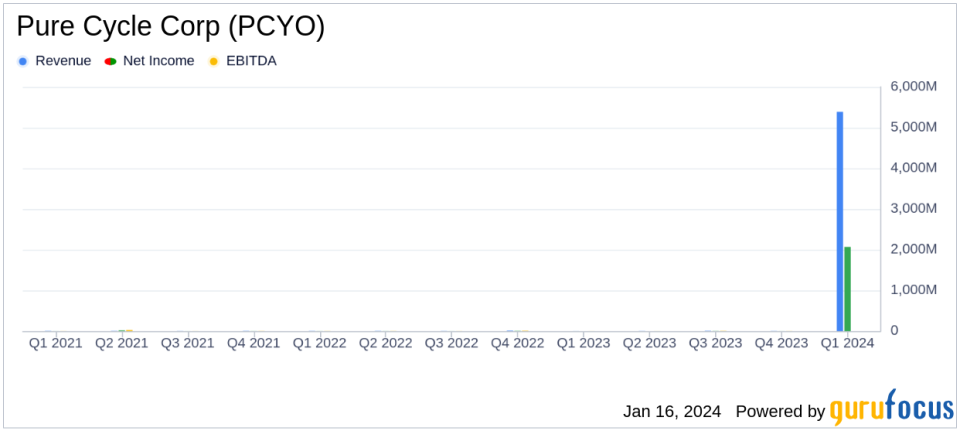

Pure Cycle Corp (PCYO) Reports Substantial Revenue and Net Income Growth in Q1 2024

Net Income: Reported $2.1 million for Q1 2024, a significant increase from $159 thousand in Q1 2023.

Revenue: Total revenues soared to $5.4 million in Q1 2024 from $1.3 million in the same period last year.

Lot Sales: Revenue from lot sales increased to $1.9 million in Q1 2024, up from $513 thousand in Q1 2023.

Water and Wastewater Revenue: Over 300% increase in water and wastewater revenue, primarily from oil and gas water sales.

EBITDA: Improved to $3.4 million in Q1 2024 from $832 thousand in Q1 2023.

Working Capital: Reported a strong working capital position of $20.4 million as of November 30, 2023.

Earnings Per Share (EPS): Fully diluted EPS rose to $0.09 in Q1 2024 from $0.01 in Q1 2023.

On January 12, 2024, Pure Cycle Corp (NASDAQ:PCYO) released its 8-K filing, announcing financial results for the three months ended November 30, 2023. The company, a diversified land and water resource development firm, operates through two segments: Water and wastewater resource development, and Land development. The latter segment generates the majority of the company's revenue.

Pure Cycle Corp (NASDAQ:PCYO) has demonstrated a remarkable performance in the first quarter of 2024, with net income reaching $2.1 million, marking the eighteenth consecutive quarter of profitability. This performance underscores the company's ability to maintain a steady growth trajectory, which is crucial for investors seeking stable returns in the Utilities - Regulated industry.

The company's financial achievements, including a 270% increase in lot sale revenue and over a 300% increase in water and wastewater revenue, are indicative of its strong market position and operational efficiency. These revenue streams are vital for Pure Cycle Corp (NASDAQ:PCYO) as they provide the financial backbone for the company's ongoing and future projects, particularly the development of the Sky Ranch Master Planned Community.

Financial Performance Insights

During the quarter, Pure Cycle Corp (NASDAQ:PCYO) recognized significant increases in revenue across its business segments. The water and wastewater resource development segment generated $3.3 million, while the land development segment contributed $2.0 million. The single-family rental business, a newer venture for the company, reported $0.1 million in revenue.

Key financial metrics from the income statement reveal the company's robust growth. Water and wastewater tap sales, which are a critical indicator of demand for Pure Cycle's services, increased to 15 taps sold for $0.6 million in Q1 2024 from 4 taps for $0.2 million in the same period last year. The balance sheet also reflects a strong financial position, with $22.0 million in cash and cash equivalents as of November 30, 2023.

"Our Sky Ranch community continues to demonstrate solid growth with entry level homes and our great location directly off Interstate 70," said Mr. Harding, CEO of Pure Cycle. "With lot inventories and existing home sales well below historic levels, Sky Ranch continues to out-perform other master planned communities in Denver."

The company's operational summary highlighted a record 623 acre-feet of water deliveries, primarily due to increased sales to oil and gas operators and new Sky Ranch customers. This operational efficiency and the ability to capitalize on market conditions are crucial for maintaining the company's growth momentum.

Looking Ahead

Pure Cycle Corp (NASDAQ:PCYO) is well-positioned to continue its growth with diversified revenue streams and a strong market demand for its services. The company's strategic focus on developing the Sky Ranch Master Planned Community and expanding its single-family rental business is expected to contribute to its long-term financial stability and success.

As Pure Cycle Corp (NASDAQ:PCYO) continues to execute its business strategy, the company's financial health and operational achievements provide a solid foundation for future growth. Investors and potential GuruFocus.com members interested in the Utilities - Regulated sector may find Pure Cycle's consistent performance and strategic developments an attractive opportunity.

For more detailed information, investors are encouraged to review the full earnings report and join the earnings call scheduled for January 16, 2024. The company's commitment to transparency and communication with shareholders is evident in its proactive approach to sharing financial results and operational updates.

For further insights and analysis on Pure Cycle Corp (NASDAQ:PCYO) and other investment opportunities, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Pure Cycle Corp for further details.

This article first appeared on GuruFocus.