Purple Innovation Inc (PRPL) Faces Challenges Despite Revenue Growth

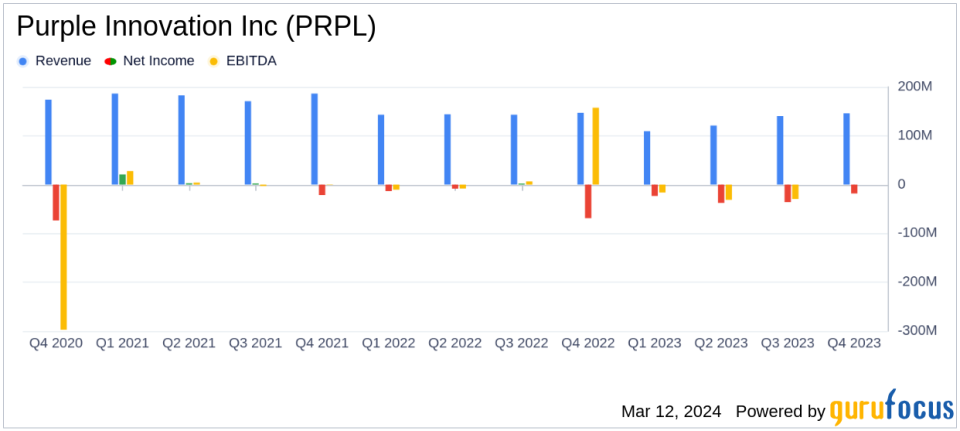

Revenue Growth: Q4 2023 net revenue increased 1.1% year-over-year, signaling a positive response to new product launches.

Gross Margin: Q4 2023 gross margin decreased to 33.2% from 34.6% in Q4 2022, impacted by product transition costs and increased labor.

Operating Loss: Operating loss widened to $(16.2) million in Q4 2023 from $(11.9) million in Q4 2022, with increased advertising expenses.

Net Loss: Net loss improved to $(18.3) million in Q4 2023 from $(71.7) million in Q4 2022, with adjusted net loss at $(15.8) million.

Full Year Performance: Full year 2023 net revenue decreased by 10.9%, with a net loss of $(120.8) million.

2024 Outlook: Company expects mid to high single-digit revenue growth and positive adjusted EBITDA in the second half of 2024.

Purple Innovation Inc (NASDAQ:PRPL), a leader in comfort technology, released its 8-K filing on March 12, 2024, detailing its financial results for the fourth quarter and full year ended December 31, 2023. The company, known for its innovative mattresses and comfort products, experienced a slight increase in Q4 revenue, marking the first year-over-year increase in eight quarters. However, the full year 2023 saw a decline in net revenue by 10.9%, reflecting the ongoing challenges in the home goods sector.

Financial Performance and Market Challenges

Despite a challenging market environment, Purple Innovation managed to capture market share and reposition itself as a premium brand. The company's CEO, Rob DeMartini, highlighted the successful launch of new mattresses and a marketing campaign that improved sales trends across all channels. However, the industry headwinds, including soft demand for home-related products, have led to a decrease in gross margin and an increase in operating expenses, primarily due to a $4.0 million rise in advertising expenses.

Adjusted EBITDA for Q4 2023 was negative at $(9.8) million, compared to $(0.8) million in the prior year period. The full year 2023 saw adjusted EBITDA at a negative $(54.7) million, a significant drop from the nearly breakeven figure of the previous year. These results underscore the importance of the company's strategic initiatives aimed at improving operating and financial performance, including driving productivity, efficiency, and innovation.

Strategic Focus and Future Outlook

Purple Innovation's strategy moving forward includes increasing conversion rates on its e-commerce site, optimizing ad spending, and focusing on product mix shifts and manufacturing improvements. The company expects these efforts to lead to earnings expansion, despite the near-term industry challenges.

For 2024, Purple Innovation anticipates revenue to be in the range of $540 to $560 million, with adjusted EBITDA between $(20) million and $(10) million. The company projects a sequential improvement in quarterly revenue and adjusted EBITDA, with the latter expected to turn positive in the second half of the year.

The balance sheet as of December 31, 2023, shows cash and cash equivalents, including restricted cash, at $26.9 million, down from $41.8 million the previous year. Inventories decreased by 8.6% year-over-year, reflecting efforts to manage working capital efficiently.

In conclusion, while Purple Innovation Inc (NASDAQ:PRPL) faces ongoing challenges, its focus on strategic initiatives and product innovation provides a foundation for potential long-term growth. Investors and stakeholders will be watching closely to see if the company's efforts translate into improved financial performance in 2024.

Explore the complete 8-K earnings release (here) from Purple Innovation Inc for further details.

This article first appeared on GuruFocus.