Public Storage's (PSA) Q4 FFO & Revenues Beat Estimates

Public Storage PSA reported a fourth-quarter 2023 core funds from operations (FFO) per share of $4.20, beating the Zacks Consensus Estimate of $4.15. The figure increased 1% year over year.

Results showed a better-than-anticipated top line, aided by an improvement in the realized annual rent per available square foot in the reported quarter. The company also benefited from its expansion efforts through acquisitions, developments and extensions. It also issued its 2024 outlook.

Quarterly revenues of $1.16 billion exceeded the Zacks Consensus Estimate of $1.14 billion. Moreover, revenues increased 6.6% year over year.

In 2023, Public Storage reported core FFO per share of $16.89, up 6.1% from $15.92 in the prior year, and beat the Zacks Consensus Estimate of $16.83. Revenues of $4.52 billion increased 8% year over year and outpaced the consensus mark of $4.50 billion.

Behind the Headlines

Public Storage’s same-store revenues increased marginally year over year to $851.7 million in the fourth quarter, highlighting higher realized annual rent per occupied square foot, partially offset by a decline in occupancy. This storage REIT witnessed a 1.3% increase in realized annual rental income per occupied square foot to $22.90. However, the weighted average square foot occupancy of 92.7% was down 0.7% year over year. Our estimate was 92.2%.

The cost of operations for same-store facilities increased 5.1% year over year, mainly due to a rise in marketing expenses.

Consequently, PSA’s same-store direct net operating income (NOI) decreased 1% to $678.7 million. Also, this REIT’s NOI growth from non-same-store facilities was $40.8 million, mainly due to the impact of facilities acquired in 2023.

The company achieved a 79.7% same-store direct NOI margin in the quarter, down from 81.1% in the prior-year quarter.

Portfolio Activity

In the fourth quarter, Public Storage acquired 11 self-storage facilities, comprising 0.8 million net rentable square feet of area, for $171.9 billion.

It opened five newly developed facilities and completed several expansion projects with 0.8 million net rentable square feet, costing $190.3 million.

As of Dec 31, 2023, PSA had several facilities in development (2.3 million net rentable square feet) estimated to cost $461.4 million and various expansion projects (1.3 million net rentable square feet) estimated to cost $304.8 million. It expects to incur the remaining $420.7 million of development costs related to these projects, mainly over the next 18 to 24 months.

Balance Sheet Position

Public Storage exited the fourth quarter of 2023 with $370 million of cash and equivalents, down from $775.3 million as of Dec 31, 2022.

2024 Guidance

Public Storage issued its guidance for 2024.

It projects 2024 core FFO per share in the range of $16.60-$17.20. The Zacks Consensus Estimate is currently pegged at $17.05, which lies within the guided range.

The company’s full-year assumption is backed by a 1% decline to 1% growth in same-store revenues, a 2.0% to 3.5% rise in same-store expenses and a 2.4% decline to 0.7% expansion in same-store NOI.

Further, the company expects $500 million in acquisitions and $450 million in development openings.

Public Storage currently carries a Zacks Rank #3 (Hold).

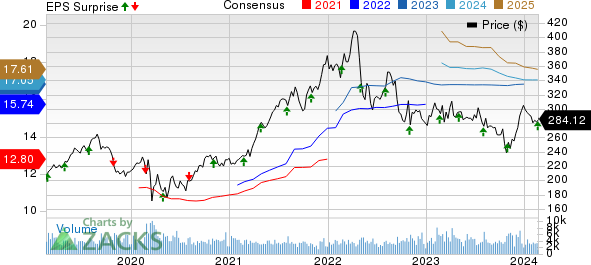

Public Storage Price, Consensus and EPS Surprise

Public Storage price-consensus-eps-surprise-chart | Public Storage Quote

Upcoming Earnings Releases

We now look forward to the earnings releases of other storage REITs like Extra Space Storage EXR and CubeSmart CUBE, which are slated to report on Feb 27 and Feb 29, respectively.

The Zacks Consensus Estimate for Extra Space Storage’s fourth-quarter 2023 FFO per share is pegged at $2.03, suggesting a year-over-year decrease of 2.9%. EXR currently carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for CubeSmart’s fourth-quarter 2023 FFO per share is pegged at 68 cents, implying a year-over-year increase of 1.5%. CUBE currently carries a Zacks Rank #3.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO), a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Public Storage (PSA) : Free Stock Analysis Report

Extra Space Storage Inc (EXR) : Free Stock Analysis Report

CubeSmart (CUBE) : Free Stock Analysis Report