Q2 Holdings Inc (QTWO) Reports Strong Year-Over-Year Revenue Growth and Margin Expansion

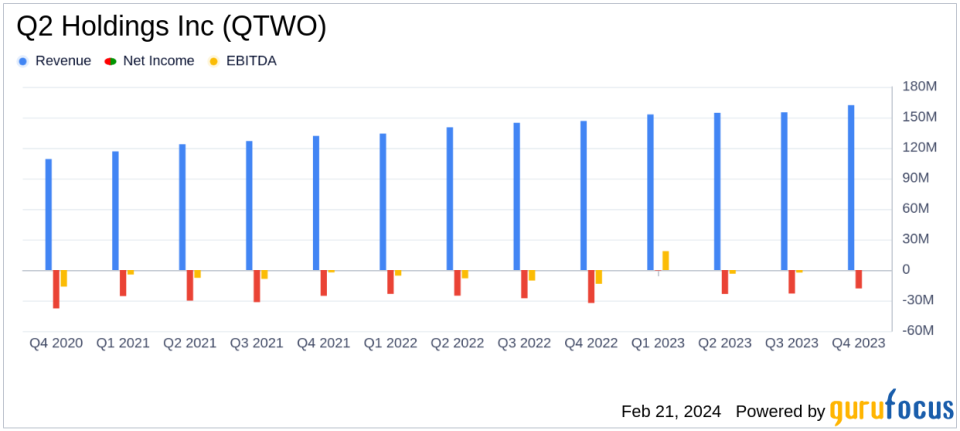

Revenue Growth: Q4 revenue increased by 11% year-over-year to $162.1 million, with full-year revenue up 10% to $624.6 million.

Gross Margin Improvement: GAAP gross margin for Q4 improved to 50.2%, and non-GAAP gross margin reached 56.0%.

Net Loss Reduction: GAAP net loss for Q4 narrowed to $18.1 million from $32.4 million in the prior-year quarter.

Adjusted EBITDA Growth: Q4 adjusted EBITDA increased significantly to $23.2 million, up from $8.4 million year-over-year.

Subscription Revenue and Backlog Increase: Subscription Annualized Recurring Revenue grew to $593.9 million, and Backlog expanded to approximately $1.8 billion.

On February 21, 2024, Q2 Holdings Inc (NYSE:QTWO), a leading provider of digital transformation solutions for financial services, released its fourth quarter and full-year 2023 financial results through an 8-K filing. The company's performance showcased significant year-over-year improvements in revenue and profitability metrics, despite facing industry-wide challenges.

Q2 Holdings Inc is renowned for its cloud-based virtual banking solutions that empower regional financial institutions to offer seamless mobile banking experiences. The company's integrated platform not only provides a comprehensive view of account holder activity but also ensures compliance with regulatory and security standards. The majority of Q2's revenue is derived from subscription-based arrangements within the United States.

Financial Performance and Challenges

The reported revenue growth is a testament to Q2's strong market position and the increasing demand for digital banking solutions. The improvement in gross margins reflects the company's successful efforts in optimizing its cost structure and enhancing operational efficiency. However, the company still reported a GAAP net loss, which, while reduced compared to the previous year, indicates ongoing challenges in achieving profitability.

Q2's CEO, Matt Flake, highlighted the company's record bookings performance, stating:

"We closed out 2023 with our best bookings performance in company history, which included our two largest deals ever."

This achievement underscores the company's competitive edge and the growing market demand for its offerings.

Financial Achievements and Industry Significance

The substantial increase in adjusted EBITDA and the growth in subscription annualized recurring revenue are critical achievements for Q2 Holdings Inc. These metrics are vital for software companies as they reflect the predictability and sustainability of revenue streams. The expansion of the company's backlog indicates a strong future revenue pipeline, which is crucial for long-term growth in the software industry.

Key Financial Details

From the income statement, Q2 Holdings Inc reported a net loss, which has narrowed significantly from the previous year, indicating progress towards profitability. The balance sheet shows a healthy cash and cash equivalents position of $229.7 million. The cash flow statement reveals a positive free cash flow of $39.6 million for the full year, which is a substantial increase from the previous year's $6.5 million, highlighting improved cash management and operational efficiency.

Q2's CFO, David Mehok, commented on the financial results:

"We've made significant strides in key financial metrics throughout 2023, effectively managing costs and strategically deploying capital."

This statement reflects the company's focus on financial discipline and its impact on the bottom line.

Analysis of Company Performance

Q2 Holdings Inc's performance in 2023 indicates a company that is successfully navigating the complexities of the financial software market. The reported growth in revenue and gross margins, coupled with a reduction in net losses and a strong increase in adjusted EBITDA, suggest that the company's strategic initiatives are yielding positive results. The company's focus on expanding its customer base, as evidenced by significant contract signings and backlog growth, positions it well for continued success in the future.

For a detailed look at Q2 Holdings Inc's financials and management's discussion of the results, interested readers and investors can access the full 8-K filing.

Explore the complete 8-K earnings release (here) from Q2 Holdings Inc for further details.

This article first appeared on GuruFocus.