Q3 Earnings Recap: First Watch (NASDAQ:FWRG) Tops Sit-Down Dining Stocks

As Q3 earnings season comes to a close, it’s time to take stock of this quarter's best and worst performers amongst the sit-down dining stocks, including First Watch (NASDAQ:FWRG) and its peers.

Sit-down restaurants offer a complete dining experience with table service. These establishments span various cuisines and are renowned for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or simply unwinding. Their extensive menus range from appetizers to indulgent desserts and wines and cocktails. This space is extremely fragmented and competition includes everything from publicly-traded companies owning multiple chains to single-location mom-and-pop restaurants.

The 14 sit-down dining stocks we track reported a mixed Q3; on average, revenues missed analyst consensus estimates by 0.8% Inflation (despite slowing) has investors prioritizing near-term cash flows, but sit-down dining stocks held their ground better than others, with the share prices up 14.4% on average since the previous earnings results.

Best Q3: First Watch (NASDAQ:FWRG)

Based on a nautical reference to the first work shift aboard a ship, First Watch (NASDAQ:FWRG) is a chain of breakfast and brunch restaurants whose menu is heavily-focused on eggs and griddle items such as pancakes.

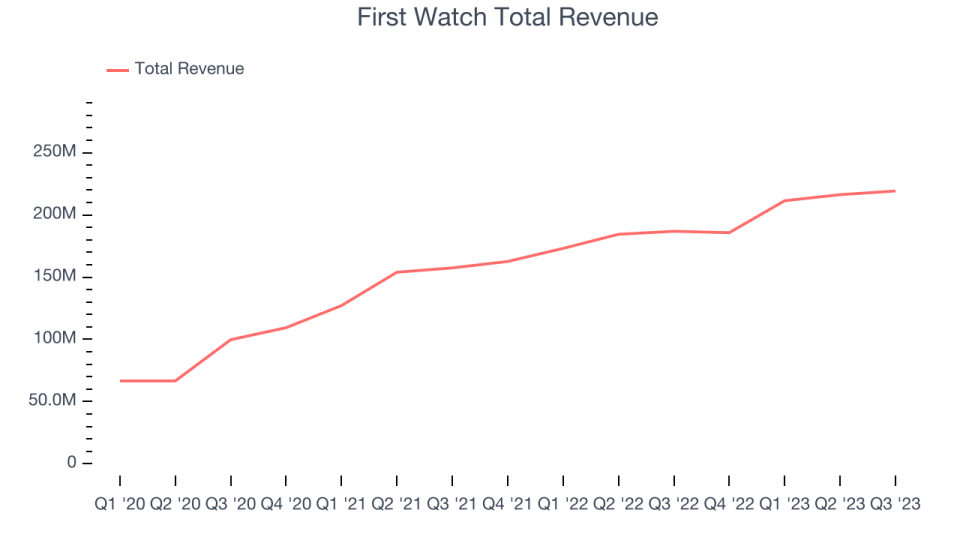

First Watch reported revenues of $219.2 million, up 17.3% year on year, topping analyst expectations by 1.2%. It was a stunning quarter for the company, with an impressive beat of analysts' earnings estimates.

The stock is up 22.7% since the results and currently trades at $20.51.

Is now the time to buy First Watch? Access our full analysis of the earnings results here, it's free.

Brinker International (NYSE:EAT)

Founded by Norman Brinker in Dallas, Texas, Brinker International (NYSE:EAT) is a casual restaurant chain that operates under the Chili’s, Maggiano’s Little Italy, and It’s Just Wings banners.

Brinker International reported revenues of $1.01 billion, up 6% year on year, in line with analyst expectations. It was a very strong quarter for the company, with an impressive beat of analysts' earnings estimates.

The stock is up 18.8% since the results and currently trades at $40.31.

Is now the time to buy Brinker International? Access our full analysis of the earnings results here, it's free.

Weakest Q3: The ONE Group (NASDAQ:STKS)

Doubling as a hospitality services provider for hotels and resorts, The One Group Hospitality (NASDAQ:STKS) is an upscale restaurant company that operates STK Steakhouse and Kona Grill.

The ONE Group reported revenues of $76.88 million, up 5.3% year on year, falling short of analyst expectations by 7.7%. It was a weak quarter for the company, with full-year revenue guidance missing analysts' expectations.

The ONE Group had the weakest performance against analyst estimates and weakest full-year guidance update in the group. The stock is down 2.4% since the results and currently trades at $4.46.

Read our full analysis of The ONE Group's results here.

Cracker Barrel (NASDAQ:CBRL)

Known for its country-themed food and merchandise, Cracker Barrel (NASDAQ:CBRL) is a beloved American restaurant and retail chain that celebrates the warmth and charm of Southern hospitality.

Cracker Barrel reported revenues of $823.8 million, down 1.9% year on year, falling short of analyst expectations by 0.5%. It was a weaker quarter for the company, with a miss of analysts' earnings estimates and full-year revenue guidance missing analysts' expectations.

The stock is down 0.9% since the results and currently trades at $74.45.

Read our full, actionable report on Cracker Barrel here, it's free.

Bloomin' Brands (NASDAQ:BLMN)

Owner of the iconic Australian-themed Outback Steakhouse, Bloomin’ Brands (NASDAQ:BLMN) is a leading American restaurant company that owns and operates a portfolio of popular restaurant brands.

Bloomin' Brands reported revenues of $1.08 billion, up 2.3% year on year, falling short of analyst expectations by 0.2%. It was a slower quarter for the company, with underwhelming earnings guidance for the next quarter.

The stock is up 11.7% since the results and currently trades at $26.32.

Read our full, actionable report on Bloomin' Brands here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned