Pura Vida Investments, LLC Acquires Additional Shares in Cutera Inc

In a recent transaction, Pura Vida Investments, LLC, a New York-based investment firm, has increased its stake in Cutera Inc. (NASDAQ:CUTR). This article provides an in-depth analysis of the transaction, the profiles of both Pura Vida Investments and Cutera Inc, and the potential implications of this acquisition on the stock market.

Details of the Transaction

On July 27, 2023, Pura Vida Investments, LLC added 291,193 shares of Cutera Inc to its portfolio at a trade price of $18.26 per share. This transaction increased the firm's total holdings in Cutera Inc to 1,554,795 shares, representing 5.48% of the firm's portfolio and 7.82% of Cutera Inc's total shares. The transaction had a 1.03% impact on Pura Vida Investments' portfolio.

Profile of Pura Vida Investments, LLC

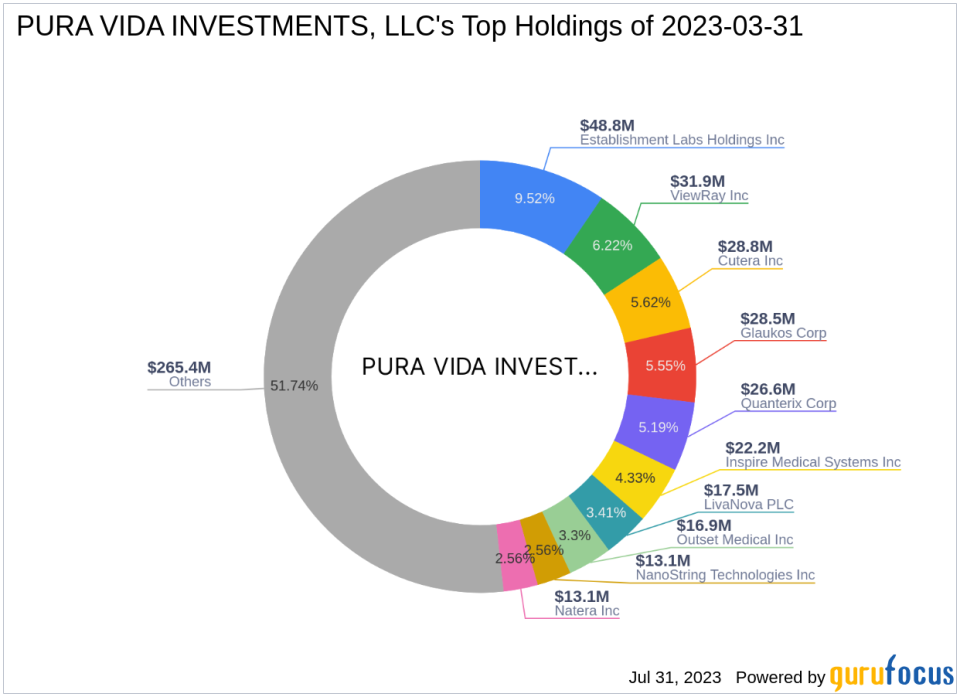

Pura Vida Investments, LLC is an investment firm located at 150 East 52nd Street, New York. The firm holds 57 stocks in its portfolio, with a total equity of $513 million. Its top holdings include Cutera Inc (NASDAQ:CUTR), ViewRay Inc (VRAYQ), Glaukos Corp (NYSE:GKOS), Quanterix Corp (NASDAQ:QTRX), and Establishment Labs Holdings Inc (NASDAQ:ESTA).

Overview of Cutera Inc

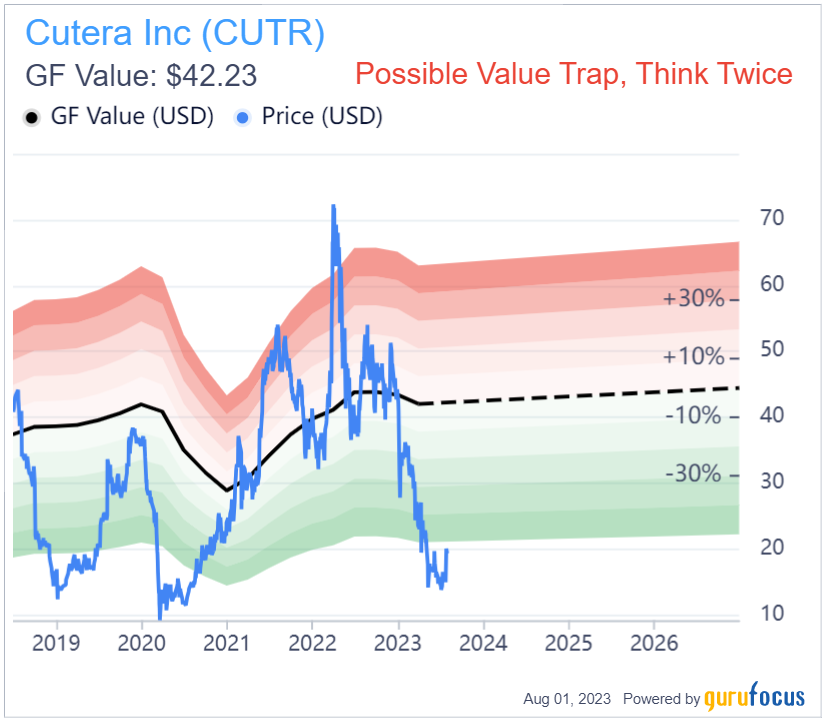

Cutera Inc, a medical device company based in the USA, specializes in the design, development, manufacture, marketing, and servicing of laser and other energy-based aesthetics systems for practitioners internationally. The company's market capitalization stands at $398.052 million, with a current stock price of $20.01. However, the company's Price-earnings ratio is not available as the company is operating at a loss. According to GuruFocus, the GF Value of Cutera Inc is $42.23, giving it a price-to-GF-Value ratio of 0.46.

Performance of Cutera Inc's Stock

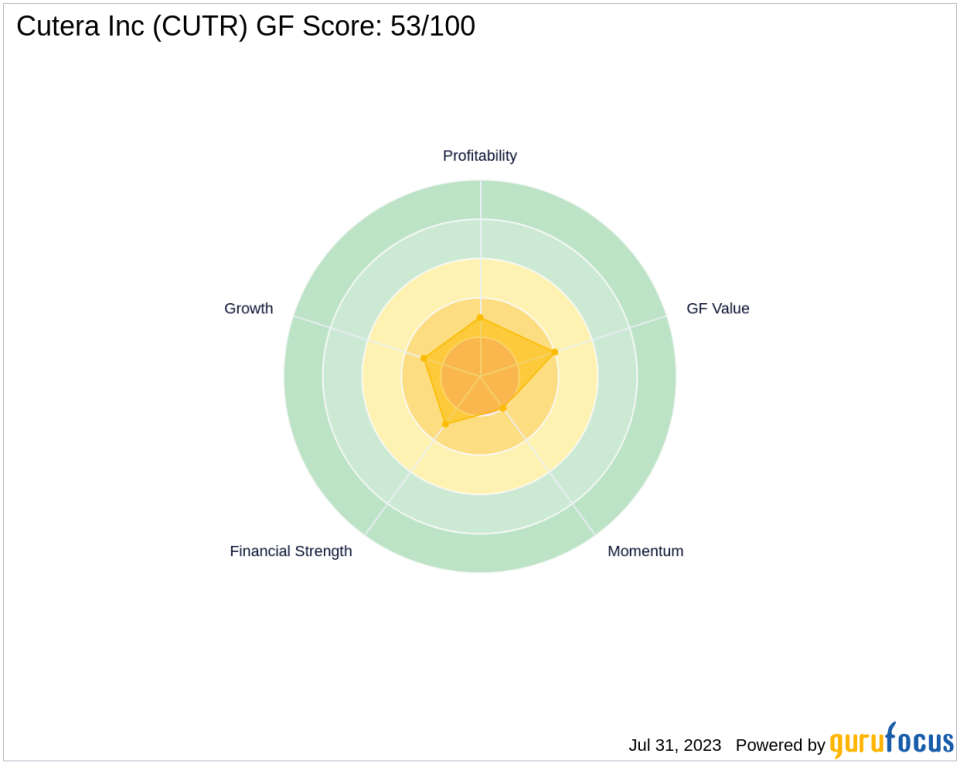

Since the transaction, Cutera Inc's stock has gained 9.58%. However, the stock has seen a year-to-date decline of 53.17%. The stock's GF Score stands at 53/100, indicating a poor future performance potential. The stock has an F Score of 3, a Z Score of 0.69, and a cash to debt ratio of 0.62, warning signs of low financial strength.

Cutera Inc's Profitability

Cutera Inc's profitability shows mixed results. The company's return on assets is -21.55%. Although Cutera has seen a gross margin growth of 0.80% per year on average over the past five years, its operating margin growth is not applicable due to negative operating income during the said period. Over the past three years, the company's revenue growth was 1.50% per year on average, while its EBITDA and earning decline were -71.90% per year on average and -70.90% per year on average, respectively.

Largest Guru Holding Cutera Inc's Stock

The largest guru holding Cutera Inc's stock is GAMCO Investors. However, the exact percentage of shares held by GAMCO Investors is not provided.

Conclusion

In conclusion, Pura Vida Investments, LLC's recent acquisition of additional shares in Cutera Inc is a significant move that increases the firm's stake in the medical device company. However, given Cutera Inc's current financial health and stock performance, the potential impact of this transaction on both Pura Vida Investments, LLC and Cutera Inc remains to be seen. As always, investors are advised to conduct their own thorough research before making any investment decisions.

This article first appeared on GuruFocus.