Container line's Q2 earnings could surprise to the upside

Container lines won’t release final results for the second quarter until next month, but early disclosures suggest they have stemmed the bleeding, at least temporarily.

Hawaii-based niche carrier Matson (NYSE: MATX) announced preliminary results late Thursday, projecting Q2 2023 net income of between $76.3 million and $81.5 million. This range is more than double Q1 2023 net income of $34 million.

Matson CEO Matt Cox confirmed that his company’s China service saw higher demand in the second quarter than in the first.

Stifel analyst Ben Nolan called it “a remarkably good quarter,” with Matson earnings “nearly double what we and the Street had expected. [We] did not see that coming.”

Matson’s shares surged in early trading on Friday to a 52-week high of $94.28 per share, then pulled back to close up 8% on the day at $88.32.

Matson’s shares have risen 41% year to date despite all the bearishness on container shipping fundamentals. Following its latest run-up, it is now the second-best-performing U.S.-listed shipping stock in any vessel segment, behind propane tanker owner Dorian LPG (NYSE: LPG).

Evergreen revenue stabilizes, Cosco profits up vs. Q1

Early disclosures by Asian ocean carriers likewise point to a stronger second quarter than some had expected.

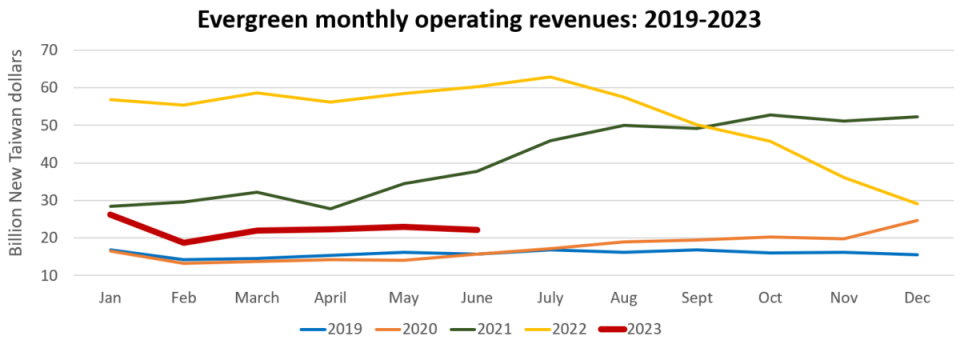

Revenues of Taiwan’s Evergreen Marine had been falling sharply quarter on quarter since Q3 2022, but the slide ended in the latest period. Q2 2023 revenues increased 1% versus the first quarter. Evergreen’s Q2 2023 revenues were 43% higher than in the same period in 2019, pre-pandemic.

China’s Cosco, the world’s fourth-largest carrier group, reported preliminary net income of 12.5 billion yuan ($1.7 billion) for Q2 2023, up 76% from the first quarter of this year.

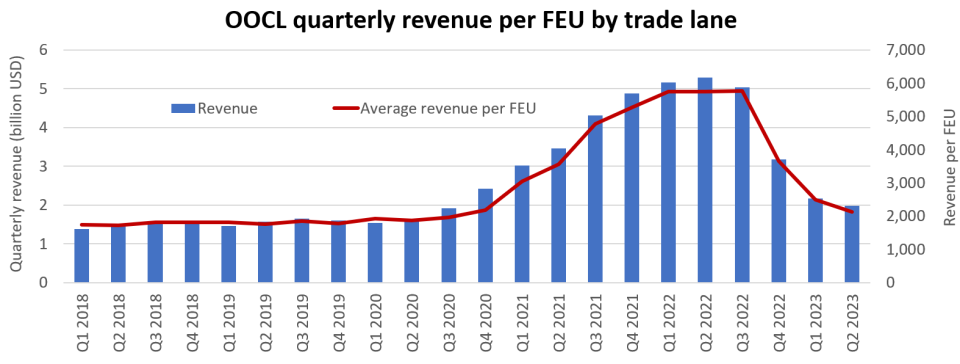

Disclosures by Cosco subsidiary OOCL were less positive: They showed a slowing pace of decline versus prior quarters and better performance versus pre-COVID, yet results were still falling.

OOCL reported Q2 2023 revenues of $1.98 billion. That’s up 35% from the second quarter of 2018 and 26% from the second quarter of 2019. OOCL’s revenue declined 9% sequentially versus the first quarter, however, the quarter-on-quarter drops were much steeper (33-37%) in the preceding two periods.

OOCL obtained an average of $2,126 in revenue per forty-foot equivalent unit during the latest quarter, up 23% from the same period in 2018 and up 20% from the same period in 2019.

Sentiment sours on 2nd half

Meanwhile, the consensus on the second half is becoming less optimistic.

Earlier this year, many carrier executives predicted that the inventory overhang would clear and inventory restocking would coincide with pre-Christmas bookings, leading to better performance in the second half compared to the first six months.

That sentiment has soured.

“We expect the [China-U.S.] trade lane to experience a muted peak season,” said Cox, although on a positive note, he added: “Absent an economic ‘hard landing’ in the U.S., we continue to expect trade dynamics to gradually improve for the remainder of the year.”

According to a report in Chinese news outlet Xinder Marine News, Evergreen Marine Chairman Chang Yen-I told a Chinese shipowners’ conference: “It seems that the traditional peak season in the third quarter has been postponed.”

Israel-based Zim (NYSE: ZIM) sharply reduced its full-year earnings guidance on July 12. According to Zim CEO Eli Glickman, “While our second-quarter results are broadly in line with our expectations, we no longer anticipate an improvement in freight rates in the second half of 2023, consistent with seasonality, as previously assumed.”

Zim now believes demand “will remain muted for the remainder of the year.”

Click for more articles by Greg Miller

Related articles:

Container shipping trilemma: Weak rates, new ships, pricey charters

Shipping faces fallout as China’s post-COVID rebound falls flat

Container shipping divide: Cargo rates weaken, ship rents ‘robust’

The post Q2 container line earnings could surprise to the upside appeared first on FreightWaves.