Q2 Earnings Roundup: TJX (NYSE:TJX) And The Rest Of The Apparel and Footwear Retail Segment

Earnings results often give us a good indication of what direction a company will take in the months ahead. With Q2 now behind us, let’s have a look at TJX (NYSE:TJX) and its peers.

Apparel and footwear was once a category thought to be relatively safe from major e-commerce penetration because of the need to try on, touch, and feel products, but the category is now meaningfully transacted online. Everyone still needs clothes and shoes to go outside unless they want some curious (or horrified) looks. But this ongoing digitization is forcing apparel and footwear retailers–that once only had brick-and-mortar stores–to respond with omnichannel offerings. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stagnate, so the evolution of clothing and shoes sellers marches on.

The 20 apparel and footwear retail stocks we track reported a mixed Q2; on average, revenues beat analyst consensus estimates by 1.93%, while next quarter's revenue guidance was 0.82% below consensus. Investors abandoned cash-burning companies since higher interest rates make it harder to raise capital, but apparel and footwear retail stocks held their ground better than others, with the share prices up 4.74% on average since the previous earnings results.

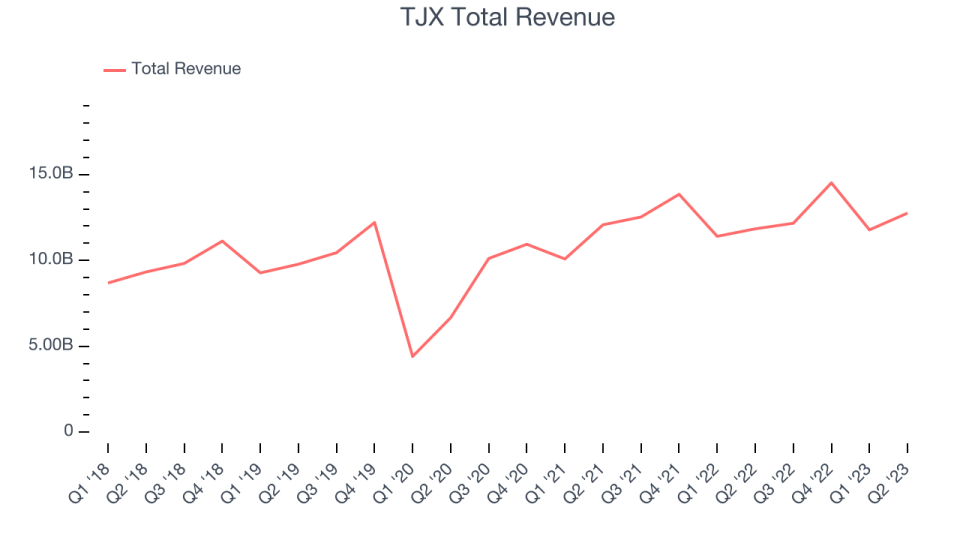

TJX (NYSE:TJX)

Initially based on a strategy of buying excess inventory from manufacturers or other retailers, TJX (NYSE:TJX) is an off-price retailer that sells brand-name apparel and other goods at prices much lower than department stores.

TJX reported revenues of $12.8 billion, up 7.73% year on year, beating analyst expectations by 2.51%. It was a mixed quarter for the company, with a solid beat of analysts' revenue estimates but a miss of analysts' gross margin estimates.

Ernie Herrman, Chief Executive Officer and President of The TJX Companies, Inc., stated, “I am extremely pleased with our second quarter performance. Our comparable store sales increase of 6%, pretax profit margin, and earnings per share all significantly exceeded our plans. Our overall comp sales growth was driven by customer traffic, which increased at every division. It was terrific to see Marmaxx, our largest division, drive an 8% comp sales increase. Our overall apparel and accessories sales were very strong. Overall home sales significantly improved and returned to positive comp sales growth, with HomeGoods posting a 4% comp sales increase. TJX Canada and TJX International also both delivered comp sales growth and customer traffic increases. With our above-plan results, we are raising our full-year outlook for comparable store sales, pretax profit margin, and earnings per share. I want to recognize the sharp execution of our teams across TJX who focus every day on bringing customers around the world excellent values on great fashions and great brands and an exciting, treasure-hunt shopping experience. The third quarter is off to a very strong start and we are seeing tremendous off-price buying opportunities in the marketplace. We are in an outstanding position to continue shipping fresh and compelling merchandise to our stores and online throughout the fall and holiday selling seasons. Going forward, we continue to see excellent opportunities to grow sales and customer traffic, capture market share, and drive the profitability of our Company.”

The stock is up 4.6% since the results and currently trades at $89.68.

Is now the time to buy TJX? Access our full analysis of the earnings results here, it's free.

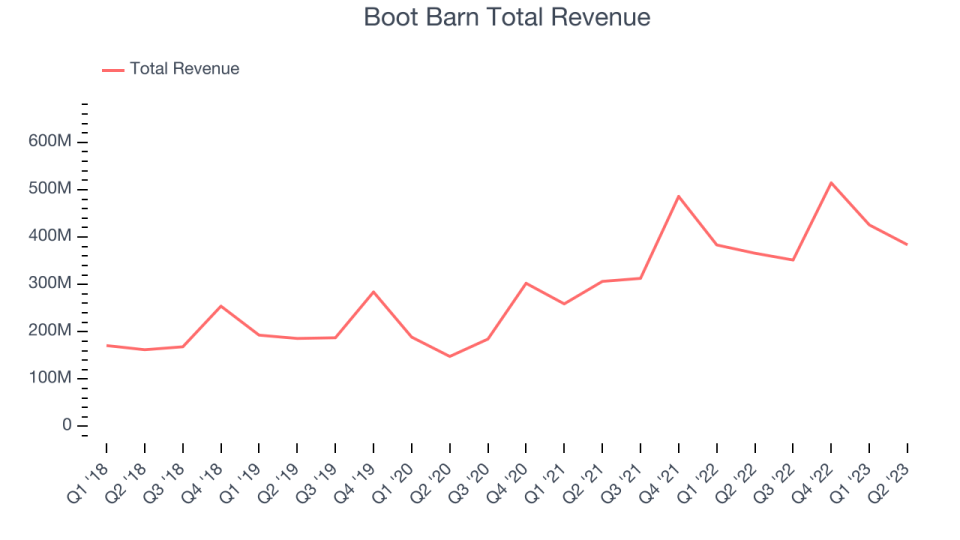

Best Q2: Boot Barn (NYSE:BOOT)

With a strong store presence in Texas, California, Florida, and Oklahoma, Boot Barn (NYSE:BOOT) is a western-inspired apparel and footwear retailer.

Boot Barn reported revenues of $383.7 million, up 4.88% year on year, topping analyst expectations by 5.79%. It was a strong quarter for the company, with an impressive beat of analysts' earnings estimates and an impressive beat of analysts' revenue estimates.

Boot Barn delivered the highest full year guidance raise among its peers. The stock is down 9.59% since the results and currently trades at $81.31.

Is now the time to buy Boot Barn? Access our full analysis of the earnings results here, it's free.

Weakest Q2: Torrid (NYSE:CURV)

Promoting a message of body positivity and inclusiveness, Torrid Holdings (NYSE:CURV) is a plus-size women’s apparel and accessories retailer.

Torrid reported revenues of $289.1 million, down 15.2% year on year, in line with analyst expectations. It was a weak quarter for the company, with full-year revenue guidance missing analysts' expectations and revenue guidance for next quarter missing analysts' expectations.

Torrid had the slowest revenue growth and weakest full year guidance update in the group. The stock is down 8.6% since the results and currently trades at $2.02.

Read our full analysis of Torrid's results here.

Victoria's Secret (NYSE:VSCO)

Spun off from L Brands in 2020, Victoria’s Secret (NYSE:VSCO) is an intimate clothing and beauty retailer that sells its own brands of lingerie, undergarments, and personal fragrances.

Victoria's Secret reported revenues of $1.43 billion, down 6.19% year on year, falling short of analyst expectations by 0.76%. It was a weak quarter for the company, with a miss of analysts' gross margin estimates and a miss of analysts' earnings estimates.

The stock is down 9.3% since the results and currently trades at $16.29.

Read our full, actionable report on Victoria's Secret here, it's free.

Gap (NYSE:GPS)

Operating under The Gap, Old Navy, Banana Republic, and Athleta brands, The Gap (NYSE:GPS) is an apparel and accessories retailer that sells its own brand of casual clothing to men, women, and children.

Gap reported revenues of $3.55 billion, down 8.01% year on year, falling short of analyst expectations by 1.19%. It was a mixed quarter for the company, with a miss of analysts' gross margin estimates and a miss of analysts' revenue estimates.

The stock is up 23.2% since the results and currently trades at $11.74.

Read our full, actionable report on Gap here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned