Q3 Earnings Highs And Lows: Sprouts (NASDAQ:SFM) Vs The Rest Of The Non-Discretionary Retail Stocks

Wrapping up Q3 earnings, we look at the numbers and key takeaways for the non-discretionary retail stocks, including Sprouts (NASDAQ:SFM) and its peers.

Food is non-discretionary because it's essential for life (maybe not those Oreos?), so consumers naturally need a place to buy it. Selling food is a notoriously tough business, however, as the costs of procuring and transporting oftentimes perishable products and operating stores fit to sell those products can be high. Competition is also fierce because the alternatives are numerous. While online competition threatens all of retail, grocery is one of the least penetrated because of the nature of the product. Still, we could be one startup or innovation away from a paradigm shift.

The 8 non-discretionary retail stocks we track reported a decent Q3; on average, revenues were in line with analyst consensus estimates while next quarter's revenue guidance was in line with consensus. Inflation (despite slowing) has investors prioritizing near-term cash flows, but non-discretionary retail stocks held their ground better than others, with the share prices up 6.1% on average since the previous earnings results.

Sprouts (NASDAQ:SFM)

Playing on the secular trend of healthier living, Sprouts Farmers Market (NASDAQ:SFM) is a grocery store chain emphasizing natural and organic products.

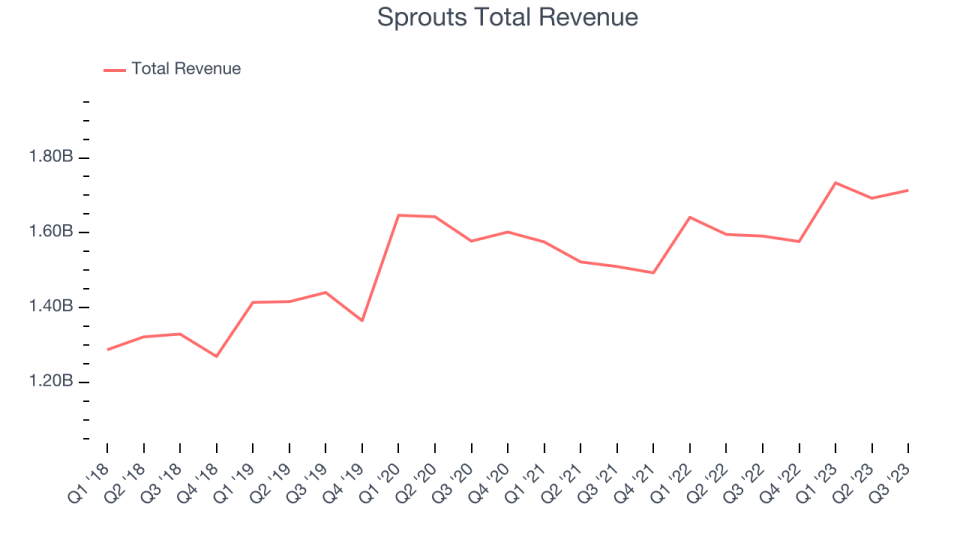

Sprouts reported revenues of $1.71 billion, up 7.7% year on year, topping analyst expectations by 2%. It was a solid quarter for the company, with a decent beat of analysts' revenue estimates and optimistic earnings guidance for the next quarter.

"We are pleased to report another solid quarter at Sprouts, with continued increases in both traffic and comparable store sales," said Jack Sinclair, chief executive officer of Sprouts Farmers Market.

Sprouts pulled off the biggest analyst estimates beat of the whole group. The stock is up 19.1% since the results and currently trades at $51.62.

Is now the time to buy Sprouts? Access our full analysis of the earnings results here, it's free.

Best Q3: Target (NYSE:TGT)

With a higher focus on style and aesthetics compared to other large general merchandise retailers, Target (NYSE:TGT) serves the suburban consumer who is looking for a wide range of products under one roof.

