Puma Biotech (PBYI) Q2 Earnings Beat, Nerlynx Sales Outperform

Puma Biotechnology PBYI reported second-quarter 2023 earnings of 10 cents per share, which beat the Zacks Consensus Estimate of 7 cents. Earnings declined 64% year over year.

The above-adjusted loss excludes the impact of stock-based compensation expense, including which, reported earnings per share were 5 cents, down 76% year over year.

In the second quarter, total revenues were $54.6 million, which beat the Zacks Consensus Estimate of $51.4 million.

Revenues declined 8.2% year over year. Total revenues comprised net product sales of Nerlynx (neratinib), Puma Biotech's only marketed drug in the United States, and license fees and royalty revenues from PBYI’s sub-licensees. Nerlynx is indicated for treating early-stage HER2-positive breast cancer.

Puma Biotech’s shares were up around 2.6% in after-hours trading on Thursday in response to the better-than-expected earnings performance.

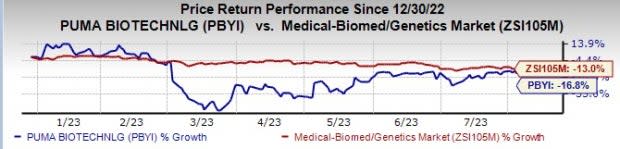

Puma Biotech’s shares have declined 16.8% so far this year compared with the industry’s 13% decline.

Image Source: Zacks Investment Research

Quarter in Detail

Product revenues from Nerlynx were $51.6 million in the quarter, almost flat year over year as sales were hurt by inventory drawdown at specialty pharmacies and specialty distributors. Nerlynx’s product sales were slightly better than the guidance range of $47-$50. Product revenues also beat the Zacks Consensus Estimate of $48.6 million as well as our model estimate of $49.0 million. Product revenues rose 10% sequentially.

On the conference call, Puma mentioned that demand for Nerlynx rose approximately 2.9% year over year and about 0.7% sequentially. While Nerlynx total prescriptions increased year over year and sequentially in the second quarter, new prescriptions declined both year over year and sequentially

Royalty revenues were $3 million, down 63.4% from the year-ago quarter. Royalty revenues declined 50% sequentially due to the unfavorable timing of shipments to the company’s partner in China. Royalty revenues were in line with the higher end of the guidance range of $2 million to $3 million.

Puma Biotech did not record any license revenues in the second quarter.

Total operating costs (including stock-based compensation expense) in the quarter were $49.7 million, up 4.9% year over year.

Selling, general and administrative expenses (including stock-based compensation expense) were up 18.4% year over year to $24.4 million due to higher salary and headcount costs.

Research and development expenses (including stock-based compensation expense) were $13.4 million in the quarter, up 12.6% year over year.

Cash, cash equivalents and marketable securities were $74.4 million as on Jun 30, 2023 compared with $71.0 million as on Mar 31, 2023.

2023 Guidance Maintained

Puma Biotech maintained its previously issued guidance for 2023. It expects Nerlynx’s product sales in the range of $205-$210 million.

The company expects royalty revenues to be in the $25-$30 million range. Net income is expected to be in the range of $20-$24 million.

Total operating expenses are anticipated to decline in 2023 from the 2022 level. SG&A is expected to decline approximately 1-3% and R&D is expected to increase 5-7% year over year.

In the third quarter, Nerlynx’s product sales are expected to be in the range of $51-$53 million, while royalty revenues are expected to be $3-$5 million. Net income is expected to be in the range of $3-$4 million.

Pipeline Update

In September, Puma Biotech in-licensed global development and commercialization rights to alisertib, an aurora kinase A inhibitor, from Japan’s Takeda.

Puma believes alisertib has the potential in HR-positive, HER2-negative breast cancer, triple-negative breast cancer, head and neck cancer and small cell lung cancer, based on the results of the already completed mid-stage studies.

At the annual meeting of the American Society of Clinical Oncology (ASCO) in June, Puma presented biomarker data from a phase II study evaluating alisertib plus paclitaxel versus paclitaxel alone in metastatic hormone receptor-positive and triple-negative breast cancer. The data showed that the addition of alisertib to paclitaxel improved progression-free survival in patients enrolled in the study.

Puma also plans to conduct a meeting with the FDA to discuss the registration pathway for alisertib in HR-positive, HER2-negative breast cancer in the fourth quarter.

Puma plans to begin a phase II clinical study on alisertib in small cell lung cancer in the second half.

Zacks Rank & Stocks to Consider

Puma Biotech currently has a Zacks Rank #3 (Hold).

Puma Biotechnology, Inc. Price, Consensus and EPS Surprise

Puma Biotechnology, Inc. price-consensus-eps-surprise-chart | Puma Biotechnology, Inc. Quote

Some better-ranked biotech companies are Alkermes ALKS, ACADIA Pharmaceuticals ALNY and Axsome Therapeutics AXSM, all with a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 30 days, estimates for Alkermes’ 2023 earnings per share have risen from 99 cents to $1.64. Year to date, shares of Alkermes have risen 5.7%.

Earnings of Alkermes beat estimates in three of the last four quarters, witnessing an earnings surprise of 81.98%, on average.

In the past 30 days, estimates for ACADIA Pharmaceuticals’ 2023 loss per share have narrowed from 53 cents to 31 cents, while that for 2024 have improved from a loss of 11 cents to earnings of 44 cents. So far this year, shares of ACADIA Pharmaceuticals have risen 70.8%.

Earnings of ACADIA Pharmaceuticals beat estimates in two of the last four quarters and missed the mark on two occasions. On average, the company witnessed a negative earnings surprise of 20.33% over the trailing four quarters.

In the past 30 days, estimates for Axsome Therapeutics’ 2023 loss per share have narrowed from $3.96 to $3.79, while that for 2024 have improved from a loss of $1.59 to $1.58. Year to date, shares of Axsome Therapeutics have declined 2.4%.

Earnings of AXSM beat estimates in three of the last four quarters, delivering an earnings surprise of 22.34%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alnylam Pharmaceuticals, Inc. (ALNY) : Free Stock Analysis Report

Alkermes plc (ALKS) : Free Stock Analysis Report

Puma Biotechnology, Inc. (PBYI) : Free Stock Analysis Report

Axsome Therapeutics, Inc. (AXSM) : Free Stock Analysis Report