Pure Storage (PSTG) Q3 Earnings & Revenues Beat Estimates, Up Y/Y

Pure Storage PSTG reported non-GAAP earnings per share (EPS) of 50 cents in third-quarter fiscal 2024, which beat the Zacks Consensus Estimate by 21.9%. The company reported non-GAAP EPS of 31 cents in the prior-year quarter.

Total revenues increased 13% from the year-ago reported quarter to $762.8 million, which surpassed the Zacks Consensus Estimate by 0.2%. Strong uptake of the FlashBlade portfolio (including FlashBlade//E) coupled with robust Evergreen//One subscription sales acted as catalysts amid macroeconomic weakness.

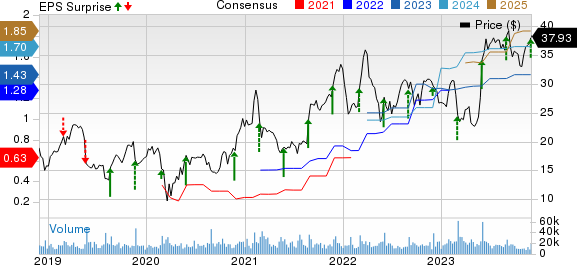

Pure Storage, Inc. Price, Consensus and EPS Surprise

Pure Storage, Inc. price-consensus-eps-surprise-chart | Pure Storage, Inc. Quote

Quarter in Detail

Product revenues (contributing 59% to total revenues) amounted to $453.2 million, up 5.1% on a year-over-year basis.

Subscription services revenues (41% of total revenues) of $309.5 million rose 26.5% on a year-over-year basis.

We expected Product and subscription revenues to be $458.9 million and $301.1 million, respectively, for the fiscal third quarter.

Subscription annual recurring revenues (ARR) amounted to nearly $1.3 billion, up 26% on a year-over-year basis. Subscription ARR includes the annualized value of all active subscription contracts as of the last day of the quarter, along with annualized on-demand revenues.

Total revenues in the United States and International were $536 and $227 million, respectively.

Margin Highlights

The non-GAAP gross margin expanded 310 basis points (bps) from the year-ago reported quarter to 74%.

The non-GAAP Product gross margin expanded 300 bps from the year-ago reported quarter to 73.1%. The non-GAAP Subscription gross margin was 75.4%, which expanded 310 bps on a year-over-year basis.

Non-GAAP operating expenses, as a percentage of total revenues, were 51.9% compared with 55% reported in the prior-year quarter.

Pure Storage reported a non-GAAP operating income of $169 million compared with $107 million reported in the year-ago quarter. The non-GAAP operating margin was 22.2% compared with 15.9% reported in the prior-year quarter.

Balance Sheet & Cash Flow

Pure Storage exited the fiscal third quarter that ended on Nov 5 with cash and cash equivalents and marketable securities of $1.35 billion, up from $1.21 billion as of Aug 6, 2023.

Cash flow from operations amounted to $158.4 million in the fiscal third quarter compared with $154.6 million reported in the prior-year quarter. Free cash flow was $113.3 million compared with $114.7 million reported in the year-ago quarter.

In the fiscal third quarter, the company returned $22.4 million to shareholders by repurchasing 0.6 million shares. The company has $167 million left from its previously announced $250 million share-repurchase plan.

Deferred revenues increased 19.9% to $1.497 billion in the quarter under review.

The remaining performance obligations at the end of the fiscal third quarter totaled $2.046 billion, up 30% year over year. The metric represents total committed non-cancelable future revenues.

Guidance

The company expects fiscal 2024 revenues to be $2.82 billion, representing a rise of 2.5% year over year amid volatile macroeconomic conditions. The non-GAAP operating margin is expected to be 16%.

Pure Storage expects revenues to be $782 million for fourth-quarter fiscal 2024, representing a decline of 3.5% from the year-ago reported figure.

The non-GAAP operating income for the fiscal fourth quarter is expected to be $150 million. The non-GAAP operating margin is expected to be 19%.

Zacks Rank and Stocks to Consider

Pure Storage currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology space are Pegasystems PEGA, Flex FLEX and Watts Water Technologies WTS. Pegasystems and Flex presently currently sport a Zacks Rank #1 (Strong Buy), whereas Watts Water Technologies presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Pegasystems’ 2023 EPS has improved 21.2% in the past 60 days to $1.77. PEGA delivered an average earnings surprise of 1,250.2% in the trailing four quarters. Shares of PEGA have jumped 45% in the past year.

The Zacks Consensus Estimate for Flex’s fiscal 2024 EPS has increased 3.6% in the past 60 days to $2.56. Flex’s long-term earnings growth rate is 12.4%.

Flex’s earnings outpaced the Zacks Consensus Estimate in each of the last four quarters, the average earnings surprise being 11%. Shares of the company have risen 28.3% in the past year.

The Zacks Consensus Estimate for Watts Water Technologies 2023 EPS has improved 2.8% in the past 60 days to $8.00. Watts Water’s long-term earnings growth rate is 7.8%.

WTS’ earnings outpaced the Zacks Consensus Estimate in each of the last four quarters, the average earnings surprise being 11.8%. Shares of WTS have rallied 28.9% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Flex Ltd. (FLEX) : Free Stock Analysis Report

Watts Water Technologies, Inc. (WTS) : Free Stock Analysis Report

Pegasystems Inc. (PEGA) : Free Stock Analysis Report

Pure Storage, Inc. (PSTG) : Free Stock Analysis Report