Puma (PBYI) Q2 Loss Narrower Than Expected, Nerlynx View Cut

Puma Biotechnology PBYI reported loss of 13 cents per share for the second quarter of 2021, narrower than the Zacks Consensus Estimate of a loss of 31 cents. The company had reported earnings of 8 cents in the year-ago quarter.

Total revenues consisted of net product sales of Nerlynx (neratinib), Puma Biotech's only marketed drug, and license revenues from Puma’s sub-licensees and royalty revenues.

Nerlynx is indicated for extended adjuvant treatment of HER2-positive early-stage breast cancer in patients, previously treated with Roche’s RHHBY Herceptin-based adjuvant therapy.

In the second quarter, total revenues were $53.4 million, down 24.4% year. Sales, however, beat the Zacks Consensus Estimate of $51 million.

Product revenues from Nerlynx were $48.9 million, almost flat year over year as business disruptions caused by the COVID-19 situation and the rising rates of the Delta variant continued to hurt sales. However, product sales were better than the company’s guidance range of $46 million-$47 million. Nerlynx revenues also rose 6.6% sequentially.

Royalty revenues from licensing partners were $4.3 million in the quarter while license revenues were $0.2 million.

Total operating costs in the quarter were $70.0 million, up 10.2% year over year. Research and development expenses were $18.6 million in the quarter, down 24.7% from the year-ago period. Selling, general and administrative expenses rose 34% year over year to $39.4 million.

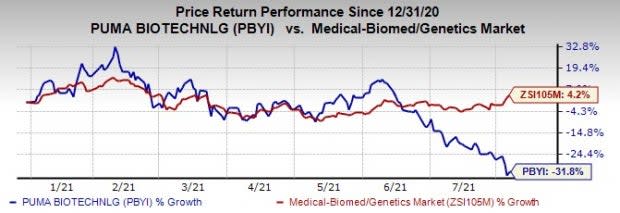

Shares were up 2.7% in after-hours trading following the earnings release. However, Puma Biotech’s shares have declined 31.8% this year so far against the industry’s increase 4.2%.

Image Source: Zacks Investment Research

Guidance

In 2021, Puma Biotech expects Nerlynx’s net sales in the range of $200 million to $205 million, which is less than the prior guidance of 208 million to $213 million. Slower-than-anticipated improvement in access to health care led to the cut in guidance. The company does not expect much improvements in customer access in the second half due to uncertainty about the impact of COVID following rising cases of the Delta variant and related risks.

Royalty revenues are expected to be in the range of $13 million to $15 million (maintained). License revenues are expected to be in the range of $50 million to $52 million (maintained).

Nerlynx’s net revenues are expected in the range of $49 million to $50 million in the third quarter of 2021. Royalty revenues will be in the range of $3 million to $4 million

Pipeline & Other Updates

In July, the FDA approved an update to the label of Nerlynx to incorporate the use of dose escalation in extended adjuvant indication as well metastatic indication based on data from the phase II CONTROL study. In addition, the FDA also approved the new 133 count commercial Nerlynx SKU, a bottle containing a four-week supply of 133 tablets that is aligned with approved dose escalation regimen.

Several additional studies on Nerlynx targeting different types of breast cancer patient populations as well as other cancers are currently underway.

A key analysis of Nerlynx is the phase II SUMMIT basket study for treating solid tumors in patients with activating EGFR, HER2 or HER4 mutated cancers. The company completed enrolment in the randomized cohort of the study in ER- positive HER2-negative breast cancer patients who have a HER2 mutation in the first quarter. Data from this cohort is expected to be reported in the fourth quarter. Additionally, the company plans to report data from another cohort of the SUMMIT study, which is evaluating Nerlynx in non-small cell lung cancer patients with EGFR exon 18 mutations in the first half of 2022, delayed from the second half of 2021.

Meanwhile, Puma Biotech plans to release results from the phase II TBCRC-022 study on Nerlynx in combination with Roche’s Kadcyla in patients with HER2-positive breast cancer with brain metastases who have previously been treated with Kadcyla in the second half of 2021 or first half of 2022.

Zacks Rank and Stocks to Consider

Puma Biotech currently carries a Zacks Rank #3 (Hold). A couple of better-ranked stocks from the same sector include Larimar Therapeutics, Inc. LRMR and Ironwood Pharmaceuticals, Inc. IRWD, both carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Puma Biotechnology, Inc. Price, Consensus and EPS Surprise

Puma Biotechnology, Inc. price-consensus-eps-surprise-chart | Puma Biotechnology, Inc. Quote

Larimar’s loss per share estimates have narrowed from $3.08 to $2.70 for 2021 and from $30.9 to $2.96 for 2022 in the past 30 days.

Ironwood’s earnings per share estimates have moved north from $1.04 to $1.08 for 2021 and from $1.18 to $1.20 for 2022 in the past 30 days. The stock has risen 16.7% so far this year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Ironwood Pharmaceuticals, Inc. (IRWD) : Free Stock Analysis Report

Puma Biotechnology, Inc. (PBYI) : Free Stock Analysis Report

Larimar Therapeutics, Inc. (LRMR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research