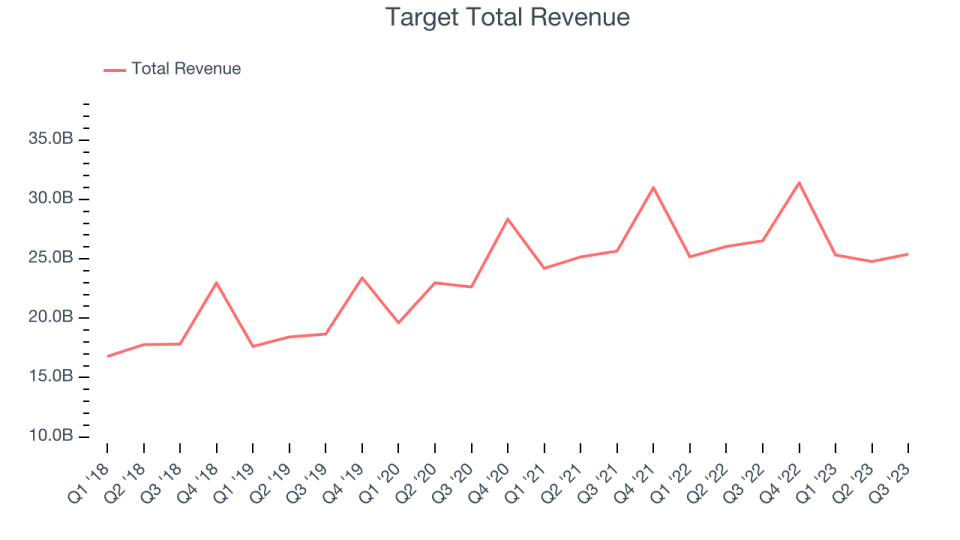

Target reported revenues of $25.4 billion, down 4.2% year on year, in line with analyst expectations. It was a very strong quarter for the company, with an impressive beat of analysts' earnings estimates.

Target had the slowest revenue growth among its peers. The stock is up 24.8% since the results and currently trades at $138.14.

Is now the time to buy Target? Access our full analysis of the earnings results here, it's free.

Weakest Q3: Dollar General (NYSE:DG)

Appealing to the budget-conscious consumer, Dollar General (NYSE:DG) is a discount retailer that sells a wide range of household essentials, groceries, apparel/beauty products, and seasonal merchandise.

Dollar General reported revenues of $9.69 billion, up 2.4% year on year, in line with analyst expectations. It was a mixed quarter for the company, with a narrow beat of analysts' earnings estimates. Guidance was underwhelming, with the company lowering its sales growth and EPS outlooks, both of which came in below Consensus.

The stock is down 1.1% since the results and currently trades at $132.5.

Read our full analysis of Dollar General's results here.

Grocery Outlet (NASDAQ:GO)

Due to its differentiated procurement and buying approach, Grocery Outlet (NASDAQ:GO) is a discount grocery store chain that offers substantial discounts on name-brand products.

Grocery Outlet reported revenues of $1.00 billion, up 9.3% year on year, falling short of analyst expectations by 0.4%. It was a mixed quarter for the company, with a solid beat of analysts' earnings estimates but underwhelming earnings guidance for the full year.

Grocery Outlet achieved the fastest revenue growth and highest full-year guidance raise among its peers. The stock is down 9.1% since the results and currently trades at $25.9.

Read our full, actionable report on Grocery Outlet here, it's free.

Dollar Tree (NASDAQ:DLTR)

A treasure hunt because there’s no guarantee of consistent product selection, Dollar Tree (NASDAQ:DLTR) is a discount retailer that sells general merchandise and select packaged food at extremely low prices.

Dollar Tree reported revenues of $7.31 billion, up 5.4% year on year, falling short of analyst expectations by 1.4%. It was a mixed quarter for the company, with optimistic earnings guidance for the next quarter but a miss of analysts' revenue estimates.

Dollar Tree had the weakest performance against analyst estimates and weakest full-year guidance update among its peers. The stock is up 12.5% since the results and currently trades at $130.58.

Read our full, actionable report on Dollar Tree here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned