Q3 Earnings Review: Design Software Stocks Led by Procore Technologies (NYSE:PCOR)

As design software stocks’ Q3 earnings season wraps, let's dig into this quarter's best and worst performers, including Procore Technologies (NYSE:PCOR) and its peers.

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

The 8 design software stocks we track reported a weak Q3; on average, revenues beat analyst consensus estimates by 1.2% while next quarter's revenue guidance was 1.5% below consensus. Valuation multiples for growth stocks have reverted to their historical means after reaching highs in early 2021, but design software stocks held their ground better than others, with the share prices up 16.6% on average since the previous earnings results.

Best Q3: Procore Technologies (NYSE:PCOR)

Used to manage the multi-year expansion of the Panama Canal that began in 2007, Procore Technologies (NYSE:PCOR) offers a software-as-service project, finance and quality management platform for the construction industry.

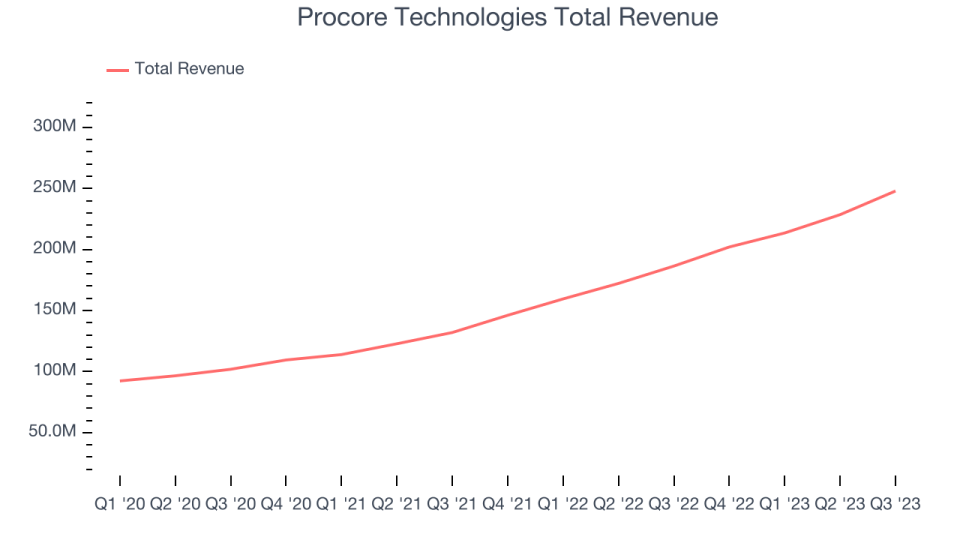

Procore Technologies reported revenues of $247.9 million, up 33% year on year, topping analyst expectations by 6.1%. It was a mixed quarter for the company, with a solid beat of analysts' revenue estimates but decelerating customer growth.

Procore Technologies pulled off the biggest analyst estimates beat and highest full-year guidance raise of the whole group. The company added 363 customers to reach a total of 16,067. The stock is up 14.4% since the results and currently trades at $68.85.

Is now the time to buy Procore Technologies? Access our full analysis of the earnings results here, it's free.

Adobe (NASDAQ:ADBE)

One of the most well-known Silicon Valley software companies around, Adobe (NASDAQ:ADBE) is a leading provider of software as service in the digital design and document management space.

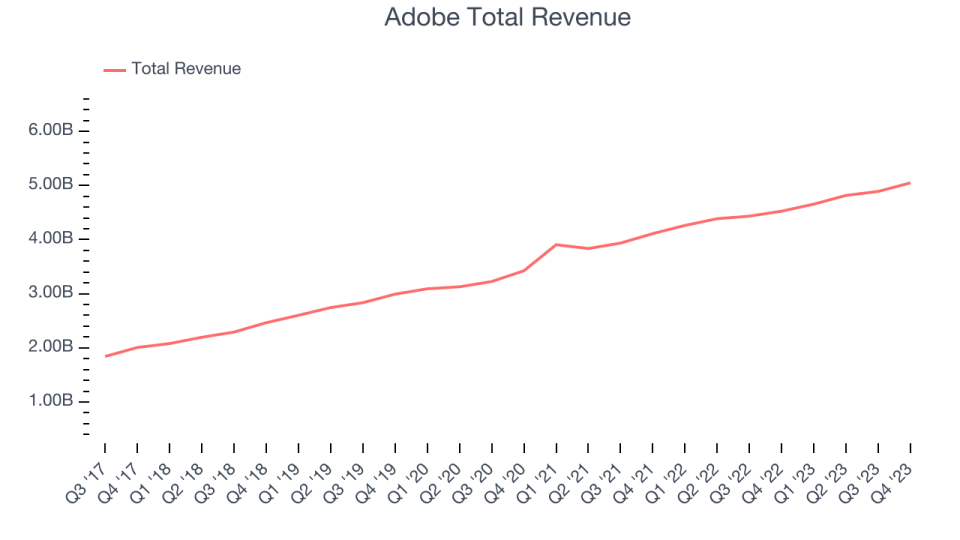

Adobe reported revenues of $5.05 billion, up 11.6% year on year, in line with analyst expectations. It was a mixed quarter for the company, with optimistic revenue guidance for the next year but full-year revenue guidance missing analysts' expectations.

The stock is down 4.5% since the results and currently trades at $596.

Is now the time to buy Adobe? Access our full analysis of the earnings results here, it's free.

Weakest Q3: ANSYS (NASDAQ:ANSS)

Used to help design the Mars Rover, Ansys (NASDAQ:ANSS) offers a software-as-a-service platform that enables simulation for engineering and design.

ANSYS reported revenues of $458.8 million, down 2.9% year on year, falling short of analyst expectations by 1.7%. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and full year.

ANSYS had the slowest revenue growth in the group. The stock is up 27.4% since the results and currently trades at $354.86.

Read our full analysis of ANSYS's results here.

Unity (NYSE:U)

Started as a game studio by three friends in a Copenhagen apartment, Unity (NYSE:U) is a software as a service platform that makes it easier to develop and monetize new games and other visual digital experiences.

Unity reported revenues of $544.2 million, up 68.5% year on year, falling short of analyst expectations by 0.9%. It was a weak quarter for the company, with a miss of analysts' revenue estimates. The major negative, however, was that the company stopped providing financial guidance.

Unity pulled off the fastest revenue growth among its peers. The stock is up 37.2% since the results and currently trades at $34.62.

Read our full, actionable report on Unity here, it's free.

Autodesk (NASDAQ:ADSK)

Founded in 1982 by John Walker and growing into one of the industry's behemoths, Autodesk (NASDAQ:ADSK) makes computer-aided design (CAD) software for engineering, construction, and architecture companies.

Autodesk reported revenues of $1.41 billion, up 10.5% year on year, surpassing analyst expectations by 1.9%. It was a mixed quarter for the company, with a decent beat of analysts' revenue estimates but underwhelming revenue guidance for the next quarter.

The stock is up 10.8% since the results and currently trades at $240.99.

Read our full, actionable report on Autodesk here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned