Q3 Earnings Review: Data Infrastructure Stocks Led by Teradata (NYSE:TDC)

Wrapping up Q3 earnings, we look at the numbers and key takeaways for the data infrastructure stocks, including Teradata (NYSE:TDC) and its peers.

Generating insights from system level data is an increasing priority for most businesses, but to do so requires connecting and analyzing piles of data stored and siloed in separate databases. This is the demand driver for cloud based data infrastructure software providers, who can more readily integrate, distribute and process information vs. legacy on-premise software providers.

The 4 data infrastructure stocks we track reported a weaker Q3; on average, revenues beat analyst consensus estimates by 0.9% while next quarter's revenue guidance was 1.7% below consensus. Stocks have been under pressure as inflation (despite slowing) makes their long-dated profits less valuable, but data infrastructure stocks held their ground better than others, with the share prices up 4.5% on average since the previous earnings results.

Best Q3: Teradata (NYSE:TDC)

Part of point-of-sale and ATM company NCR from 1991 to 2007, Teradata (NYSE:TDC) offers a software-as-service platform that helps organizations manage their data across multiple storages and analyze it.

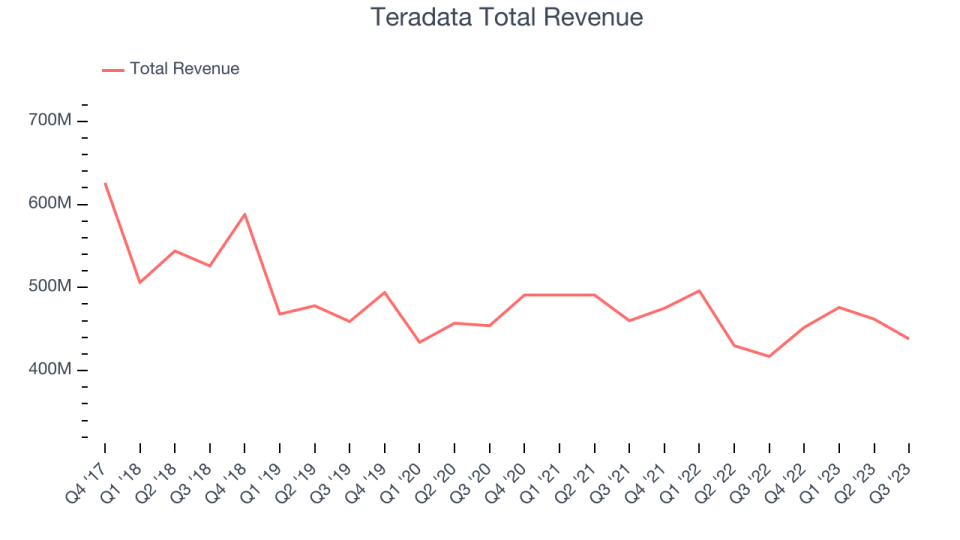

Teradata reported revenues of $438 million, up 5% year on year, in line with analyst expectations. It was a decent quarter for the company. Although Teradata's EPS guidance for next quarter beat analysts' expectations, its adjusted operating income and free cash flow missed Wall Street's estimates.

“Our best-in-class cloud analytics and data platform for AI delivers harmonized data, trusted AI, and faster innovation for better decision-making,” said Steve McMillan, President and Chief Executive Officer of Teradata.

Teradata delivered the slowest revenue growth of the whole group. The stock is up 5.6% since the results and currently trades at $47.52.

Is now the time to buy Teradata? Access our full analysis of the earnings results here, it's free.

Elastic (NYSE:ESTC)

Started by Shay Banon as a search engine for his wife's growing list of recipes at Le Cordon Bleu cooking school in Paris, Elastic (NYSE:ESTC) helps companies integrate search into their products and monitor their cloud infrastructure.

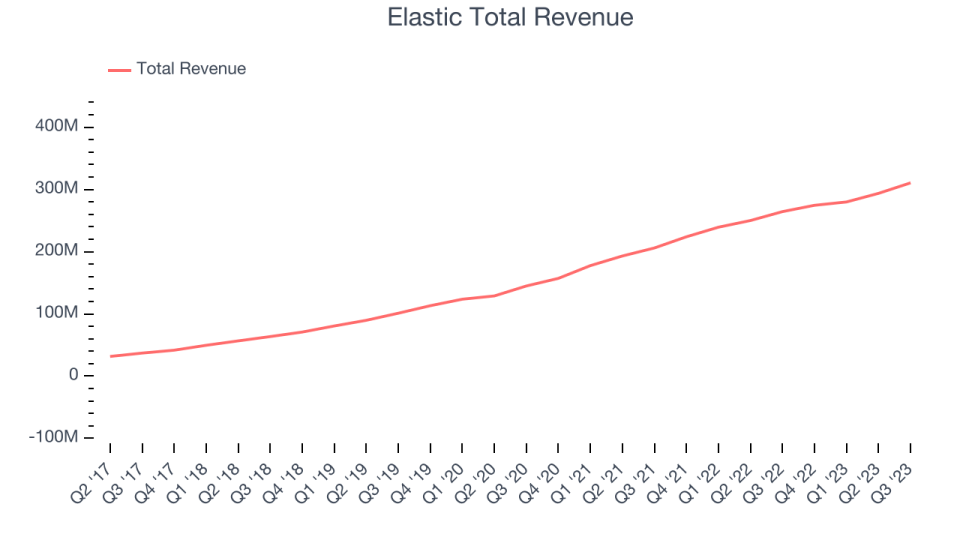

Elastic reported revenues of $310.6 million, up 17.5% year on year, outperforming analyst expectations by 2.2%. It was a mixed quarter for the company, with a decent beat of analysts' revenue estimates but decelerating customer growth.

Elastic delivered the highest full-year guidance raise among its peers. The company added 30 enterprise customers paying more than $100,000 annually to reach a total of 1,220. The stock is up 46.9% since the results and currently trades at $117.95.

Is now the time to buy Elastic? Access our full analysis of the earnings results here, it's free.

Weakest Q3: C3.ai (NYSE:AI)

Founded in 2009 by enterprise software veteran Tom Seibel, C3.ai (NYSE:AI) provides software that makes it easy for organizations to add artificial intelligence technology to their applications.

C3.ai reported revenues of $73.23 million, up 17.3% year on year, falling short of analyst expectations by 1.5%. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and a miss of analysts' revenue estimates.

C3.ai had the weakest performance against analyst estimates in the group. The stock is down 14.2% since the results and currently trades at $25.03.

Read our full analysis of C3.ai's results here.

Confluent (NASDAQ:CFLT)

Started in 2014 by the team of engineers at LinkedIn who originally built it as an internal tool, Confluent (NASDAQ:CFLT) provides infrastructure software for organizations that makes it easy and fast to collect and move large amounts of data between different systems.

Confluent reported revenues of $200.2 million, up 31.9% year on year, surpassing analyst expectations by 2.6%. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and decelerating growth in large customers.

Confluent scored the biggest analyst estimates beat and fastest revenue growth, but had the weakest full-year guidance update among its peers. The company added 41 enterprise customers paying more than $100,000 annually to reach a total of 1,185. The stock is down 20.4% since the results and currently trades at $22.4.

Read our full, actionable report on Confluent here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned