Q2 Earnings Outperformers: Tenable (NASDAQ:TENB) And The Rest Of The Cybersecurity Stocks

The end of an earnings season can be a great time to assess how companies are handling the current business environment and discover new stocks. Let’s take a look at how Tenable (NASDAQ:TENB) and the rest of the cybersecurity stocks fared in Q2.

Cybersecurity continues to be one of the fastest-growing segments within software for good reason. Almost every company is slowly finding itself becoming a technology company and facing rising cybersecurity risks. Businesses are accelerating adoption of cloud-based software, moving data and applications into the cloud to save costs while improving performance. This migration has opened them to a multitude of new threats, like employees accessing data via their smartphone while on an open network, or logging into a web-based interface from a laptop in a new location.

The 9 cybersecurity stocks we track reported a mixed Q2; on average, revenues beat analyst consensus estimates by 2.01% while next quarter's revenue guidance was 0.61% below consensus. Technology stocks have been hit hard by fears of higher interest rates as investors search for near-term cash flows, but cybersecurity stocks held their ground better than others, with the share prices up 9.64% on average since the previous earnings results.

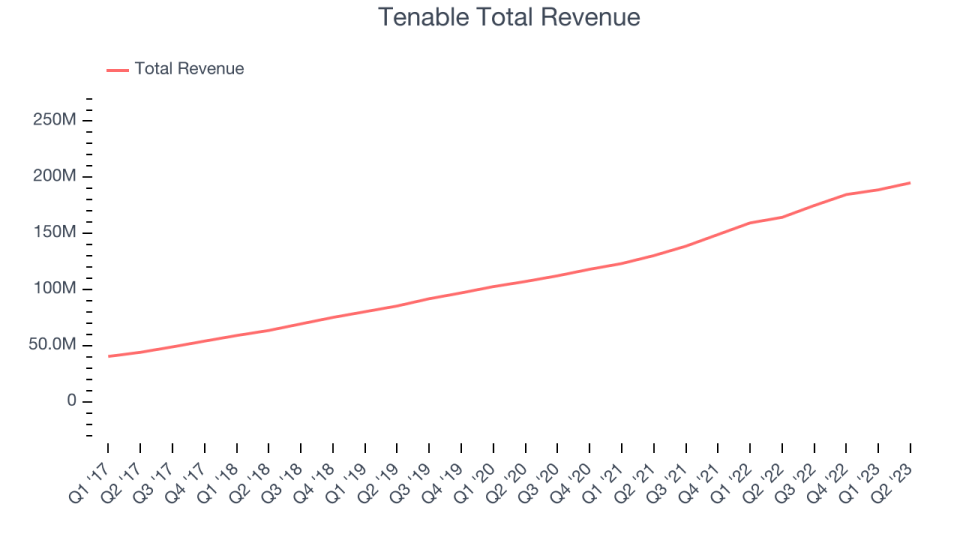

Tenable (NASDAQ:TENB)

Founded in 2002 by three cybersecurity veterans, Tenable (NASDAQ:TENB) provides software as a service that helps companies understand where they are exposed to cyber security risk and how to reduce it.

Tenable reported revenues of $195 million, up 18.7% year on year, topping analyst expectations by 2.52%. It was a solid quarter for the company, with a meaningful improvement in its gross margin and a decent beat of analysts' revenue estimates.

"We are very pleased with our Q2 results, which included better than expected top-line growth and a sizable beat in earnings," said Amit Yoran, Chairman and CEO of Tenable.

The stock is down 4.07% since the results and currently trades at $42.

Is now the time to buy Tenable? Access our full analysis of the earnings results here, it's free.

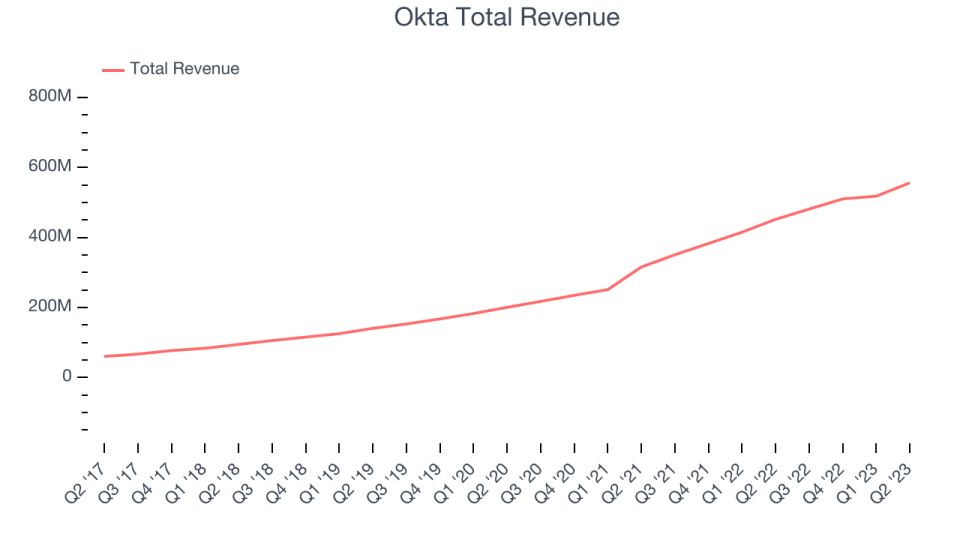

Best Q2: Okta (NASDAQ:OKTA)

Founded during the aftermath of the financial crisis in 2009, Okta (NASDAQ:OKTA) is a cloud-based software-as-a-service platform that helps companies manage identity for their employees and customers.

Okta reported revenues of $556 million, up 23.1% year on year, outperforming analyst expectations by 4.06%. It was a solid quarter for the company, with a decent beat of analysts' revenue estimates and strong sales guidance for the next quarter.

The stock is up 12.6% since the results and currently trades at $82.85.

Is now the time to buy Okta? Access our full analysis of the earnings results here, it's free.

Slowest Q2: Varonis (NASDAQ:VRNS)

Founded by a duo of former Israeli Defense Forces cyber warfare engineers, Varonis (NASDAQ:VRNS) offers software-as-service that helps customers protect data from cyber threats and gain visibility into how enterprise data is being used.

Varonis reported revenues of $115.4 million, up 3.56% year on year, falling short of analyst expectations by 3.23%. It was a weak quarter for the company, with full-year revenue guidance missing analysts' expectations and underwhelming revenue guidance for the next quarter.

Varonis had the weakest performance against analyst estimates, slowest revenue growth, and weakest full-year guidance update in the group. The stock is up 11.3% since the results and currently trades at $31.96.

Read our full analysis of Varonis's results here.

Qualys (NASDAQ:QLYS)

Founded in 1999 as one of the first subscription security companies, Qualys (NASDAQ:QLYS) provides organizations with software to assess their exposure to cyber-attacks.

Qualys reported revenues of $137.2 million, up 14.4% year on year, surpassing analyst expectations by 1.05%. It was a mixed quarter for the company, with an improvement in its gross margin.

The stock is up 12.7% since the results and currently trades at $155.72.

Read our full, actionable report on Qualys here, it's free.

Zscaler (NASDAQ:ZS)

After successfully selling all four of his previous cybersecurity companies, Jay Chaudhry's fifth venture, Zscaler (NASDAQ:ZS) offers software-as-a-service that helps companies securely connect to applications and networks in the cloud.

Zscaler reported revenues of $455 million, up 43.1% year on year, surpassing analyst expectations by 5.67%. It was a decent quarter for the company, with a solid beat of analysts' revenue estimates but underwhelming revenue guidance for the next year.

The stock is down 1.26% since the results and currently trades at $160.79.

Read our full, actionable report on Zscaler here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned