Q2 Design Software Earnings Review: First Prize Goes to Procore Technologies (NYSE:PCOR)

As the craze of earnings season draws to a close, here's a look back at some of the most exciting (and some less so) results from Q2. Today we are looking at the design software stocks, starting with Procore Technologies (NYSE:PCOR).

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

The 8 design software stocks we track reported a slower Q2; on average, revenues beat analyst consensus estimates by 1.96%, while on average next quarter revenue guidance was 2.83% under consensus. Investors abandoned cash burning companies since high interest rates will make it harder to raise capital and design software stocks have not been spared, with share prices down 11.8% since the previous earnings results, on average.

Best Q2: Procore Technologies (NYSE:PCOR)

Used to manage the multi-year expansion of the Panama Canal that began in 2007, Procore Technologies (NYSE:PCOR) offers a software-as-service project, finance and quality management platform for the construction industry.

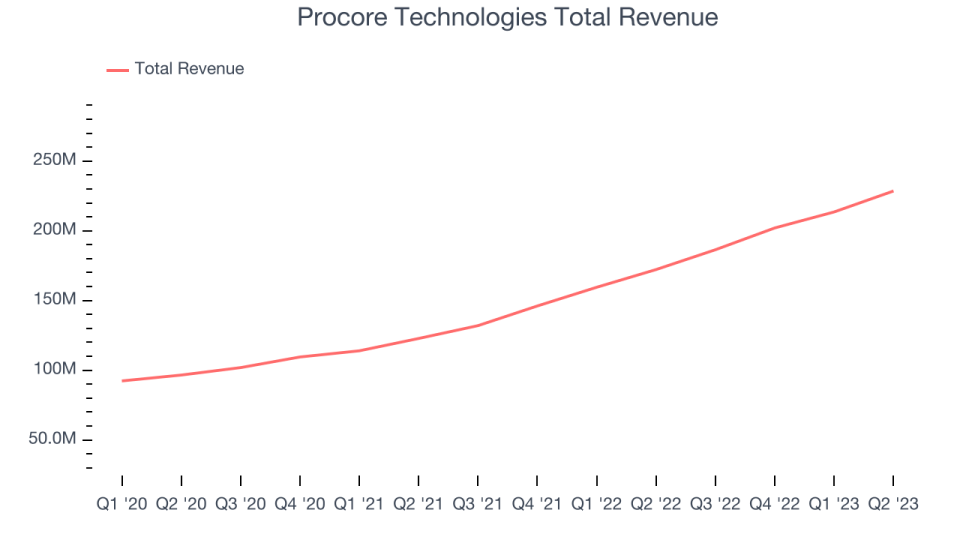

Procore Technologies reported revenues of $228.5 million, up 32.7% year on year, beating analyst expectations by 4.84%. It was a "beat and raise" quarter for the company. Revenue and EPS exceeded expectations during the quarter. The company lifted full-year revenue guidance, which also exceeded Wall Street's expectations.

Procore Technologies pulled off the strongest analyst estimates beat and highest full year guidance raise of the whole group. The company added 615 customers to a total of 15,704. The stock is down 8.26% since the results and currently trades at $66.41.

Is now the time to buy Procore Technologies? Access our full analysis of the earnings results here, it's free.

Adobe (NASDAQ:ADBE)

One of the most well-known Silicon Valley software companies around, Adobe (NASDAQ:ADBE) is a leading provider of software as service in the digital design and document management space.

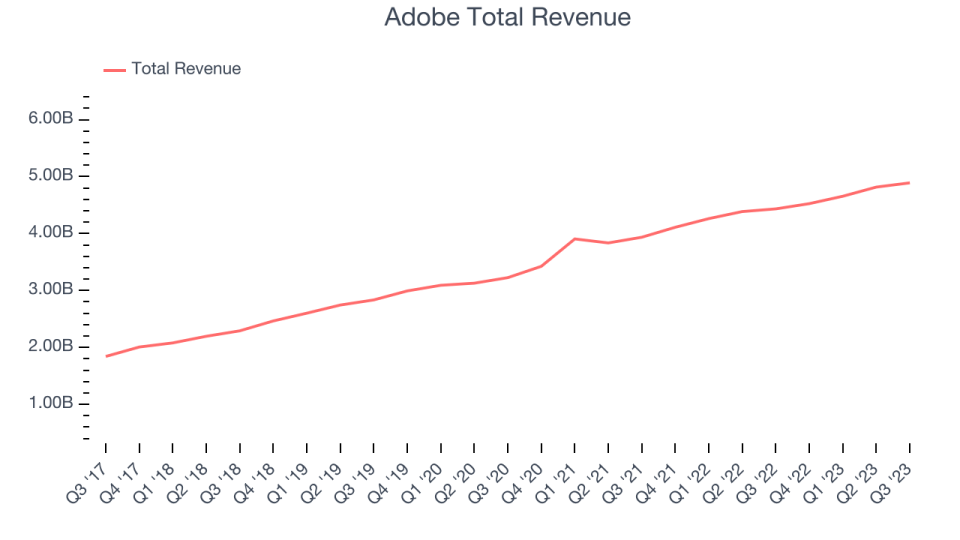

Adobe reported revenues of $4.89 billion, up 10.3% year on year, in line with analyst expectations. It was a decent quarter for the company, with total digital media ARR (annual recurring revenue) and reported revenue roughly in line with expectations. It was also good to see next quarter's much-watched Digital Media net new ARR and earnings guidance exceeding Wall Street's estimates. On the other hand, free cash flow in the quarter missed and next quarter's revenue guidance was just in line.

The stock is down 6.27% since the results and currently trades at $517.77.

Is now the time to buy Adobe? Access our full analysis of the earnings results here, it's free.

Weakest Q2: Matterport (NASDAQ:MTTR)

Founded in 2011 before any mass market VR headset was released, Matterport (NASDAQ:MTTR) provides the hardware and software necessary to turn real world spaces into 3D visualization.

Matterport reported revenues of $39.6 million, up 38.9% year on year, in line with analyst expectations. It was a weak quarter for the company, with revenue guidance for the next quarter and full-year missing analysts' expectations.

Matterport had the weakest full year guidance update in the group. The company added 56,000 customers to a total of 827,000. The stock is down 32.7% since the results and currently trades at $2.12.

Read our full analysis of Matterport's results here.

Cadence (NASDAQ:CDNS)

With the name chosen to reflect the idea of a repeating pattern or rhythm in electronic design, Cadence Design Systems (NASDAQ:CDNS) offers a software-as-a-service platform for semiconductor engineering and design.

Cadence reported revenues of $976.6 million, up 13.9% year on year, missing analyst expectations by 0.08%. It was a weaker quarter for the company, with underwhelming revenue guidance for the next quarter.

Cadence had the weakest performance against analyst estimates among the peers. The stock is down 2.53% since the results and currently trades at $235.

Read our full, actionable report on Cadence here, it's free.

PTC (NASDAQ:PTC)

Used to design the Airbus A380 and Boeing 787 Dreamliner commercial airplanes, PTC’s (NASDAQ:PTC) software-as-service platform helps engineers and designers create and test products before manufacturing.

PTC reported revenues of $542.3 million, up 17.3% year on year, beating analyst expectations by 3.41%. It was a weaker quarter for the company, with underwhelming revenue and non-GAAP EPS guidance guidance for the next quarter. Similarly, its full-year revenue and non-GAAP EPS guidance missed Wall Street's expectations.

The stock is down 3.01% since the results and currently trades at $139.82.

Read our full, actionable report on PTC here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned