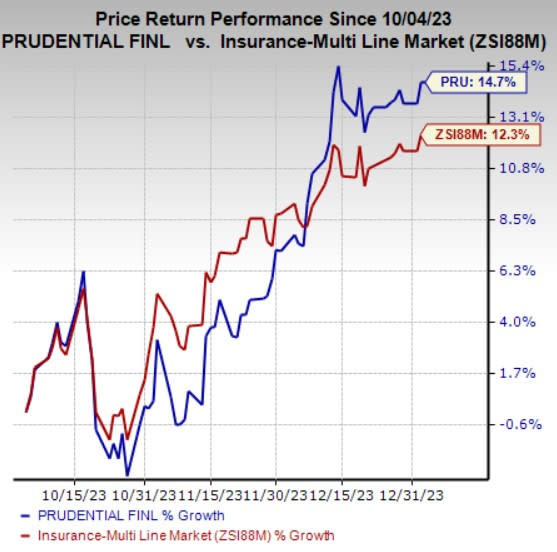

Zacks Rank & Price Performance

Prudential currently carries a Zacks Rank #3 (Hold).

Shares of Prudential have gained 14.7% in the past three months compared with the industry’s growth of 12.3%.

Image Source: Zacks Investment Research

Stocks to Consider

Investors interested in the broader Finance space can consider some better-ranked companies like Blue Owl Capital Corporation OBDC, Axos Financial, Inc. AX and Globe Life Inc. GL. Each of these companies presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The consensus mark for Blue Owl Capital’s current-year earnings is pegged at $1.91 per share, indicating 35.5% year-over-year growth. Furthermore, the consensus estimate for OBDC’s revenues in 2023 suggests 30.4% year-over-year growth.

The Zacks Consensus Estimate for Axos Financial’s current fiscal year earnings has improved 3.3% over the past month. It beat earnings estimates in each of the past four quarters, with an average surprise of 11.6%. Also, the consensus mark for AX’s revenues in the current year suggests 12.2% year-over-year growth.

The Zacks Consensus Estimate for Globe Life’s current-year earnings is pegged at $10.60 per share, which indicates 30.1% year-over-year growth. It has witnessed one upward estimate revision against none in the opposite direction in the past 60 days. It beat earnings estimates in all the past four quarters, with an average surprise of 2.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Prudential Financial, Inc. (PRU) : Free Stock Analysis Report

AXOS FINANCIAL, INC (AX) : Free Stock Analysis Report

Globe Life Inc. (GL) : Free Stock Analysis Report

Blue Owl Capital Corporation (OBDC) : Free Stock Analysis Report