Puma Biotech (PBYI) Q4 Loss Wider Than Expected, Sales Top

Puma Biotechnology PBYI reported fourth-quarter 2022 loss of 12 cents per share, which was wider than the Zacks Consensus Estimate of a loss of 6 cents. In the year-ago quarter, the company had reported earnings of 10 cents per share.

In the fourth quarter, total revenues were $65.7 million, which beat the Zacks Consensus Estimate of $57 million.

Revenues were up 19% year over year, driven by commercial revenues and royalties from Nerlynx.

Total revenues comprised net product sales of Nerlynx (neratinib), Puma Biotech's only marketed drug in the United States, and license fees and royalty revenues from PBYI’s sub-licensees. Nerlynx is indicated for treating early-stage HER2-positive breast cancer.

Puma Biotech’s shares have surged 58% this year against the industry’s 8.1 decline.

Image Source: Zacks Investment Research

Quarter in Detail

Product revenues from Nerlynx were $53.7 million in the quarter, up 5% year over year. This increase was due to improved demand trends.

Royalty revenues were $12 million, up 313% from the year-ago quarter. Puma Biotech did not record any license revenues in the fourth quarter.

Total operating costs in the quarter were $55.7 million, up 14.6% year over year. Selling, general and administrative expenses were up 11.5% year over year to $25.1 million.

Adjusted research and development expenses were $13.8 million in the quarter, down 3% year over year. This was primarily due to lower expense for clinical studies.

Cash, cash equivalents and marketable securities were $81.1 million as on Dec 31, 2022, compared with $78 million as on Sep 30, 2022.

Full-Year Results

Puma generated total revenues of $228 million in 2022, down 10% year over year.

The company reported breakeven earnings for 2022 against a loss of 72 cents per share in 2021.

2023 Guidance

Puma Biotech issued a fresh guidance for 2023. It expects Nerlynx’s product sales in the range of $205-$210 million.

The company expects royalty revenues to be in the $25-$30 million range. Net income is expected to be in the range of $20-$24 million.

Pipeline Update

In September, Puma Biotech in-licensed global development and commercialization rights to alisertib, an aurora kinase A inhibitor, from Japan’s Takeda.

Several studies on Alisertib targeting treatment for hormone receptor-positive breast cancer and small-cell lung cancer are underway.

The company anticipates meeting with the FDA in the first half of 2023 to discuss the clinical development plan for alisertib in hormone receptor-positive HER2-negative breast cancer and small-cell lung cancer.

In December, Puma Biotech released results from three cohorts of the phase II TBCRC-022 study on Nerlynx in combination with Roche’s Kadcyla in HER2-positive breast cancer patients with brain metastases, previously treated with Kadcyla.

The three cohorts were: 4A – patients with previously untreated BCBM, 4B – patients with BCBM progressing after prior local CNS-directed therapy without T-DM1 exposure and 4C – patients with BCBM progressing after prior local CNS-directed therapy with previous T-DM1 exposure. The primary endpoint, Response Assessment in Neuro-Oncology-Brain Metastases (RANO-BM), was evaluated in each cohort separately. The efficacy results from the trial showed that CNS Objective Response Rate by RANO-BM was 33.3% of patients in cohort 4A, 29.4% in cohort 4B, and 28.6% in cohort 4C.

Puma announced that it would discontinue the neratinib SUMMIT study for now due to challenging randomized trials and patient enrollment.

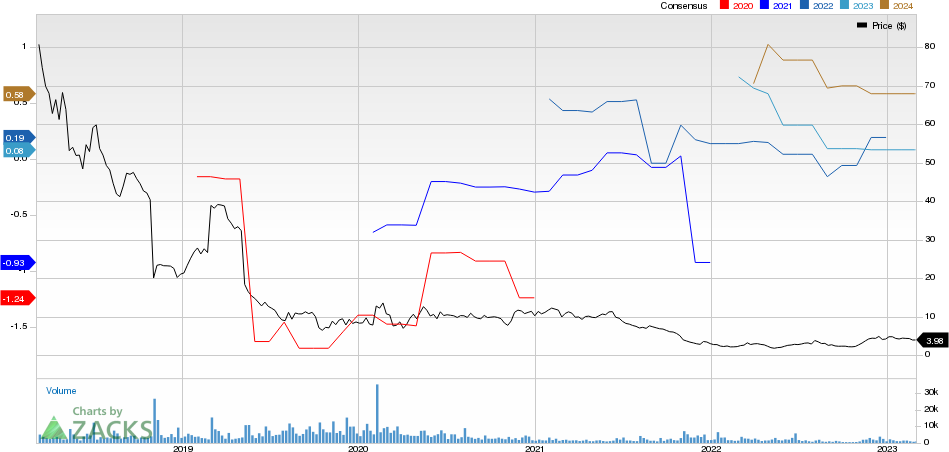

Puma Biotechnology, Inc. Price and Consensus

Puma Biotechnology, Inc. price-consensus-chart | Puma Biotechnology, Inc. Quote

Zacks Rank & Stocks to Consider

Puma Biotech currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the same sector include Allogene Therapeutics ALLO, CRISPR Therapeutics CRSP and Arcus Biosciences (RCUS), all holding a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Allogene Therapeuctics’ loss per share estimates have narrowed from $2.84 to $2.83 for 2023 and from $2.85 to $2.63 for 2024, in the past 60 days.

Earnings of ALLO beat estimates in all the last four quarters, the average surprise being 8.33%. The stock has plunged 25.1% in the past year.

CRISPR Therapeutics' loss per share estimates for 2023 have narrowed from $8.21 to $7.52 in the past 60 days.

CRSP's earnings beat estimates in two of the last four quarters and missed the mark in the other two, the average surprise being 3.19%. CRSP’s shares declined 7.5% in the past year.

Arcus Biosciences’ loss per share estimates have narrowed from $4.75 to $4.57 for 2023 and from $3.79 to $3.56 for 2024, in the past 60 days. Arcus Biosciences’ shares have plunged 48.1% in the past year.

Earnings of RCUS beat estimates in two of the last four quarters, met the mark in one and missed in another, the average negative surprise being 48.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Puma Biotechnology, Inc. (PBYI) : Free Stock Analysis Report

CRISPR Therapeutics AG (CRSP) : Free Stock Analysis Report

Arcus Biosciences, Inc. (RCUS) : Free Stock Analysis Report

Allogene Therapeutics, Inc. (ALLO) : Free Stock Analysis Report