PSEG (PEG) Q2 Earnings Beat Estimates, Revenues Rise Y/Y

Public Service Enterprise Group Incorporated PEG, or PSEG, reported second-quarter 2023 adjusted operating earnings of 70 cents per share, which beat the Zacks Consensus Estimate of 61 cents by 14.8%. Earnings also increased 9.4% from the prior-year reported figure.

The company reported quarterly GAAP earnings per share (EPS) of $1.18 in the second quarter of 2023 compared with 26 cents reported in the second quarter of 2022.

Total Revenues

Operating revenues came in at $2,421 million in the second quarter, which beat the Zacks Consensus Estimate of $2,025.6 million by 19.5%. The top line also increased by 16.6% from the year-ago quarter’s $2,076 million.

In the quarter, electric sales volumes were 8,796 million kilowatt-hours, while gas sales volumes were 528 million therms.

Under electric sales, residential sales volumes were 2,811 million kilowatt-hours, down 11% from the prior-year quarter figure. Its commercial and industrial sales volumes accounted for 5,914 million kilowatt-hours, registering a decline of 5% from the same period last year.

Other sales were 71 million kilowatt-hours, down 1% from the year-ago quarter figure.

Total gas sales volumes witnessed a decrease of 11% in firm sales volumes and a drop of 19% in the non-firm sales volumes of gas from the year-ago quarter figure.

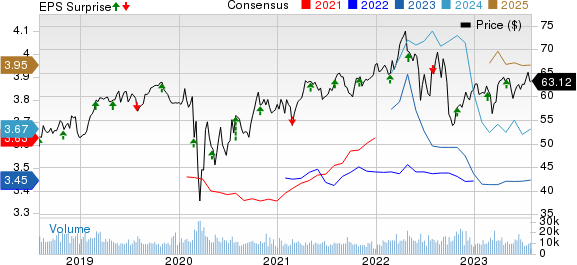

Public Service Enterprise Group Incorporated Price, Consensus and EPS Surprise

Public Service Enterprise Group Incorporated price-consensus-eps-surprise-chart | Public Service Enterprise Group Incorporated Quote

Highlights of the Release

In the second quarter of 2023, the operating income came in at $794 million compared with the operating income of $296 million in the year-ago quarter, reflecting massive growth from the prior-year period. Total operating expenses were $1,627 million, down 8.6% from the year-ago quarter.

Segmental Performance

PSE&G: The net income was $341 million, up from $305 million in the prior-year quarter.

PSEG Power & Other: Adjusted operating earnings were $10 million compared with operating earnings of $15 million in the prior-year quarter.

Financial Update

The long-term debt (including the current portion of the long-term debt) as of Jun 30, 2023 was $19,666 million compared with $20,270 million as of Dec 31, 2022

PSEG generated $2,409 million in cash from operations during the six months ended Jun 30, 2023 compared with the $356 million generated in the prior-year period.

2023 Guidance

The company reaffirmed its 2023 guidance. PEG expects its adjusted operating earnings in the range of $1,700-$1,750 million and adjusted EPS in the range of $3.40-$3.50. The Zacks Consensus Estimate for earnings is currently pegged at $3.45 per share, in line with the midpoint of the company’s guided range.

PSEG expects its PSE&G adjusted operating earnings in the range of $1,500-$1,525 million for 2023. It anticipates PSEG Power & Other adjusted operating earnings in the band of $200-$225 million.

Zacks Rank

PSEG currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Utility Releases

NextEra Energy, Inc. NEE released second-quarter 2023 adjusted earnings of 88 cents per share, which beat the Zacks Consensus Estimate of 83 cents by 6%. The bottom line was also up 8.6% from the prior-year quarter. The year-over-year improvement was due to the solid performances of Florida Power & Light Company and NextEra Energy Resources.

For the second quarter, NextEra’s operating revenues were $7,349 million, which surpassed the Zacks Consensus Estimate of $6,681 million by 10%. The top line improved 41.8% year over year.

PG&E Corporation’s PCG adjusted EPS of 23 cents in the second quarter of 2023 lagged the Zacks Consensus Estimate of 27 cents by 14.8%. The bottom line decreased 8% from the year-ago quarter’s reported figure.

In the second quarter, PCG reported total revenues of $5,290 million compared with $5,118 million in the year-ago period. Operating revenues missed the Zacks Consensus Estimate of $5,608.6 million by 5.7%.

CenterPoint Energy, Inc. CNP reported second-quarter 2023 adjusted earnings of 28 cents per share, which lagged the Zacks Consensus Estimate of 29 cents by 3.4%. The bottom line also declined 10.7% from the year-ago quarter’s figure of 31 cents.

CNP generated revenues of $1,875 million, down 3.5% from the year-ago figure. The top line missed the Zacks Consensus Estimate of $1,922.8 million by 2.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

Public Service Enterprise Group Incorporated (PEG) : Free Stock Analysis Report

Pacific Gas & Electric Co. (PCG) : Free Stock Analysis Report

CenterPoint Energy, Inc. (CNP) : Free Stock Analysis Report