Q2 Earnings Highlights: Guidewire (NYSE:GWRE) Vs The Rest Of The Vertical Software Stocks

Let's dig into the relative performance of Guidewire (NYSE:GWRE) and its peers as we unravel the now-completed Q2 vertical software earnings season.

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, some have very specific needs. As a result, vertical software, which addresses industry-specific workflows, is growing and fueled by the pressures to improve productivity, whether it be for a life sciences, education, or banking company.

The 4 vertical software stocks we track reported a mixed Q2; on average, revenues beat analyst consensus estimates by 3.63% while next quarter's revenue guidance was 6.09% below consensus. Technology stocks have been hit hard by fears of higher interest rates as investors search for near-term cash flows, but vertical software stocks held their ground better than others, with the share prices up 9.34% on average since the previous earnings results.

Slowest Q2: Guidewire (NYSE:GWRE)

Founded by two individuals involved in the development of leading procurement software Ariba, Guidewire (NYSE:GWRE) offers a software-as-a-service platform for insurance companies to help sell their products and manage their workflows.

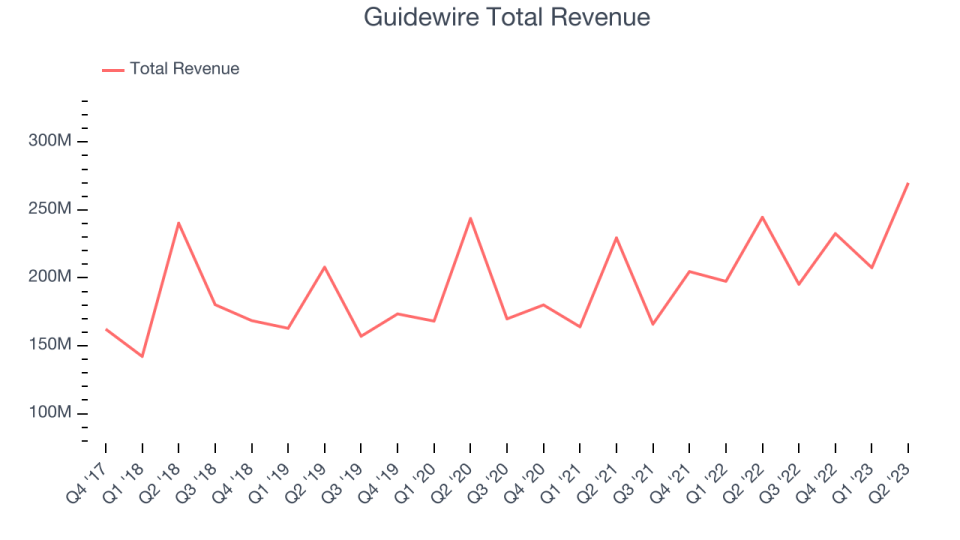

Guidewire reported revenues of $270 million, up 10.4% year on year, topping analyst expectations by 3.31%. It was a weak quarter for the company, with full-year revenue guidance missing analysts' expectations and underwhelming revenue guidance for the next quarter.

“This was an exceptional fourth quarter with record demand for Guidewire Cloud Platform, completing an outstanding year for the Guidewire team and the broader community,” said CEO Mike Rosenbaum.

Guidewire delivered the weakest full-year guidance update of the whole group. The stock is up 8.12% since the results and currently trades at $91.71.

Read our full report on Guidewire here, it's free.

Best Q2: Manhattan Associates (NASDAQ:MANH)

Boasting major consumer staples and pharmaceutical companies as clients, Manhattan Associates (NASDAQ:MANH) offers a software-as-service platform that helps customers manage their supply chains.

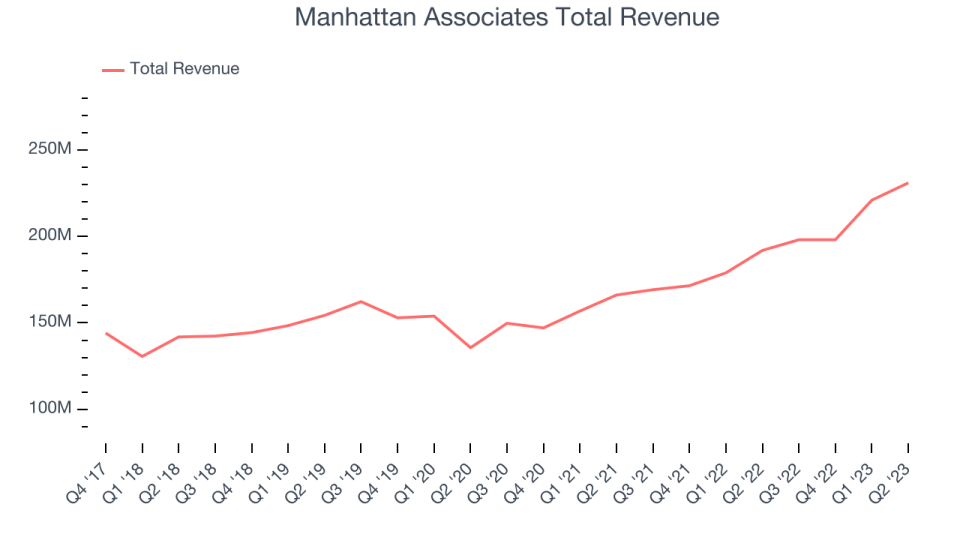

Manhattan Associates reported revenues of $231 million, up 20.4% year on year, outperforming analyst expectations by 6.62%. It was a very strong quarter for the company, with a solid beat of analysts' revenue estimates and full-year revenue guidance exceeding analysts' expectations.

Manhattan Associates scored the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. The stock is up 7.02% since the results and currently trades at $206.92.

Is now the time to buy Manhattan Associates? Access our full analysis of the earnings results here, it's free.

Bentley (NASDAQ:BSY)

Founded by brothers Keith and Barry Bentley, Bentley Systems (NASDAQ:BSY) offers a software-as-a-service platform that addresses the lifecycle of infrastructure projects such as road networks, tunnel systems, and wastewater facilities.

Bentley reported revenues of $296.7 million, up 10.6% year on year, in line with analyst expectations. It was a mixed quarter for the company,

Bentley had the weakest performance against analyst estimates in the group. The stock is up 5.38% since the results and currently trades at $53.71.

Read our full analysis of Bentley's results here.

Alarm.com (NASDAQ:ALRM)

Founded in 2000 as a business unit within MicroStrategy, Alarm.com (NASDAQ:ALRM) is a software-as-a-service platform that enables users to control their security systems and smart home appliances from a single app.

Alarm.com reported revenues of $223.9 million, up 5.18% year on year, surpassing analyst expectations by 4.48%. It was a solid quarter for the company, with a decent beat of analysts' revenue estimates.

Alarm.com had the slowest revenue growth among its peers. The stock is up 16.8% since the results and currently trades at $57.49.

Read our full, actionable report on Alarm.com here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned