PulteGroup (PHM) Cheers Investors With 25% Dividend Hike

In a bid to reward shareholders, PulteGroup, Inc. PHM announced a 25% hike in its quarterly dividend. The company has consistently enhanced shareholder value by implementing regular increases in dividends, executing share repurchase initiatives, and strategically reinvesting in its core business.

On Nov 16, PulteGroup announced that its board of directors has voted to boost the quarterly dividend to 20 cents per share (or 80 cents annually) from 16 cents (or 64 cents annually) paid earlier. The dividend will be payable on Jan 3, 2024, to its shareholders of record as of the close of business on Dec 19, 2023.

Enhancement of Shareholder Value

Since 2018, PulteGroup's board of directors adopted a regular quarterly cash dividend policy. In the last five years, PulteGroup accumulated $6.9 billion in operational cash flow, fueling its expansion efforts, and allocated nearly $4.0 billion to shareholders through dividends and share repurchases.

PulteGroup is also highly active on the buyback front. Through the first nine months of 2023, PulteGroup has repurchased 10.2 million common shares, or 4.5% of shares outstanding, for $700 million, or $68.76 per share. During the third quarter, the company also retired a total of $65 million of its 2026 and 2027 senior notes via open market repurchases. After these equity and debt repurchases, the company ended the quarter with $1.9 billion of cash and a debt-to-capital ratio of 16.5% (down from 18.7% in 2022).

Investors always prefer a return-generating stock. A high-dividend-yielding one is highly coveted. Stockholders are always looking for companies with a track record of consistent and incremental dividend payments.

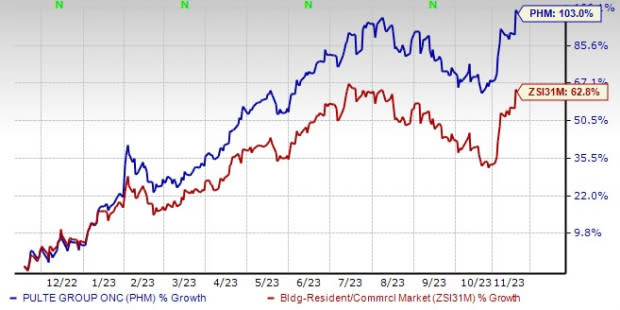

Image Source: Zacks Investment Research

Shares of this Zacks Rank #3 (Hold) company have gained 103% compared with the Zacks Building Products - Home Builders industry’s 62.8% growth over the past year.

Although rising mortgage rates have been hurting the affordability of prospective buyers, builders are cautiously optimistic for 2024 as a lack of existing inventory shifts demand to the new home market. Although builders continue to grapple with high construction costs and material supply-chain disruptions, they continue to witness strong pent-up demand as buyers wait for interest rates to drop and turn more to the new home market due to a shortage of existing inventory.

3 Better-Ranked Construction Stocks Hogging in the Limelight

Gates Industrial Corporation plc GTES manufactures engineered power transmission and fluid power solutions.

GTES currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

GTES’ expected earnings growth rate for 2023 is 10.5%. The consensus mark for GTES’ 2023 earnings has moved north to $1.26 per share from $1.21 in the past 30 days.

Howmet Aerospace, Inc. HWM is a global manufacturer of engineered products serving the aerospace, defense and commercial transportation industries. The company is expected to benefit from higher aircraft production rates and ease of supply chains in the transportation market.

Howmet Aerospace currently carries a Zacks Rank #2 (Buy). HWM’s earnings for 2023 are expected to grow 27.1%. The consensus mark for HWM’s 2023 earnings has moved north to $1.78 per share from $1.77 in the past seven days.

Sterling Infrastructure, Inc. STRL currently has a Zacks Rank #2. STRL delivered a trailing four-quarter earnings surprise of 14.9%, on average.

The Zacks Consensus Estimate for STRL’s 2023 sales and EPS indicates growth of 3.9% and 29.4%, respectively, from the previous year’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PulteGroup, Inc. (PHM) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

Gates Industrial Corporation PLC (GTES) : Free Stock Analysis Report

Howmet Aerospace Inc. (HWM) : Free Stock Analysis Report