PTC Inc (PTC) Reports First Fiscal Quarter 2024 Results: ARR and Cash Flow Growth Amidst Macro ...

Annualized Recurring Revenue (ARR): PTC Inc (NASDAQ:PTC) reported a 24% year-over-year increase in ARR, reaching $2,057 million.

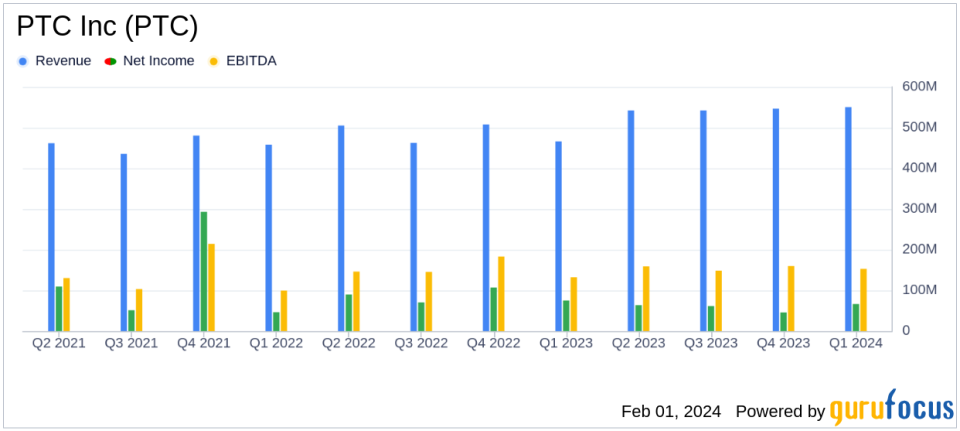

Revenue: Revenue for the quarter was $550 million, an 18% increase from the same period last year.

Earnings Per Share (EPS): GAAP EPS was $0.55, a decrease of 13% year-over-year, while non-GAAP EPS increased by 11% to $1.11.

Cash Flow: Operating cash flow was $187 million, with free cash flow at $183 million, marking a 4% and 6% increase respectively.

Debt Management: Gross debt increased by 67% to $2,267 million, while the company aims to prioritize debt repayment in FY24.

On January 31, 2024, PTC Inc (NASDAQ:PTC) released its 8-K filing, announcing financial results for its first fiscal quarter ended December 31, 2023. PTC, a global software company known for its computer-assisted design (Creo) and product lifecycle management (Windchill) software, as well as Internet of Things and AR industrial solutions, has reported a solid performance in ARR and cash flow, despite a challenging macroeconomic environment.

Financial Performance Overview

PTC's ARR saw a significant increase, reaching $2,057 million, a 24% rise from the previous year, with constant currency ARR also up by 23%. This growth is attributed to the company's robust subscription license business model and operational discipline. Revenue for the quarter stood at $550 million, an 18% increase from the previous year, with non-GAAP operating margin remaining stable at 36%. However, GAAP EPS saw a decrease to $0.55, down by 13% from the prior year, influenced by an increase in expenses related to stock-based compensation and amortization of acquired intangible assets.

Challenges and Strategic Focus

Despite the positive results, PTC Inc (NASDAQ:PTC) faces challenges, including a 32% decrease in total cash and cash equivalents and a significant increase in gross debt. The company's CFO, Kristian Talvitie, acknowledges the ongoing challenging macro backdrop but maintains confidence in the resilience of PTC's business model. CEO-elect Neil Barua emphasizes the importance of investing in technologies that meet evolving customer needs to enhance PTC's market position.

"In our first fiscal quarter, we again delivered solid ARR and cash flow results. I am confident that PTC is well positioned to continue delivering durable and consistent ARR and cash flow growth under the leadership of Neil Barua," said James Heppelmann, CEO, PTC.

Future Outlook and Guidance

Looking ahead, PTC Inc (NASDAQ:PTC) has provided guidance for fiscal 2024 and Q224, expecting constant currency ARR growth of 11% to 14% and free cash flow growth of approximately 23%. The company plans to continue its rapid de-leveraging, with a debt to EBITDA ratio back under 3.0x at the end of Q1. PTC also aims to return approximately 50% of its free cash flow to shareholders via share repurchases, while prioritizing debt repayment.

PTC's solid ARR and cash flow performance in a challenging macroeconomic climate demonstrates the company's resilience and strategic focus on growth. With a commitment to technological investment and operational discipline, PTC Inc (NASDAQ:PTC) is poised to maintain its strong market position and deliver value to its stakeholders.

For more detailed information and analysis, investors are encouraged to review the full 8-K filing and join the company's conference call to discuss the results.

Explore the complete 8-K earnings release (here) from PTC Inc for further details.

This article first appeared on GuruFocus.