PulteGroup Inc (PHM) Reports Q4 Earnings: Net Income Dips but Orders Surge

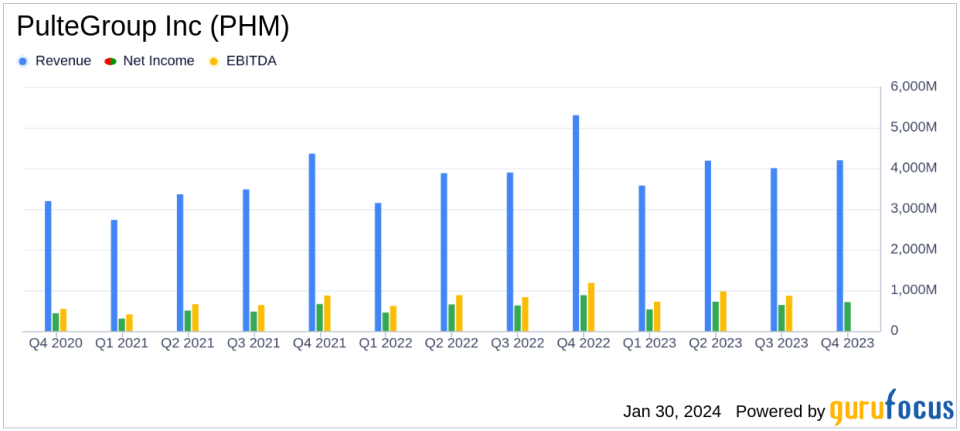

Net Income: Reported $711 million, or $3.28 per share, compared to $882 million, or $3.85 per share in the prior year.

Revenue: Home sale revenues of $4.2 billion, down from $5.0 billion in the prior year.

Net New Orders: Increased by 57% to 6,214 homes with the value of these orders up by 56% to $3.4 billion.

Gross Margin: Home sale gross margin reported at 28.9%, slightly down from 29.4% in the prior year.

Share Repurchase: Repurchased 3.6 million shares for $300 million in Q4, with a $1.5 billion increase to share repurchase authorization announced.

Debt-to-Capital Ratio: Ended the year with a strong balance sheet, showcasing a debt-to-capital ratio of 15.9%.

Backlog: Unit backlog of 12,146 homes with a value of $7.3 billion, indicating a healthy pipeline for future revenues.

On January 30, 2024, PulteGroup Inc (NYSE:PHM), a leading homebuilder in the United States, released its 8-K filing, detailing financial results for the fourth quarter ended December 31, 2023. The Atlanta-based company, which operates in 42 markets across 24 states and offers a variety of homebuilding and financial services, reported a net income of $711 million, or $3.28 per share. This represents a decrease from the prior year's net income of $882 million, or $3.85 per share.

Despite the dip in net income, PulteGroup experienced a significant increase in net new orders, which rose by 57% to 6,214 homes. The value of these orders also increased by 56% to $3.4 billion. This surge in orders provides the company with strong momentum heading into 2024, as noted by President and CEO Ryan Marshall. PulteGroup's home sale revenues totaled $4.2 billion, a decrease from $5.0 billion in the prior year, reflecting a reduction in closings from 8,848 homes to 7,615 homes and a slight decrease in the average sales price from $561,000 to $547,000.

Financial Highlights and Challenges

The company's home sale gross margin for the quarter was 28.9%, compared to 29.4% in the prior year. Selling, general, and administrative expenses were $308 million, or 7.4% of home sale revenues, which included a $65 million pre-tax insurance benefit recorded in both Q4 2023 and Q4 2022. The slight decrease in gross margin and the increase in SG&A expenses as a percentage of home sale revenues are important metrics for investors, as they reflect the company's profitability and operational efficiency.

PulteGroup's financial services segment reported a pre-tax income of $44 million, up from $24 million in the prior year, benefiting from favorable market conditions and higher capture rates in mortgage operations. The company's strong financial position is further underscored by its year-end cash balance of $1.8 billion and a low debt-to-capital ratio of 15.9%. Additionally, the announcement of a $1.5 billion increase to the share repurchase authorization signals confidence in the company's future and a commitment to delivering value to shareholders.

Analysis of Performance

PulteGroup's performance in the fourth quarter, while mixed, shows resilience in a challenging market. The increase in net new orders is particularly noteworthy as it indicates potential for revenue growth in the coming year. The company's strategic positioning, with a ready supply of homes and lots, positions it well to capitalize on market conditions, especially if interest rates remain lower, as anticipated by CEO Ryan Marshall.

The company's backlog of 12,146 homes, valued at $7.3 billion, is a critical indicator of future performance, providing visibility into the company's revenue pipeline. The repurchase of 3.6 million common shares in the quarter reflects a proactive approach to capital management and shareholder returns. Overall, PulteGroup's Q4 results demonstrate a solid foundation for growth, despite the net income decline and the competitive pressures in the homebuilding industry.

Value investors and potential GuruFocus.com members may find PulteGroup's latest earnings report indicative of a company with a strong balance sheet, a robust order book, and a clear strategy for shareholder returns. The company's ability to navigate market fluctuations and its commitment to capitalizing on favorable market conditions may present opportunities for those looking for stable investments in the homebuilding sector.

For a more detailed analysis and updates on PulteGroup Inc (NYSE:PHM), stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from PulteGroup Inc for further details.

This article first appeared on GuruFocus.